The technical situation for USDJPY has looked indecisive for the better part of a month and we’re getting to the point where the pair needs to commit one way or another. Next week offers key even risks for the two in the form of a Shinzo Abe speech on October 1 that will see the prime minister announcing plans for: (1) a possible corporate tax break (interesting, rumours of this tax cut this week saw a sharp weakening of the JPY that was quickly erased), (2) whether there will be a stimulus (and whether that stimulus will be financed with debt issuance – probably too early for overt money printing), and (3) whether the sales tax increase will go forward on schedule. Also next week we have the major US economic activity surveys and the US employment report on Friday as well as a Bank of Japan meeting that same day.

In the options market, one-week options are extremely bid in recognition of the near-term risk for volatility while one-month option implied volatility remains low relative to recent history, probably due to the indecisiveness of the chart.

Factors working on the JPY next week

Reasons for pressure on USDJPY to the downside lately include the recent decision by the Fed not to taper asset purchases, even if we’ve had lots of Fed jawboning on the decision being a close one. As well, it appears we have emerging market worries cropping up again, as the JPY is the favourite carry trade funding currency out there at the moment and this serves as a headwind.From here, the most JPY positive factors would be: modest or no corporate sales tax break and a modest stimulus while US data is weak and bonds look strong and risk weak. A sales tax delay would also be seen as JPY positive because the Bank of Japan has targeted this tax as a risk to the recovery and as a policy trigger.

The most JPY negative factors would be a sales tax increase, a corporate tax cut and any stimulus announcement, especially if it is large and not debt financed (the latter would be a real shocker at this point). Meanwhile, if the US data all comes in unequivocally strong (both ISMs and the Friday employment report), this could set up fear of an October taper.

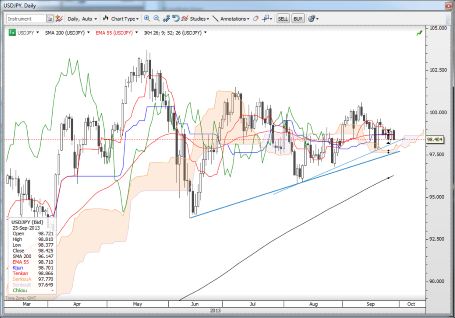

Chart: USDJPY

The trend lines are fairly obvious to the downside, as is the Ichimoku cloud area. The pair really needs to take out 98.00/97.50 to open up a downside break scenario, possibly toward the 200-day moving average or the previous lows from the summer. To the upside, 100.00 is the first milestone, followed by the 100.60+ high. Stay tuned, next week won’t be as quiet for USDJPY as this week

Recommended Content

Editors’ Picks

EUR/USD retreats toward 1.0850 on modest USD recovery

EUR/USD stays under modest bearish pressure and trades in negative territory at around 1.0850 after closing modestly lower on Thursday. In the absence of macroeconomic data releases, investors will continue to pay close attention to comments from Federal Reserve officials.

GBP/USD holds above 1.2650 following earlier decline

GBP/USD edges higher after falling to a daily low below 1.2650 in the European session on Friday. The US Dollar holds its ground following the selloff seen after April inflation data and makes it difficult for the pair to extend its rebound. Fed policymakers are scheduled to speak later in the day.

Gold climbs to multi-week highs above $2,400

Gold gathered bullish momentum and touched its highest level in nearly a month above $2,400. Although the benchmark 10-year US yield holds steady at around 4.4%, the cautious market stance supports XAU/USD heading into the weekend.

Chainlink social dominance hits six-month peak as LINK extends gains

-637336005550289133_XtraSmall.jpg)

Chainlink (LINK) social dominance increased sharply on Friday, exceeding levels seen in the past six months, along with the token’s price rally that started on Wednesday.

Week ahead: Flash PMIs, UK and Japan CPIs in focus – RBNZ to hold rates

After cool US CPI, attention shifts to UK and Japanese inflation. Flash PMIs will be watched too amid signs of a rebound in Europe. Fed to stay in the spotlight as plethora of speakers, minutes on tap.