Canada’s stagflation problem

Stagflation is an economic ordeal characterized by the combination of rising inflation levels amidst low growth and therefore high unemployment. In this environment, the rising cost of goods and services outpaces the purchasing power of individuals and households in the real economy.

Canada is a nation burdened by some of the highest debt levels of any advanced economy today. A confluence of record-high leverage levels for households, provincial and federal governments, and the private sector will complicate Canada’s economic recovery moving forward. Policymakers need a creative legislative agenda if they hope to avoid lagging behind their G7 counterparts in the race to repair the damages incurred in 2020.

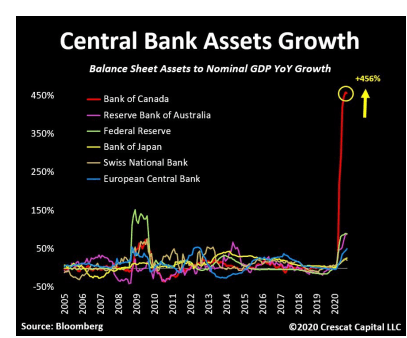

With Canada’s CPI inflation data ticking up this week, it looks as though economic stagflation is indeed beginning to rear its ugly head. While the unemployment rate remains above peak levels from the 2008 recession, rising inflation is a painful drag on Canada’s working class. Yet, central planning officials have failed to identify and implement a more equitable solution than simple currency debasement. The Bank of Canada’s balance sheet has ballooned at a faster rate than any other world leader’s central bank this year. As the BoC races to keep financial markets liquid and the government solvent amid its massive deficit spending, they seem unwilling to acknowledge the collateral damages being shouldered by the Canadian consumer, small businesses, and households.

The chart below compares the balance sheet growth of leading global democracies. Note the Bank of Canada:

Canadian taxpayers are not only on the hook for the largest government deficit by any nation year (20% of GDP), but the central bank balance sheet expansion of over 450% (now 30+% of GDP) is also the public’s liability and encourages malinvestment. This means Canadians face even higher future taxation and of course much greater risk of volatility for the Loonie (CAD) in foreign exchange markets because of the BoC’s actions. The ladder could be dubbed an “inflation tax” on the people.

