Corporate earnings are still pouring out

Corporate earnings are still pouring out. One name we wonder about--Intuitive Surgical. Rejoicing in our new titanium hip, we admire our human surgeon. So what on earth can “intuitive” surgery be?

Markets are unusually messy right now and even downright contradictory. You’d think the fear factor would be higher if Israel feels compelled to retaliate against Iran, but the price of gold ticked up only a little and oil is actually down. The FT reports “Iran is exporting more oil than at any time for the past six years, giving its economy a $35bn-a-year boost even as western countries discuss stepping up sanctions in response to its attack on Israel.”

Reuters reports “Despite the Middle East tensions and punchy U.S. economic readouts, U.S. crude prices turned tail and have now recoiled some 6.5% from Friday's 2024 highs to levels last seen before Israel's attack on Iran's Syrian consulate on April 1. Surging U.S. crude inventories, poor economic numbers from China for March and a U.S. warning about releasing more of its Strategic Petroleum Reserve if necessary have all reined in oil.” So much for geopolitical angst.

From left field comes a hint of FX market intervention from none other than TreasSec Yellen in a press conference with her South Korean and Japanese counterparts. This is a holy cow moment. We have not had talk of joint intervention for many years. The FT reports “The finance ministers said after a trilateral meeting in Washington on Wednesday that they would ‘consult closely on foreign exchange market developments’.

“The comments were an indication of their concern at the scale of the dollar’s gains against Asian currencies after US inflation data led markets to scale back expectations of Federal Reserve rate cuts this year. … The three countries expressed their concerns as China also took steps to limit the impact of the dollar’s strength.”

Here is a sentence that should be rocking the boat all over the world: “ The Biden administration has joined with Japan and South Korea in a bid to limit the dollar’s recent rise against Asian currencies after days in which markets have been hit by shifting interest rate expectations.

“The won strengthened as much as 1 per cent in early trading on Thursday, while the yen, the Indonesian rupiah and Chinese renminbi were all marginally up after the rare joint statement….. Asian currencies suffered a sharp sell-off on Tuesday, with the yen falling to ¥154 a dollar, its weakest level since 1990. Markets have been on high alert for the possibility of direct intervention by Japanese authorities, a measure Tokyo last took in 2022.”

ING Economics wrote that the likelihood is high of joint intervention if “key levels” get broken. We are not so sure. This may well be plain old-fashioned jawboning. After all, the joint statement calls for “close consultation.” No levels are named. And realistically, since we haven’t had any such statements for such a long time, the trio do not need to do more. Threats are very effective against parties whose license to do business is granted by those doing the threatening.

Then there is arm-twisting, in the form of some carefully placed phone calls to the banks’ CEO. MoF’s can offer to subsidize some trading. Finally, there is lying. We saw this first-hand and takes the form of the Treasury/Fed “advising” top bank officials of what’s going on, knowing they will go back and trade the information to their own advantage, but really for the sake of the intervention cause.

Not liking to be left out, the PBoC said today it would “resolutely correct” what it called “procyclical behaviour” and prevent the “formation of one-sided consensus and self-reinforcement” of views on the direction of the currency. According to the FT story, “’The central bank is determined and unwavering in its stance to keep the relative stability of the yuan rate,’ Zhu Hexin, head of the State Administration of Foreign Exchange and vice-governor of the PBoC, told reporters in Beijing on Thursday.”

The saga of FX market intervention is long and complicated. We cover some of it in The FX Matrix. But after two big bouts of joint interventions, the US’ unstated policy came to be “this doesn’t work and has backfired.” Then TreasSec Rubin came up with the delightfully ambiguous “policy” statement that “a strong dollar is in the US best interests.” That was in 1994 and pretty much remains the unofficial US stance.

The US has helped with intervention since then, notably in the dollar/yen but also in the form of short-term loans to European central banks during the 2008-09 financial crisis. You can see an interesting take on the strong dollar at Wikipedia (https://en.wikipedia.org/wiki/Strong_dollar_policy). We lived and worked in FX during much of the period covered and do not see things quite the same way, but as far as we can tell, the Wikipedia account is accurate. Don’t sneer at Wikipedia—experts claim to find errors and discrepancies but on the whole, it’s good.

Bottom line: we do not expect actual intervention. Unless the rhetoric keeps up, the FX market will return to the previous mode—pressure on the Asian currencies. This gets complicated as the ECB and BoE appear ready to go first. One of our Rocky’s Rules is “When in doubt, go to the cross-rates,” mean GBP/JPY and the like (anything without the USD is a “cross”).

To return to the main story, Mr. Powell delivered a message already priced in—the first quarter delivered a bump in the inflation road—the last mile--that justifies keeping rates high for longer. The only surprise was Mr. Powell saying it out loud; usually the other Feds say such things and he remains above the fray.

