AUD/USD Weekly Forecast: Riding the iron rooster

- AUD/USD reaches 29-month high against US dollar.

- Aussie poised to break the top of the five-month ascending channel.

- Iron ore prices up 70% this year on Chinese economic stimulus.

- Resource demand to keep AUD/USD bid through the first half of 2021.

- FXStreet Forecast Poll contrasts technicals and fundamental aspects of the AUD/USD.

While the rest of the world waits for the pandemic to ease China's infrastructure based recovery has boosted iron ore prices to their highest since Singapore futures began trading in 2013, propelling the currency of its main supplier, Australia, to its best level in two-and-a-half years.

The AUD/USD reached 0.7539 on Thursday, closing at 0.7536 and touched 0.7572 on Friday before ending at 0.7535, up 1.4% on the week and 1.9% in December. Since closing at 0.7028 on October 30 the aussie has gained 7.2% versus the greenback.

Australian strength has triumphed against a background of dollar weakness. Initial Jobless Claims in the US jumped to an 11 week high and a stimulus package remains mired in Congressional and election year politics. The euro has gained 4% on the dollar since October 30 and the Canadian dollar, another resource currency, is up 4.1%.

Chinese demand and potential shortage in supply have driven iron ore futures prices about 70% higher this year. Spot prices of $157.45 on Wednesday were the highest since 2013 though still about the $36 below the record from 2010. Supply constraints from the world's largest producer, Vale SA, as it tries to restore capacity after a tailings dam collapse in Brumadinho, Brazil killed 270 people in January 2019, are likely driving price speculation beyond normal boundaries. .

Australian business confidence reflects the boom out of China. The National Australia Bank's Business Confidence Index in November saw its best score in three years and the Current Conditions Index was the highest since November 2018.

Markets are discounting the recent diplomatic wrangle between Beijing and Canberra over a tweet by a Chinese official of a fake picture of an Australian soldier that had escalated into competing trade threats.

The economy has restored 68.3%% of its pandemic job losses, though October's unexpected 178,800 increase, forecast has been for a loss of 30,000, is expected to cool to 50,000 in November.

AUD/USD outlook

The fundamental background supporting the Australian dollar should improve further as the global economy moves into recovery in the next two quarters. China will not be the only major industrial power attempting to restart growth with a combination of industrial and consumer stimulus. Demand for raw materials will continue to rise in the early stages of the renaissance and the scope for gains in resource currencies will be strong.

Technically, the upper border of the five-month old rising channel at Friday's close is not a substantial impediment as the recent appreciation of the AUD/USD is a fundamental endeavor.

Initial resistance at 0.7600 is weak with a more definite level at 0.7670. The Australian dollar ranges of the last two year have been an anomaly largely based on the US-China trade dispute and then the COVID-19 pandemic. Historically, currency markets have been comfortable with a considerably stronger AUD/USD. That ease is about to return.

*Riding the Iron Rooster is a travel book by American author Paul Theroux about his journeys in China in the 1980s.

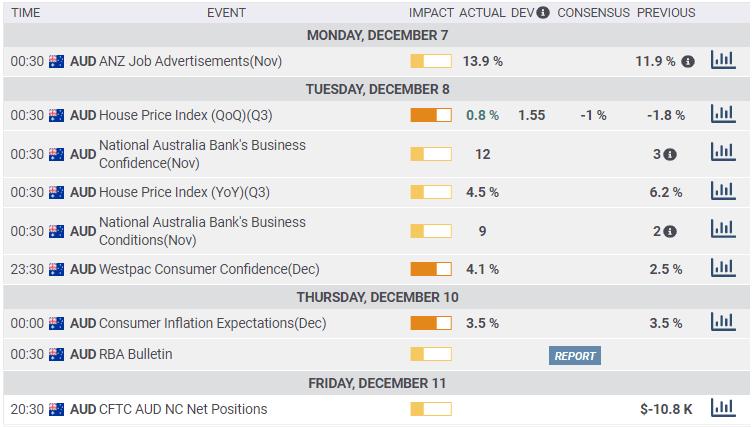

Australia statistics December 7-December 11

Australian Business confidence reached two year and more highs in December. Consumer Confidence rose but was below its level in September and October.

Monday

The ANZ Job Advertisements for November rose 13.9% after 11.9% in October.

Tuesday

The National Australia Bank's Business Confidence climbed to 12 in November from 3 prior. It was the best reading since July 2017. The pandemic low was -65 in March. The National Australia Bank's Business Conditions increased to 9 in November from 2 in October. For the best score since November 2018. The April low was -34. Westpac Consumer Confidence for December was 4.1 up from 2.5 in November.

Thursday

Consumer Inflation Expectations were unchanged in December at 3.5%.

US statistics December 7-December 11

Initial Claims and Michigan Consumer Sentiment held the greatest economic interest. Consumer confidence was better than forecast but claims were much worse. November CPI confirmed that inflation continues to recover from its second quarter lows.