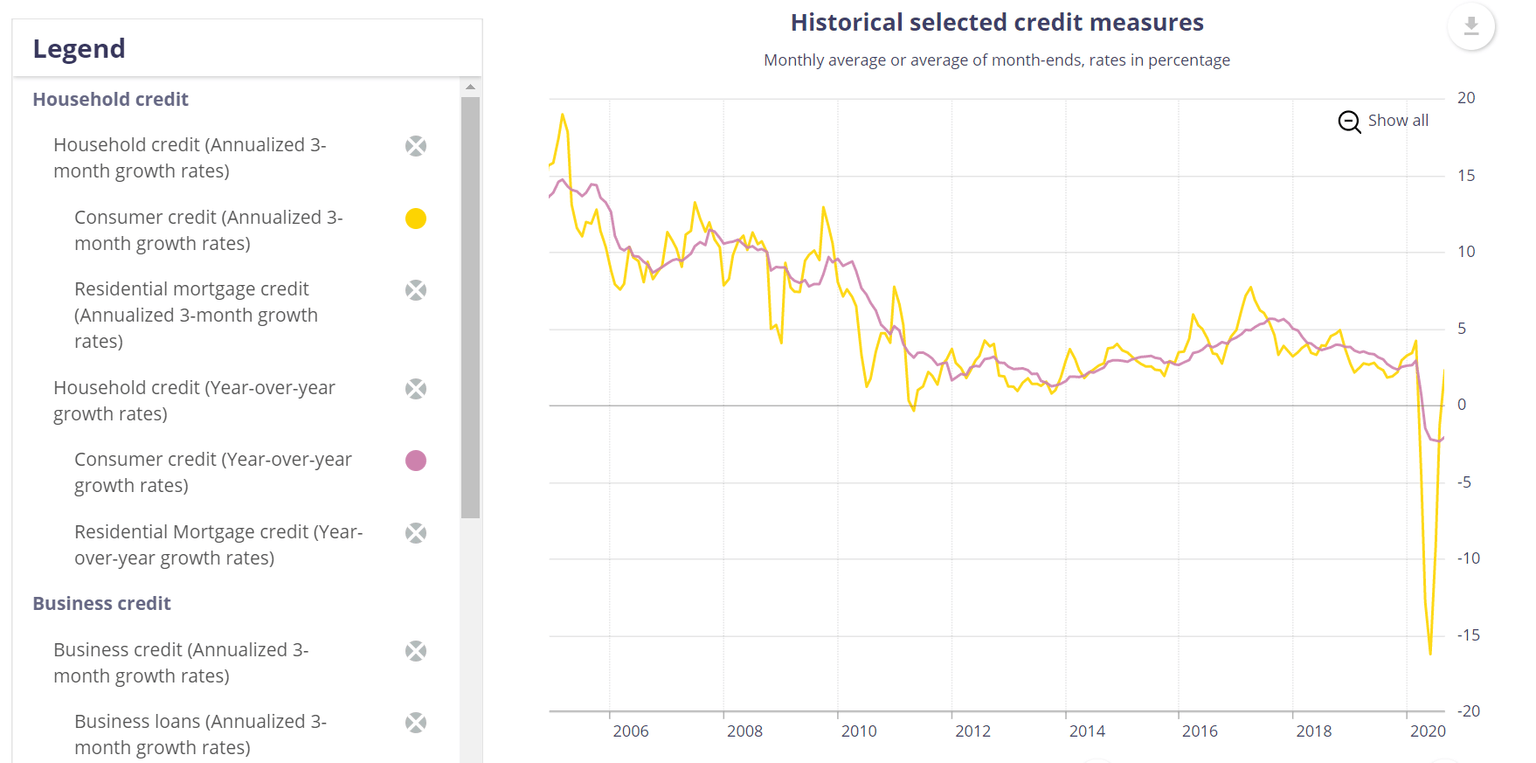

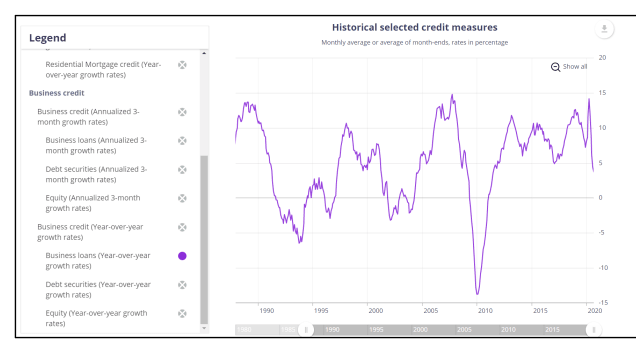

What specifically makes Canada vulnerable on its road to recovery is the rather extreme degree to which GDP has depended on consumer credit growth. The Canadian dollar is not a reserve currency like the US dollar, or the Euro to a lesser degree. This means Canada cannot consume more than it produces over extended periods without experiencing grave side effects. Canada’s economy was well over 50% dependent on consumer spending before the pandemic even began. This means post-pandemic, trade deficits will grow even larger unless a serious policy shift is made. With this in mind, the chart below displays an alarming reality - banks are much more unwilling to lend to households today than even during the worst of the 2008 recession.

As the chart indicates by comparing year over year (purple) and quarterly (yellow) consumer credit growth rates, the Canadian consumer is seen as a much greater risk by lenders than in 2008’s recession. On this graph, the 2020 recession makes 2008 look as if it were a “normal” period! Most concerning is the fact that year over year consumer credit growth is negative, this will be a severe drag on the broad economy.

