Australian GDP Preview: How will GDP impact AUD?

- Australia headed for a recession, analysts at looking to today's GDP for clues.

- AUD firmer on less than expected intervention from RBA and emergency Fed cut.

Australia’s quarterly national accounts are due at 11:30am Syd/8:30am Sing/HK. The event will be held in high regard with financial and commodity markets considering the coronavirus and the fear-factor in the markets, driving equities into official correction territories and central banks to act accordingly.

The Reserve Bank of Australia, yesterday, cut the cash rate -25bp to 0.5%, although market pricing was between -30bp- -50bp cut which gave some value in the Aussie that bounced from under 0.6530 to 0.6566, before sliding to 0.6540. Markets are pricing around 100% chance of another 25bp cut at the next RBA meeting on 7 April and today's GDP will be another key influencer for AUD.

What to expect in GDP

Some analysts are expecting the global economy to move into a recession and Australia is in the firing line. While today's GDP data will not factor in the threat of the spread of the coronavirus and its impact on business and the economy, traders will be looking at the vulnerability of the economy according to the prior quarter as the coronavirus impacts in the first quarter of January 2020.

One of the major concerns has been with international trade and according to the Bureau of Statistics, the current account surplus, seasonally adjusted, fell by 85 per cent to $955 million in the December quarter 201, reflecting lower commodity prices and lower demand for exports. Also, Australian retail turnover fell 0.5 percentage points in December 2019, which is a worry considering consumer spending generates the bulk of economic growth. One would expect that this will be a trait that will continue in the first quarter of 2020 as the coronavirus bites.

Spending by businesses was also lacklustre in December and businesses spending on equipment, plant and machinery only rose 0.8 per cent in the December quarter and as the Reserve Bank governor, Philip Lowe, said, businesses remain reluctant to spend and certainly do not possess the "animal spirits".

Meanwhile, the market consensus is for a year on year outcome as 1.9% vs 1.7% prior. Where most of the focus will be today, markets look for 0.3% vs 0.4% for the quarter over the prior quarter result. We have seen soft net exports and public demand data, and the markets are factoring headwinds surrounding productivity in the main as well as a subdued economy. December quarter current account deficit fell back to 0.2% Gross Domestic Product on the back of lower export prices.

However, on the other hand, we have seen stronger than expected inventories, profits, and wages, only partly offset by slightly weaker government spending and net exports. any improvements in the expected data today could put the economy on track towards a 2.3% target, consistent with the RBA’s characterization of a “gentle turning point”.

How will GDP impact AUD?

We have already seen the Reserve Bank of Australia cut interest rates, but below the genal consensus and hence AUD was bid into the emergency interest rate cut by the Federal Reserve overnight. The market was long AUD into 0.6645 vs the greenback highs before moving back to current levels around 0.6580.

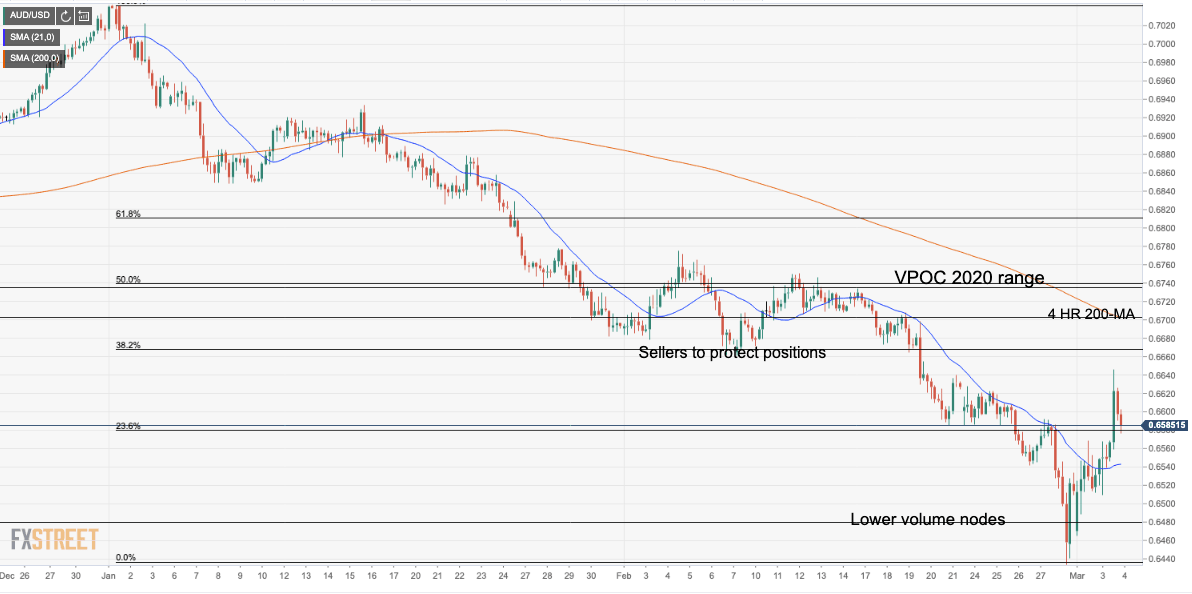

Depending on today's outcome, the levels of interest are seen as 0.6544 and 0.6721 on the wide-based on the volume profiles and points of control of the 28th Feb swing low-post-Fed rate cut rally and the 2020 range respectively. The former has a confluence of a 50% mean reversion of the range while the latter has a 50% mean reversion confluence of the 2020 range. However, the 200 four-hour moving average falls in at 0.6700 and we also see strong support at 0.6670 built up over Feb business, where sellers would be expected to defend shorts in a higher volume node area. To the downside, 0.6540 and 0.6510 and 0.6480 are the final supports on the 2020 value range. Should the data come out in line with expectations, we can expect to see some weakness in AUD considering the weakness in the economy. Immediate support comes as 0.6570.

AUD 4-hour chart

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.