Eurostat’s latest flash estimate reported HICP inflation in November remained below consensus expectation for a 0.2% year-on-year increase in consumer prices. The inflation figure for November stood at 0.1 per cent as low oil prices continued to exert downward pressure on headline inflation. Core inflation dropped to 0.9% year-on-year from 1.1% in October. Services prices increased only 1.1% year-on-year, lower than the 1.3% increase seen in October. The strong trade-weighted exchange rate has been building additional pressure, which holds back inflation.

As of now, the current inflation forecast of 1.7% for 2017 looks not-achievable. In the absence of loose monetary policy, it is possible that inflation in 2017 will remain as low as 1.3 per cent. In that case, euro zone will run the risk of entering a situation similar to the one faced by Japan now.

ECB will do everything within its scope to stabilize prices in the bloc

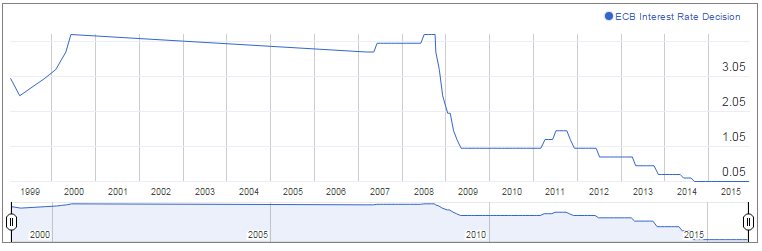

The ECB has pledged to do all it can to pull inflation up “as quickly as possibleâ€. The central bank on December 3rd decided to slash deposit rate by 10 basis points. The deposit rate now at -0.30 per cent moves further into the negative territory. The latest rate cut decision highlights the central bank’s intention to further weaken the euro exchange rate and thereby support economic growth through exports. The critics of easing however, argue that monetary policy is already exceptionally loose. They feel low oil prices have been blamed for the bloc’s inflation woes. It must be noted however, core CPI that stripped energy prices has also stayed half the inflation target indicating that the scenario will be no better even when oil prices actually rises.The ECB also extended its quantitative easing program (QE) to March 2017. The central bank not only decided to include euro-denominated regional and local debt in its QE program but said it will reinvest the principal payments on the securities purchased to support liquidity conditions. Draghi, despite aggressive pricing in the Euro heading into Dec 3rd ECB meeting, did not expand the QE scheme. Draghi noted "our asset purchase program is flexible. It can always be adjusted. We decided the extension of our horizon and especially the re-investment of principal would be sufficientâ€.

Markets were disappointed with the smaller than expected stimulus package offered by the central bank. The ECB Chief Mario Draghi, in an effort to assure markets that the central bank would do all that it takes to push up price pressures in the euro zone, stated on 14th December that there was no limit to the tools that it can opt for to raise inflation to target. He reassured that inflation target would be reached "without undue delay". "After the recalculation of our tools carried out by the Governing Council earlier this month, we expect inflation to reach our target without undue delay," Draghi said. He also said that the use of instruments can also be intensified further to achieve price stability in the bloc. With inflation hovering just above zero, the ECB is aware that further delays in achieving its inflation target of just below 2 per cent could damage its credibility.

Outlook skewed to the downside

The risks to the world economy and to the inflation outlook remain skewed to the downside. GDP is expected to grow 1.5 per cent in 2015, 1.6 per cent and 1.7 per cent in 2017. Economic activity will likely continue to be supported by sustained monetary stimulus, neutral fiscal stance and lower oil prices. However, high private indebtedness will remain a drag on consumption and investment in many countries of the bloc.

The ECB expects inflation to come in at 1 per cent in 2016. Inflation forecast has been estimated at 1.6 per cent for 2017 as against 1.7 per cent estimated earlier. The central bank believes low oil price will support household disposable income thereby supporting private consumption.

The labour force is expected to expand only moderately in the next fiscal hindered by impact of still high unemployment in some countries of the bloc and adverse demographics in others. The unemployment rate edged down to 11.1% in the second quarter of 2015 and will likely fall to 10.1% in 2017. In the euro area, employment is expected to grow by 0.9 % by the end of 2015 and pick up to 1% in 2017.

Hurt by lower private credit expansion, job growth and slower capital investment, overall economic growth will likely continue remain slow through 2016. In the absence of additional stimulus measures the challenges that the bloc currently faces will get deeply rooted.

Lower rates alone cannot guarantee lasting prosperity

Draghi is aware that lower interest rates, though can ensure price stability, cannot guarantee lasting prosperity. He thus stressed on the need for “structural recovery†to lift potential growth in the euro zone. Draghi has called for increase in investment. He feels weak demand dynamics, the still-high private debt overhang and fragile private sector confidence have weighed on investment in the bloc. He has also urged countries to facilitate a "work-out" of toxic loans to facilitate recovery in credit and lending.

If and only when relevant fiscal policies go hand in hand with expansionary monetary policy the bloc will attain the much needed boost to overcome disinflation and grow. Absolute reliance on monetary policy will not be able to help recovery. On the contrary, it will sow the seeds for the next financial crisis.

Read also other related articles about what 2016 could bring for the markets:

Currencies

EUR USD Forecast 2016

GBP USD Forecast 2016

USD JPY Forecast 2016

Central Banks

RBA Forecast 2016

PBoC Forecast 2016

FED Forecast 2016

BoE Forecast 2016

BoJ Forecast 2016

SNB Forecast 2016

Commodities

Gold Forecast 2016

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.