RBI policy meet

RBI governor has declared that he's done with raising interest rates since any price spike in farm products would now be seasonal, and is ready to lower them if there are signs of the accelerated easing of price pressures. SLR cut of 0.50 percent and increasing the limits on foreign remittances is an indication of the trend towards normalcy for Indian currency markets.

Our View: It is upto the government to control prices of living essentials. Higher base price effect of last year will bring down headline inflation. It is the inflation outlook which will determine interest rate. The Budget will be the key for the short term.

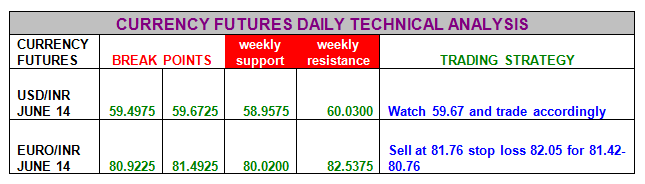

Usd/inr June 2014: A break of 59.67 will result in 60.10 and 60.36. Initial support is at 59.49 and there will be sellers only below 59.67

Euro/inr June 2014: It needs to trade over 80.90 to target 81.36-81.76. Initial support is at 80.90 and there will be sellers as long as euro/inr trades below 8090

Gbp/Inr June 2014: It needs to trade over 100.05 to target 100.20-100.75. Initial support 99.61 and there will be another wave of selling only below 99.61

Jpy/Inr June 2014: It needs t0 trade over 58.05 to target 58.56-58.88. There will be sellers only below 58.05 today.

Recommended Content

Editors’ Picks

AUD/USD holds gains near 0.7000 amid PBOC's status-quo, Gold price surge

AUD/USD is clinging to mild gains near 0.7000 early Monday. The pair benefits from a risk-on market profile, China's steady policy rates and surging Gold and Copper prices. Focus now remains on Fedspeak for fresh impetus.

Gold price hits an all-time high to near $2,440

Gold price (XAU/USD) climbs to a new record high near $2,441 during the Asian trading hours on Monday. The bullish move of the precious metal is bolstered by the renewed hopes for interest rate cuts from the US Federal Reserve (Fed).

EUR/USD gains ground above 1.0850, focus on Fedspeak

The EUR/USD pair trades on a stronger note around 1.0875 on Monday during the early Asian trading hours. The uptick in the major pair is bolstered by the softer Greenback. The Federal Reserve’s Bostic, Barr, Waller, Jefferson, and Mester are scheduled to speak on Monday.

AI tokens could really ahead of Nvidia earnings

Native cryptocurrencies of several blockchain projects using Artificial Intelligence could register gains in the coming week as the market prepares for NVIDIA earnings report.

Week ahead: Flash PMIs, UK and Japan CPIs in focus. RBNZ to hold rates

After cool US CPI, attention shifts to UK and Japanese inflation. Flash PMIs will be watched too amid signs of a rebound in Europe. Fed to stay in the spotlight as plethora of speakers, minutes on tap.