This will be the last issue of the COT report on behalf of OrderflowTrading. We have recently enhanced our business structure, and are now a Trading Academy that develops/searches for top trading talent for our Proprietary Trading firm, Predator Trading Group. In order to continue viewing our proprietary reports, feel free to pop onto our site.

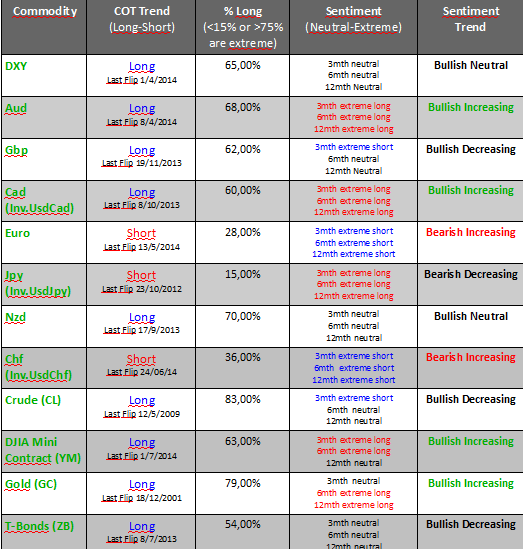

The COT report is a very useful but overlooked sentiment indicator. The way we use it at OrderFlowTrading helps us attain a longer term perspective on major capital flows, as well as a read on how overextended certain markets may be. It is part of a larger arsenal of sentiment indicators that we use.

Recent developments:

- DXY: Specs still long, printing a strong week for the USD.

- Amongs the comm-dolls, last week we saw interest return to Aud and longs back in Cad.

- Amongst European FX, we saw a loss of interest in Gbp and an increase of short interest in Eur.

- Amongst Safe-Haven FX, we saw more interest in Chf (short) and longs back in Jpy.

- Speculative interest is highest in Aud overall and lowest in Eur overall.

- Most crowded trades: Nzd(FX), Crude (Commodities).

Comments & most intersting charts:

- The Aussie has attracted more interest last week, and has also closed with a pin-bar. However, the upper/lower bounds of the recent range have not been stressed so we cannot derive any significant signal from this close. The Aussie remains crowded and extreme...but price has not yet confirmed a shift to the downside.

AudUsd Weekly chartSource: Tradingview.com

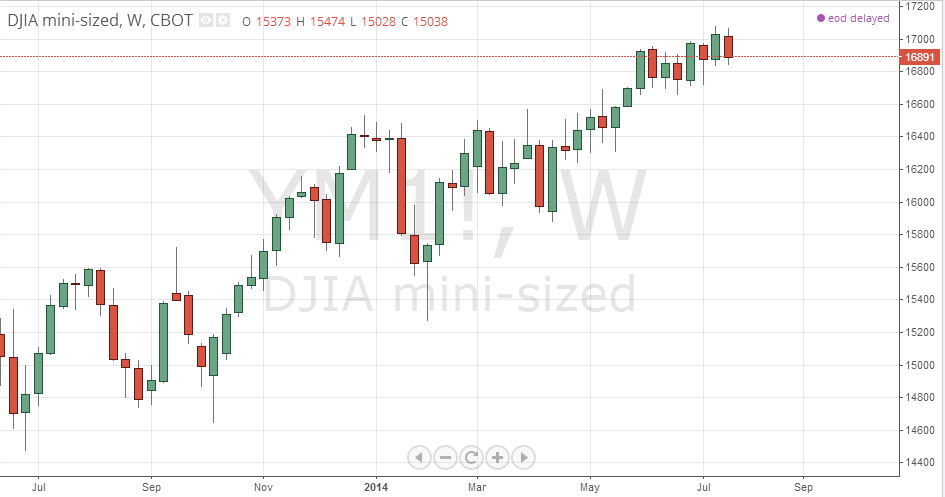

- YM is consolidating at recent highs. We have closed with an inside week but unless we get some material break to the downside, there is no real news to report.

YM Weekly chart

Source: Tradingview.com

In other news:

- The Euro has been hit hard once again last week. Sentiment is very bearish.

- Cad surprizingly continues to attract interest, even though the spot price has taken a hit.

- Chf continues to attract interest as well.

To sum up: keep a lazy eye on AudUsd and YM. Not much else to report.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 after US data

EUR/USD struggles to build on Wednesday's gains and fluctuates in a tight channel near 1.0700 on Thursday. The data from the US showed that weekly Jobless Claims held steady at 208,000, helping the USD hold its ground and limiting the pair's upside.

GBP/USD fluctuates above 1.2500 following Wednesday's rebound

GBP/USD stays in a consolidation phase slightly above 1.2500 on Thursday after closing in the green on Wednesday. A mixed market mood caps the GBP/USD upside after Unit Labor Costs and weekly Jobless Claims data from the US.

Gold retreats to $2,300 despite falling US yields

Gold stays under bearish pressure and trades deep in negative territory at around $2,300 on Thursday. The benchmark 10-year US Treasury bond edges lower following the Fed's policy decisions but XAU/USD struggles to find a foothold.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.