US 10yr future rebound risk

A slightly positive tone on Tuesday, but still viewed as a digestion phase to start the week with further range activity expected into midweek.

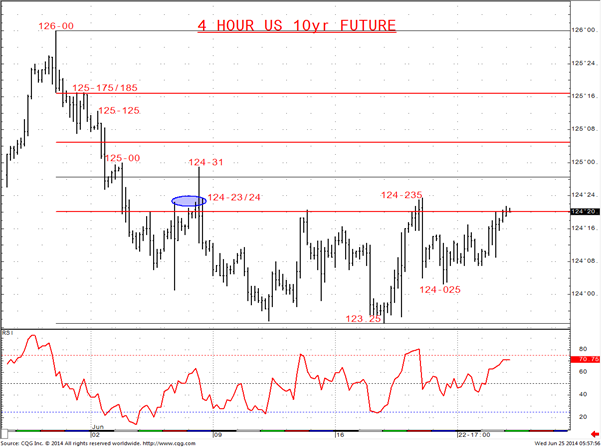

The upside head fake last Thursday, faltering back from resistance at 124-23/24 ahead of better chart barriers at 124-31/ 125-00, leaves late June bear pressures intact.

We see a modest upside risk, maybe above 124-23/24, but capped by 125-00 into midweek.

For the week, we see downside extension risk through 124-025 for 123-25/21.

Overshoot threat is down to the key trend line from Sept 2013, now 123-05.

WHAT CHANGES THIS?

Above 124-24 eases bear risks; through 124-31 signals a neutral tone, only shifting positive above 125-175/185.

4 Hour US 10yr Sept Future Chart

Daily US 10yr Sept Future: Adjusted Continuation Chart

THERE IS SUBSTANTIAL RISK OF LOSS IN TRADING FUTURES, OPTIONS AND FX PRODUCTS. INFORMATION PROVIDED WITHIN THIS MATERIAL SHOULD NOT BE CONSTRUED AS ADVICE

Recommended Content

Editors’ Picks

AUD/USD extends gains due to improved risk appetite

The Australian Dollar maintained its winning streak for the fourth consecutive session on Monday, buoyed by a hawkish sentiment surrounding the Reserve Bank of Australia. This optimism bolsters the strength of the Aussie Dollar, providing support to the AUD/USD pair.

USD/JPY snaps three-day losing streak above 153.50, Yellen counsels caution on currency intervention

The USD/JPY pair snap a three-day losing streak during the Asian trading hours on Monday. The uptick of the pair is bolstered by the modest rebound of the US Dollar and US Treasury Secretary Janet Yellen’s comments on potential Japanese interventions last week.

Gold price rebounds on downbeat NFP data, softer US Dollar

Gold price snaps the two-day losing streak during the Asian session on Monday. The weaker-than-expected US employment reports have boosted the odds of a September rate cut from the US Federal Reserve. This, in turn, has dragged the US Dollar lower and lifted the USD-denominated gold.

Bitcoin Cash could become a Cardano partnerchain as 66% of 11.3K voters say “Aye”

Bitcoin Cash is the current mania in the Cardano ecosystem following a proposal by the network’s executive inviting the public to vote on X, about a possible integration.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.