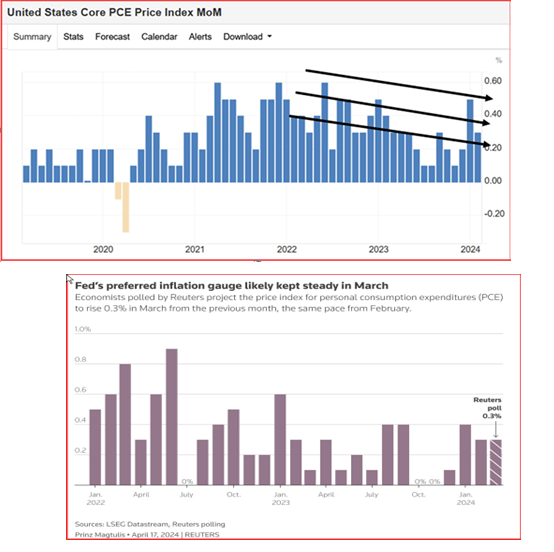

But let’s not go overboard—he also said a hike is not being contemplated. Rate cuts are still on the table and the only question is the timing. The Fed is data dependent. It seeks not only a continuation of the downward trajectory, but evidence of “stabilization.” Incoming data, including the PCE and core PCE near month-end, could very well restore the downward direction.

At a guess, one month of data won’t do it—it will take more. We have two PCE releases ahead of the June meeting. Not enough to call a stable trend. We have four PCE releasees before the July meeting, which comes on July 31. We will bet $10 that July brings the rate cut.

If this is correct, the next question is when the bond and FX markets start pricing in that first cut. Estimates from experts vary, but it can be 2-3 months, at least when recession is looming.

We may already have the first sighting of this point of view. Bloomberg reports :Traders in the interest-rate futures market are piling into a contrarian bet that would pay off in the event of aggressive Federal Reserve monetary easing this year.

The wager is happening in futures on the Secured Overnight Financing Rate — which closely tracks the central bank’s key policy rate — and it involves buying the December 2024 contract while selling the contract due in December 2025.

Scenarios in which the trade stands to gain include the Fed front-loading interest-rate cuts before the presidential election in November, and being more aggressive than the 40 basis points of easing that’s currently priced into the market for this year.

“The trade goes against the current consensus on Wall Street, where strategists have been dialing back their expectations for rate cuts amid continuing evidence of US economic strength and sticky inflation. That recalibration has sparked a rout in Treasuries that drove the US two-year yield to as high as 5% this week.

We do not understand this type of trade. Bloomberg offers a primer: Record Volumes Seen in SOFR Spreads as Technical Level Breached

“The futures position, a bet that the 2024 contract will outperform the 2025 contract, saw record volumes on Tuesday. …Positioning Wednesday pointed to new wagers, giving fresh momentum to the trade.

… “Sentiment favoring interest-rate cuts this year has also been emerging in SOFR options this week, with buying of deep-out-the money calls continuing Wednesday, targeting a central bank rate as low as 3% by the December policy meeting, down from a range of 5.25% to 5.5% now.

“A sudden downturn in US economic data could warrant a more aggressive path of monetary policy easing than priced over the coming months. The trade may also be targeting the potential for rising inflation expectations beyond this year, a scenario that could see the December 2025 contract underperform and the spread to steepen.” Got that?

Forecast: It's well-nigh impossible to judge whether the intervention threat will be met with obedience or rebellion. Both outcomes have been seen, at least in the case of the dollar/yen. We do not expect actual intervention, just more jawboning (if that).

We do think however, that talk of the 10-year going to 5% and staying up there, as some wild commentators have been saying (presumably talking their position), is not gonna happen, either. The economy may be fairly strong (with some of the regional Fed mentioning softness in the Beige Book yesterday), but the Fed is determined to cut this year. Unless the geopolitical crisis worsens and the quest for yield heats up, we expect the yields to start sliding downhill.

Longer run, by which we mean May, the dipping yields will start to drag the dollar down.

Tidbit: The PCE forecasts are starting to come in. Our last week’s chart of the core PCE with the trend arrows is contradicted by the latest Reuters poll, which sees the headline the same as before. See the second chart below.

We remain impressed with the observation from Reuters that the CPI in the month/month was 0.359%, then rounded up to 0.4%, when 0.3% had been forecast. “The rounded print would have been in line with expectations had the number come in less than one basis point lower.”

Nobody knows whether the next bump in PCE inflation will be to the upside or downside. It would take a decent drop in core PCE to restore some of the expectation of rate cuts. If a drop, given the current hysterical mood, the yields and dollar are at risk.

Remember yesterday’s second chart, which showed that shelter in particular is driving the number and that’s something that can be shoved to one side.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

Author

Barbara Rockefeller

Rockefeller Treasury Services, Inc.

Experience Before founding Rockefeller Treasury, Barbara worked at Citibank and other banks as a risk manager, new product developer (Cititrend), FX trader, advisor and loan officer. Miss Rockefeller is engaged to perform FX-relat