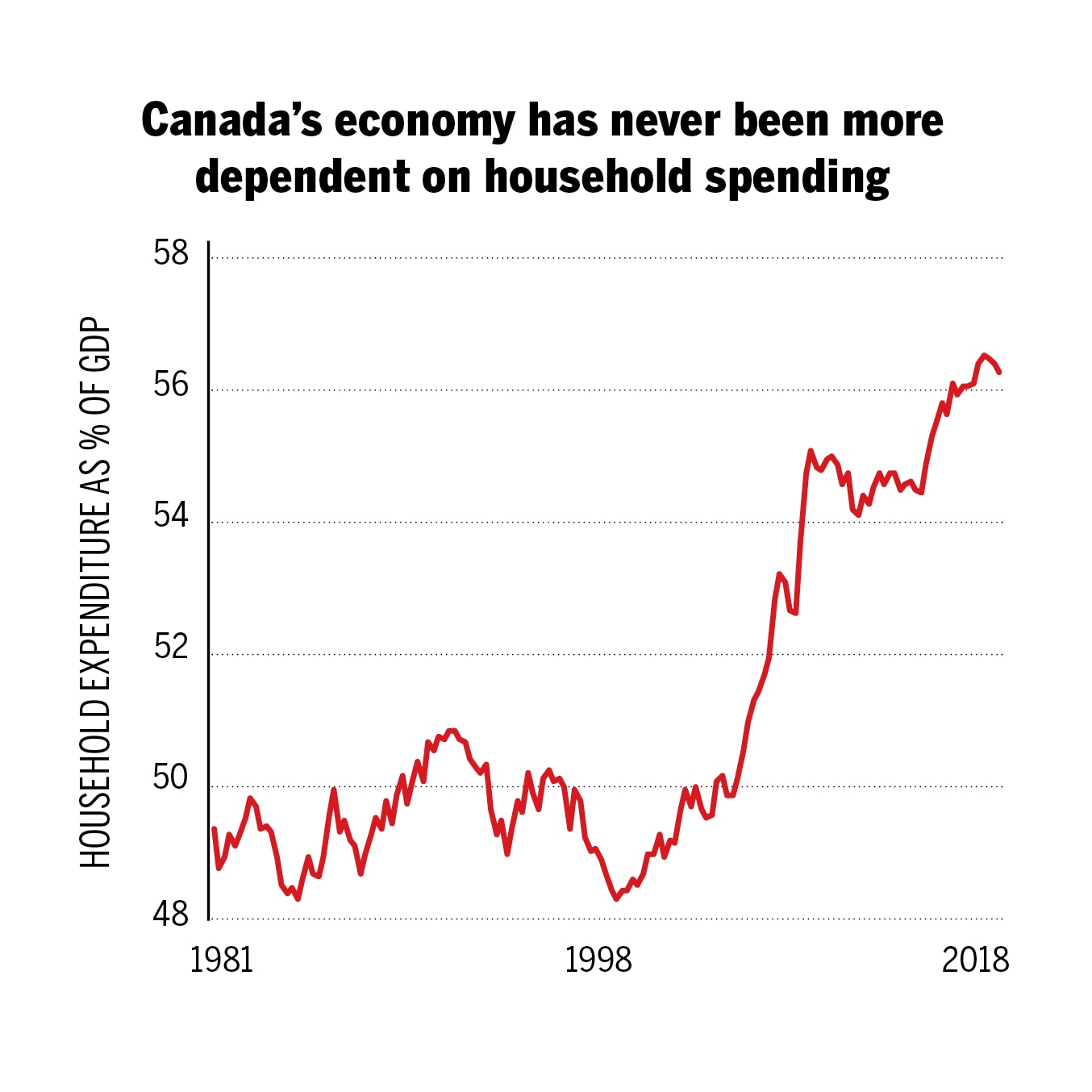

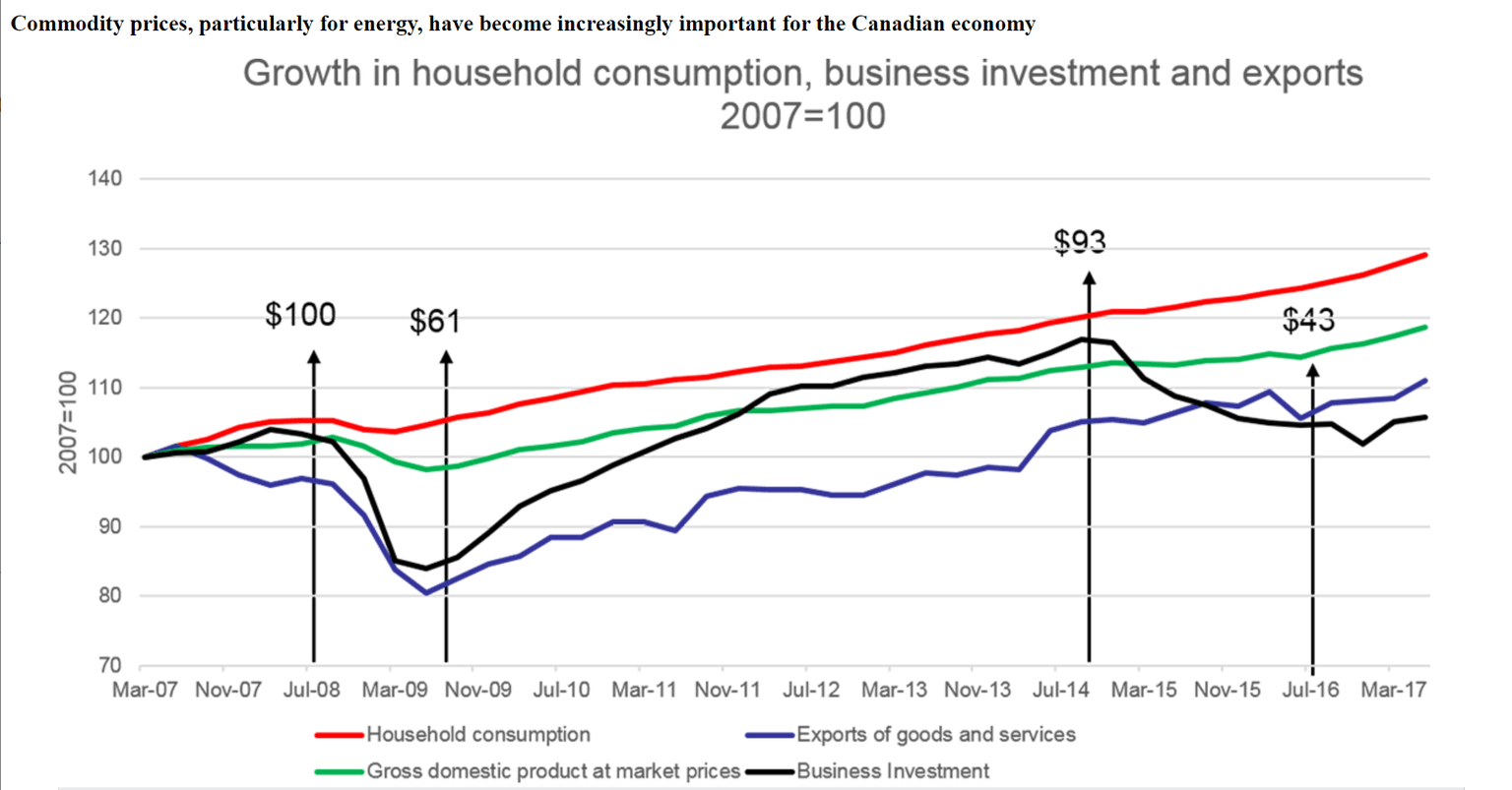

If Canada produced more goods to bolster exports to foreign countries, the last chart wouldn’t be as devastating to the overall economy. Unfortunately, the next charts suggest that severely constricted consumer credit is indeed a big problem for Canada. The first, from Maclean’s, shows us how reliant the Canadian economy had become on consumer spending in the wake of the 2008 recession.

