Will rising COVID-19 cases number hamper the Eurozone recovery?

Cryptocurrency prices retreated after the Securities and Exchange Commission (SEC) asked Congress for more powers to regulate the industry. Gary Gensler, the SEC chair made the request at the Aspen Security Forum. The industry is now valued at more than $1.6 billion according to data compiled by CoinMarketCap. More than 70 coins are valued at more than $1 billion. He lamented that many investors and traders were not even aware of how the cryptocurrencies they invested in, work. Also, they lacked adequate information about the projects and their founders. His statement came a day after it emerged that Congress is planning to tax crypto transactions in a bid to raise funds for the infrastructure project. The new tax is expected to raise almost $30 billion.

The British pound tilted higher as the Bank of England (BOE) started its monetary policy meeting. The bank will publish its decision tomorrow. Analysts expect that the bank will leave interest rates unchanged and sound cautious about the economy. This is because business activity is expected to retreat as the reported Delta variant spreads. Data published today showed that the service sector saw lower activity in July. Growth in the sector declined to the lowest level in four months as cases and inflation. The PMI declined to 59.6 in July. Most respondents of the survey blamed isolation rules and tight restrictions on international travel.

The EURUSD retreated after the relatively mixed Eurozone retail sales and services PMI numbers. According to Eurostat, the bloc’s retail sales rose by 1.5% in June after rising by 4.1% in the previous month. This increase was lower than the median estimate of 1.7%. The sales rose by 5.0% on a year-on-year basis. Meanwhile, business activity rose at a lower-than-expected rate. The services PMI rose from 58.3 in June to 59.8 in July while the composite PMI rose from 59.5 to 60.2. The Eurozone has benefited from robust vaccination process but the rising number of covid cases may hamper the recovery.

BTC/USD

The BTCUSD pair declined slightly as investors feared regulations and taxes. The pair declined to 37,500, which was substantially lower than this week’s high of more than 42,000. On the hourly chart, the pair moved below the 25-day and 15-day moving averages. It has also formed what looks like a head and shoulders pattern while the MACD has remained below the neutral level. Therefore, the pair may keep falling as investors target the key support at 36,000.

EUR/USD

The EURUSD pair declined sharply after the latest Eurozone PMI and retail sales data. It moved to a low of 1.1840, which was the lowest level since July 29. The pair moved below the lower side of the bearish pennant pattern. It has also moved below the 25-day moving average while the MACD moved below the neutral level. The pair has also retested the lower line of the pennant. Therefore, the pair will likely resume the downward trend now that it has formed a break and retest pattern.

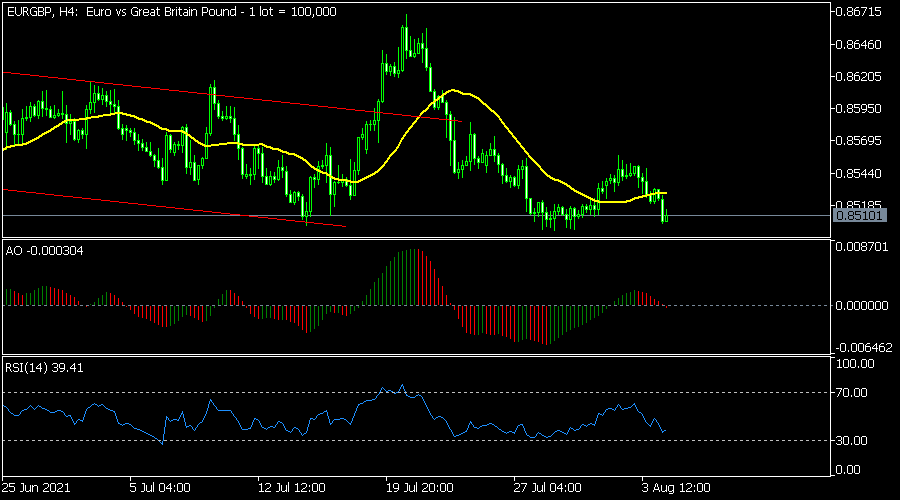

EUR/GBP

The EURGBP pair declined to a low of 0.8500, which was the lowest level since July 28. On the four-hour chart, the pair has formed a head and shoulders pattern. It has also moved below the 25-day and 50-day moving averages. The Relative Strength Index (RSI) and MACD have also declined. Therefore, the pair will likely keep falling as bears target the next key support at 0.8750.

Author

OctaFx Analyst Team

OctaFX

OctaFX is a market-leading forex broker, providing personalised forex brokerage services to customers in over 100 countries worldwide.