Headlines

Polish PMIs may paint too pessimistic view of the Polish industry

The NBH may adopt further “unconventional” measures

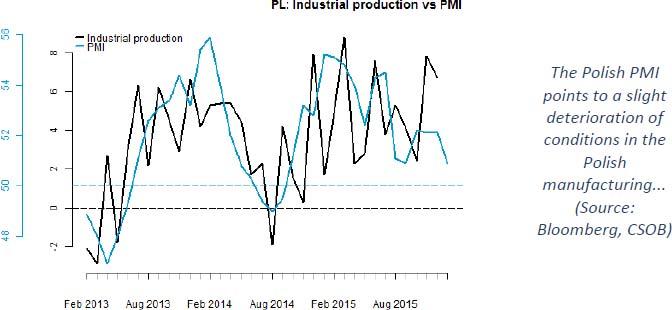

Yesterday, the zloty ignored worse than expected results of PMI for January and strengthened to a new three week high against the euro. Although the index fell to a four-month low due to a slowdown of new orders and output, the employment sub-index still points to a solid improvement in labour market conditions. For the time being, we would therefore not overemphasize the importance of the headline figure although it points to some slowdown in industrial production growth (see the chart below).

Central banks’ meetings in the Czech Republic and Poland are in focus in the remainder of this week. Nevertheless, comments of Deputy Governor of the Hungarian central bank (NBH), Marton Nagy, may draw some attention today. Mr. Nagy said that the Hungarian central bank would review its recent policy measures in March or April and may ease its policy further if necessary. Mr. Nagy also reiterated that ‘unconventional’ measures were preferable policy tools now and that the ECB meeting in March is of a key importance.

Clearly, the main attention of the NBH is lowering the amount of liquidity placed at the central bank and ‘unconventional’ measures such as those adopted so far seem to be more appropriate for achieving this goal in our view, too. So the Monetary Council may change rather the monetary tools first, but in a case the forint strengthens to around the EUR/HUF 300 base a rate cut cannot be excluded either, although this is not our baseline scenario.

| Currencies | % chng | |

| EUR/CZK | 27.01 | 0.0 |

| EUR/HUF | 310.1 | -0.3 |

| EUR/PLN | 4.40 | -0.5 |

| EUR/USD | 1.09 | 0.5 |

| EUR/CHF | 1.11 | 0.1 |

| FRA 3x6 | % | bps chng |

| CZK | 0.26 | 0 |

| HUF | 1.27 | 0 |

| PLN | 1.55 | 1 |

| EUR | -0.27 | 1 |

| GB | % | bps chng |

| Czech Rep. 10Y | 0.66 | -1 |

| Hungary 10Y | 3.41 | -14 |

| Poland 10Y | 3.20 | 4 |

| Slovakia 10Y | 0.68 | 0 |

| CDS 5Y | % | bps chng |

| Czech Rep. | 46 | 0 |

| Hungary | 159 | 0 |

| Poland | 87 | 0 |

| Slovakia | 46 | 0 |

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

EUR/USD retreats toward 1.0850 on modest USD recovery

EUR/USD stays under modest bearish pressure and trades in negative territory at around 1.0850 after closing modestly lower on Thursday. In the absence of macroeconomic data releases, investors will continue to pay close attention to comments from Federal Reserve officials.

GBP/USD holds above 1.2650 following earlier decline

GBP/USD edges higher after falling to a daily low below 1.2650 in the European session on Friday. The US Dollar holds its ground following the selloff seen after April inflation data and makes it difficult for the pair to extend its rebound. Fed policymakers are scheduled to speak later in the day.

Gold climbs to multi-week highs above $2,400

Gold gathered bullish momentum and touched its highest level in nearly a month above $2,400. Although the benchmark 10-year US yield holds steady at around 4.4%, the cautious market stance supports XAU/USD heading into the weekend.

Chainlink social dominance hits six-month peak as LINK extends gains

-637336005550289133_XtraSmall.jpg)

Chainlink (LINK) social dominance increased sharply on Friday, exceeding levels seen in the past six months, along with the token’s price rally that started on Wednesday.

Week ahead: Flash PMIs, UK and Japan CPIs in focus – RBNZ to hold rates

After cool US CPI, attention shifts to UK and Japanese inflation. Flash PMIs will be watched too amid signs of a rebound in Europe. Fed to stay in the spotlight as plethora of speakers, minutes on tap.