Tuesday

National Federation of Independent Business Optimism Index for November was 101.4, down from 104 in October. In February the index was 104.5, the April low was 90.9.

Wednesday

The Job Openings and Labor Turnover survey (JOLTS) from the US Bureau of Labor Statistics which tracks jobs vacancies, was 6.652 million in October, better than the 6.3 million estimate and September's 6.494 million. The high since February's 7.004 million has been 6.697 in July. The low has been 4.996 million in April.

Thursday

The Consumer Price Index for November was 0.2% on the month and 1.2% the year after October's 0.0% and 1.2% scores. The forecasts were 0.2% and 1.1%. The core CPI rates were 0.2% (MoM) and 1.6% (YoY) following 0.0% and 1.6% in October. Estimates were 0.1% and 1.6%.

Initial Jobless Claims jumped to 853,000 in the week of December 4 on a 725,000 prediction and a revised 716,000 prior. Continuing Claims were 5.757 million in the November 27 week on a 5.527 million prior and a 5.335 million projection.

Friday

The preliminary Michigan Consumer Sentiment Index for December came in at 81.4, considerably better than the 76.5 forecast and November's 76.9 reading.

The Producer Price Index (PPI) rose 0.1% on a 0.2% forecast in November, down from 0.3% prior. On the year it rose 0.8% as expected, up from 0.5% in November. The core index gained 0.1% (MoM) and 1.4% (YoY) after 0.1% and 1.1% in October.

Australian statistics December 14-December 18

The Australian labor market is forecast to cool in November but with Chinese resource demand still rising the prospects are excellent for the first half.

Monday

Labor market information for November is paramount. Job creation is forecast to fall sharply in November. The greater the drop the higher the negative impact on the aussie which is trading at 18-month highs.

Minutes from the Reserve Bank of Australia's December 1 meeting. Commonwealth Bank Preliminary Services and Manufacturing PMI for December, prior was 55.4 and 55.8 respectively. The Composite Index was 54.9 in November. The Westpac Leading Index for November. October's 0.12% was the weakest in three months.

Wednesday

The Housing Industry Association (HIA) New Home Sales for October. September fell 1.3%.

Thursday

The Employment Change for November from the Australian Bureau of Statistics is expected to create 50,000 jobs after adding 178,800 in October. The labor market has recovered 68.3% of jobs lost in April and May. Fulltime and Part-Time Employment added 97,000 and 81,800 in October. The Unemployment Rate for November is predicted to be unchanged at 7% as is the Participation Rate at 65.8%.

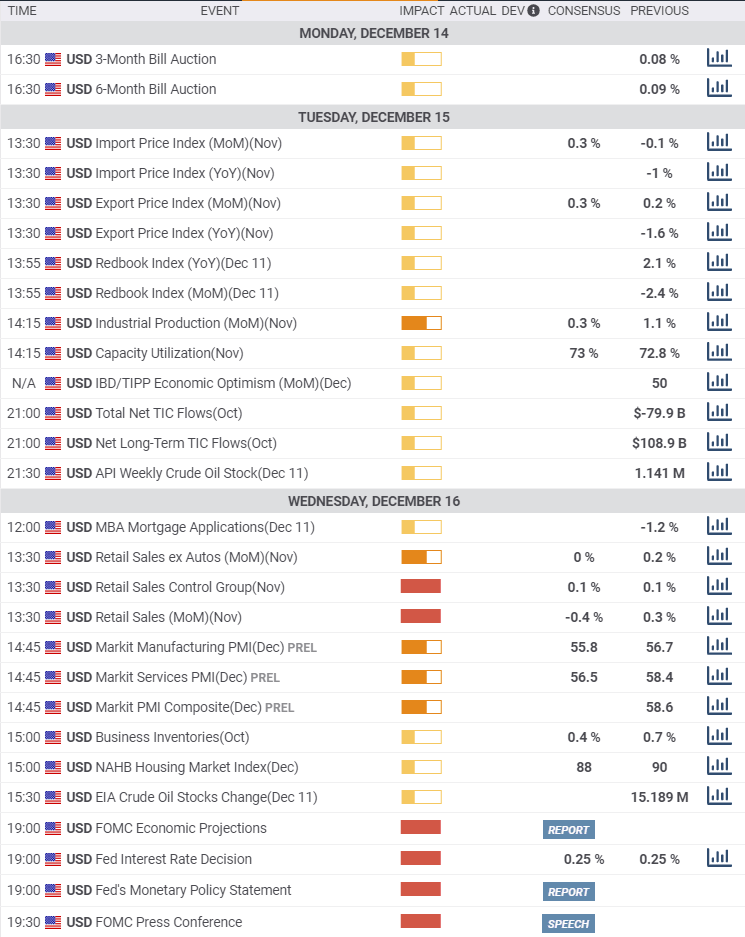

US statistics December 14-December 18

The Federal Reserve rate and economic projections and Chairman Jerome Powell's new conference are the main interests this week. No change in foreseen in the fed funds rate or the monthly $120 billion bond program, though the minutes from the November meeting noted that “Many participants judged that the Committee might want to enhance its guidance for asset purchases fairly soon.” Any 'guidance' that hints at reduction will support the dollar as US Treasury rates are being restrained solely by the force of the purchase program.