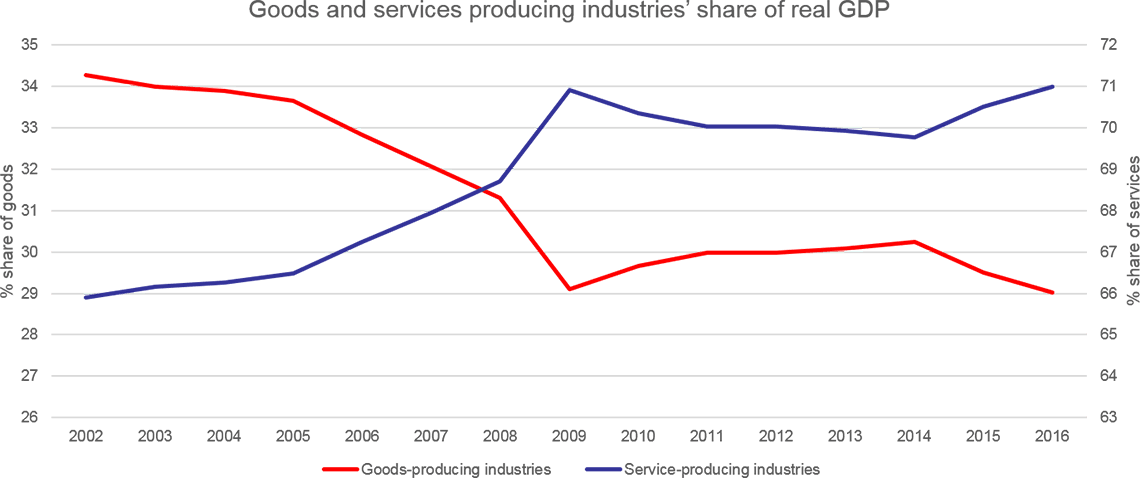

With household spending having been accelerated by the last recession, to well over 50% of GDP, an already overly indebted Canadian consumer looks unlikely to be able to take on such an acceleration after the current recession of 2020. The second chart showing just how dependent Canada has become on the consumer, from Stats Canada, puts into perspective the acceleration in the service industry (blue) in the post-2008 Canadian economy. This does not bode well for the future now that banks seem to be signaling that the Canadian consumer is tapped-out. Goods-producing economic activity (red), would ideally be bolstered if Canada were to recover more quickly from the current pandemic-recession.

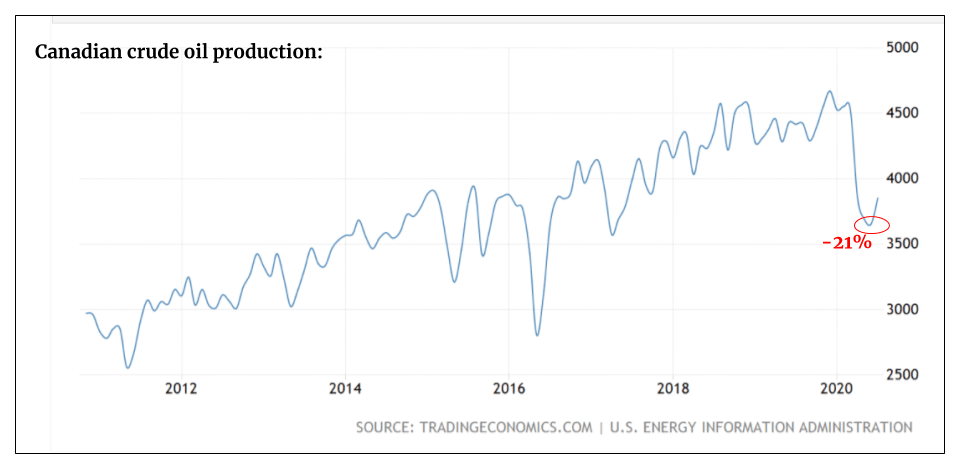

One might say, well why pick on Canada so much? Other countries have spent in deficits this year, with their central banks aggressively expanding their balance sheets! What makes Canada more vulnerable is the aforementioned reliance on consumer spending and excessive leverage. Moreover, Canada’s economy was already much less dynamic than its G7 counterparts, before the current crisis hit. Canada has long been relying on a deteriorating oil and gas sector for exports and a housing market that is ranked among the top “bubbles” in the world.

