Canadian dollar higher on Retail Sales

The Canadian dollar hasn’t made any spectacular daily gains since May 13th, when it shot up 1.1%. The currency has, however, made slow but steady progress against its US cousin. Earlier today, USD/CAD touched a low of 1.2731, its lowest level in three weeks.

Canada Retail Sales jump in Q1

Canada’s retail sales for March helped the Canadian dollar rally on Thursday. The headline figure was virtually unchanged, but core retail sales rose 1.5%. According to StatsCan, retail sales jumped 3.0% in Q1, its highest level since Q3 2020. Consumers continue to spend despite red-hot inflation, but if consumers decide to tighten the purse strings, the economy would likely take a hit and drag the Canadian dollar lower.

The US dollar finds itself under pressure as risk appetite has rebounded. Investors were pleased with the FOMC minutes, as the Fed signalled that it planned to press ahead with 50-bps rate increases in June and July, which soothed concerns about a possible massive 75-bps hike. This gave the equity markets a boost and sent the greenback lower.

The US economy may not be in a recession, but negative growth in the first quarter is certainly a concern. Second-estimate GDP came in at -1.5% QoQ, shy of the estimate of -1.3% and revised downwards from the initial estimate of -1.4%. Growth in Q1 was hampered by a surge in Omicron as well as the Ukraine war.

One bright spot was solid consumer spending, which remains strong in the face of spiralling inflation. Consumer spending, as gauged by PCE expenditures, rose 3.1% in Q1, up from 2.7% prior. The markets are keeping a close eye on Personal Spending and Personal Income, which will be released later today. The economy is expected to rebound in Q2, but could be much lower than the rosy GDP numbers we saw after the US economy reopened.

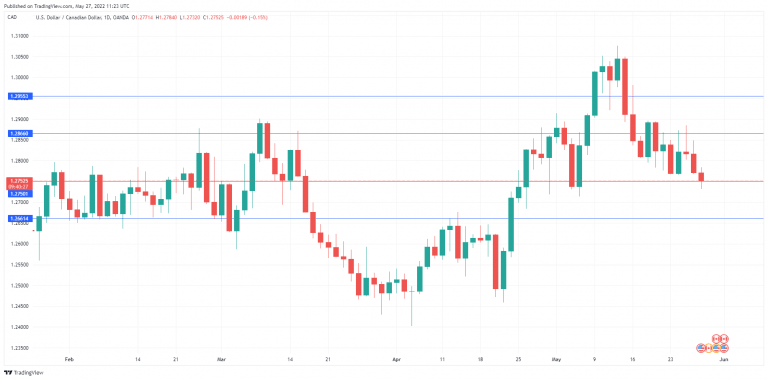

USD/CAD technical

-

There is resistance at 1.2866 and 1.2955.

-

USD/CAD is testing support at 1.2750. Below, there is support at 1.2661.

Author

Kenny Fisher

MarketPulse

A highly experienced financial market analyst with a focus on fundamental analysis, Kenneth Fisher’s daily commentary covers a broad range of markets including forex, equities and commodities.