The prior set of Projection Materials in September added a fourth year, 2023, to the estimates. Economic growth was forecast to be -3.7% this year and 4% in 2021. The fed funds rate was unchanged at 0.1% through the end of 2023. Any change in these predictions or unemployment 7.6% this year, 5.5% next or Core PCE inflation, 1.5% in 2020 and 1.7%% in 2021 will, if improved as is likely, aid the dollar.

Retail Sales for November will be watched to see if the miss in October, 0.3% on a 0.5% forecast and 0.1% on a 0.5% prediction for the Control Group, is predictive for the holiday season in December. Given the increasing number of ordered closures in several states and the weak payroll numbers the risk is to the downside, for markets and the dollar. Initial Jobless Claims are important, as every week, for the state of the labor market.

Tuesday

Industrial Production in November is forecast to rise 0.5% after jumping 1.1% in October and dropping 0.4% in September. Production fell 17.1% in March and April, from May to October it has gained 12.5%. Capacity Utilization is projected to reach 73% in November from 72.8%. It was 76.9% in February and the low was 64.2% in April.

Wednesday

Retail Sales are forecast to decrease 0.1% in November following the October 0.3% gain. Control Group Sales are expected to rise 0.2% after the 0.1% addition in October. Sales ex Autos rose 0.2% in October.

The final Federal Reserve Open Market Committee (FOMC) meeting of the year will rule on the fed funds, the bond purchase program and issue new economic and rate projections. Chairman Jerome Powell will read a brief statement and answer press questions half-an-hour after the FOMC statement.

Thursday

Initial Jobless Claims for the week of December 11 are expected to drop to 800,000 from 853,000. Continuing Claims were 5.757 in the November 27 week.

Building Permits and Housing Starts for November are expected to be 1.555 million and 1.528 million annualized respectively and about par with October. The housing market has been one of the US economy's bright spots with sales, construction and prices near all-time highs.

USD/AUD technical outlook

Recent and extensive support, resistance based on distant and weak levels and a swiftly improving economic background make a near irrestiable case for a higher AUD/USD.

The rising channel that debuted in early June has reached the limit of functionality and should not offer much resistance. The week's close at the channel's upper border and nearly a two-and-a-half year high will negate any minor technical obstacle.

The Relative Strength Index is overbought at 73.37 but in the current fundamental context it is not a sell signal. The 21-day and 100-day moving averages were crossed six weeks ago on November 3 and the distance to market for both has increased since, a sign of continuing gains ahead. The 21-day average at 0.7376 coincides with 0.7375 support, the 100-day at 0.7226 and the 200-day at 0.6899 are no inthe current technical picture.

Resistance: 0.7600; 0.7670; 0.7725; 0.7800

Support; 0.7440; 0.7400; 0.7375; 0.7330; 0.7270

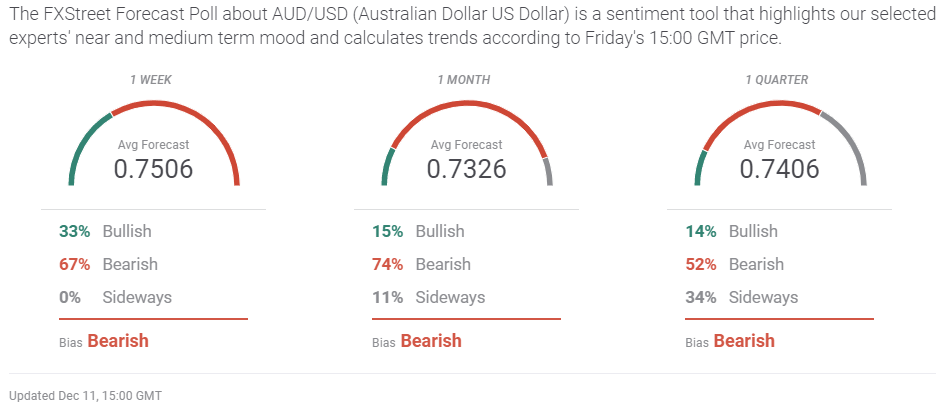

AUD/USD Forecast Poll

The technical indicators that limit the AUD/USD in the FXStreet Forecast Poll advance beyond the ascending channel are in conflict with the fundamental factor of a demand driven surge for the Australian economy. China is in the pole position for the economic recovery but as the first quarter proceeds other major powers should join. The limitations of resistance should bow to the aussie's fundamental strengths.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.