In 2019, over one-fifth of Canada’s exports came from crude oil and related products. The chart below signals danger ahead as Canadian oil production has taken more than a 20% hit in 2020. Adding to the pain is the fact that oil prices have been decimated this year due to a collapse ein demand. Economic shutdowns around the world have exposed an oversupply in oil markets, and the distinct advantage shared by Saudi and Russian producers. Competitors are capable of producing oil at a fraction of the price it costs to bring Canadian crude to market, and thus the demand for Canada’s oil is unlikely to recover quickly. A lack of any viable pipeline project to bring Canadian oil to southern US refineries will also weigh on the sector’s road to recovery.

Following massive debt monetization by the central bank, financial asset prices rebounded to fill the void left behind by the initial shock in March of this year. However, we can see that Canadians are left with the prospects of even higher taxation in the future and less purchasing power. Another pandemic-driven event that is sure to hinder Canadian consumer spending has been an even more inflated housing bubble. Thanks to the limited supply of homes on the market during the pandemic, buyers looking to capitalize on low rates have been willing to pay well over asking prices to own a home.

The next chart from Stats Canada, below, shows us how Canadian household consumption (red), business investment (black), and exports (blue) all stack up relative to GDP growth (green) since we pulled out of the last recession. This serves to paint a vivid picture of the consumption trap:

It’s hard to imagine that with mounting costs for housing and everyday goods, Canadians will be excited to go out and consumer in greater quantities, even once a vaccine arrives. This will likely be a drag on Canada’s businesses, which have benefitted from lenient consumer credit conditions for their customers. Speaking of businesses, it seems that banks are also looking to decrease lending to Canadian businesses as well. In the chart below (from the Bank of Canada), year over year business loan growth seems to have peaked and is heading lower.

We can note that there is still a long way for the chart to fall - if it is to reach 2008 levels. Given the bleak pictures painted by both the household credit crunch and weak exports, there is a good chance that banks remain in a defensive posture and business loans continue to fall. This will hurt the job market’s recovery, as tighter credit for businesses will be an unwelcome change from the loose lending conditions that followed the 2008 recession. With interest rates having no room left to fall, it’s hard to see how much government policy can help to soften this burden on businesses.

To recap, here’s where things stand for Canada:

- The bank of Canada and government legislators have managed to achieve rising inflation, but banks remain in a defensive posture with a stagflationary environment beginning to set in.

- An already overly-leveraged Canadian consumer and private sector are both largely unable to shoulder higher costs and unable to take on more debt. This means the same playbook from 2008 is unlikely to stimulate the economy.

- While financial assets may have recovered along with CPI, the flow of credit does not look to be loose enough to suggest the real economy can handle such a burden.

- Interest rates have nowhere to fall unless the BoC moves below the zero bound. Banks will likely remain defensive in this environment and look to reduce their exposure to the Canadian consumer. This makes for a more financialized Canadian economy and is likely to further increase inequality as the Bank of Canada keeps assets propped up with its balance sheet.

- As of October, Canada’s unemployment rate has rebounded slightly from the 2020 peak of over 13%. It remains at 8.9%, however, still higher than the 8.7% peak unemployment rate during the 2008 recession.

To judge the recovery from here, it will be important to see whether there is a rebound in business lending and if credit conditions for households manage to ease. This will be a tall task for Canadian policymakers. We can expect the Canadian recovery to be much slower than in 2008 if officials are unable to conjure a miracle of sorts.

Investors and businesses alike would be well advised to examine the heightened currency risks in a situation where the Bank of Canada and government planners elect to continually inflate their economies woes away by monetizing extreme deficits. Legendary investor Ray Dalio has recently made it clear that he believes currency diversification and the ownership of gold will be necessary moving forward.

Finally, this all begs the question: how long can this amount of price inflation continue to be imposed on the Canadian private sector and households before they realize the pain policymakers are inflicting with their “inflation at all costs” beliefs? Currency debasement and the monetization of government deficits seem destined to reduce the Canadian working-class’ standard of living.

Author

Miles Ruttan

Bytown Capital

Miles' focus at the firm is to oversee our macro analysis, with the emphasis being placed on global credit and liquidity flows.