The Aud has had a choppy session by using 0.7400 as a pivot but is finishing towards the lower end of the 0.7425/0.7377 range, partly due to the firmer US$ and partly because copper and iron-ore continue to weigh on the pair. The underperforming Building Permits early yesterday also added to the downside momentum.

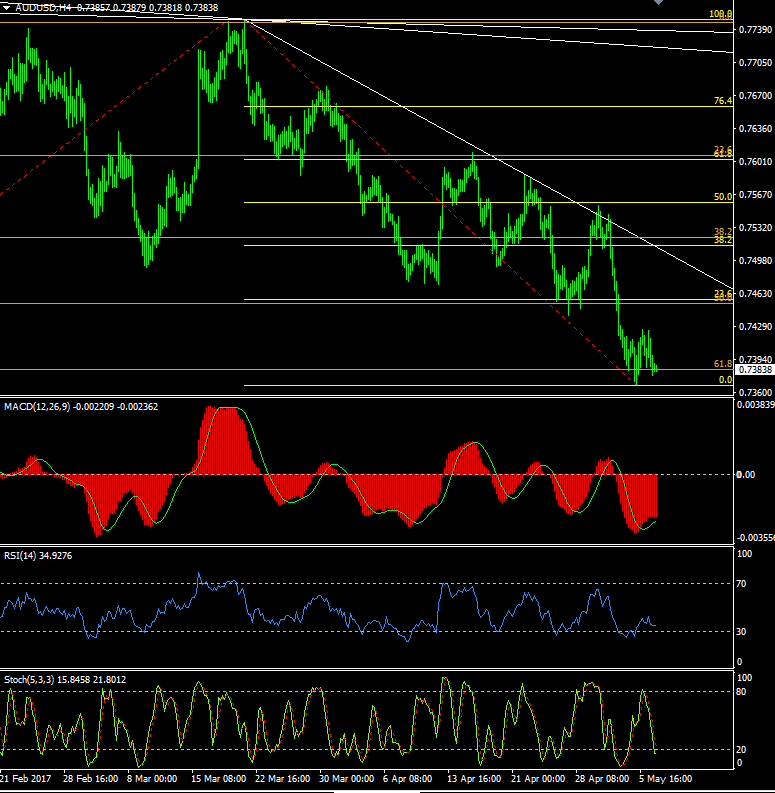

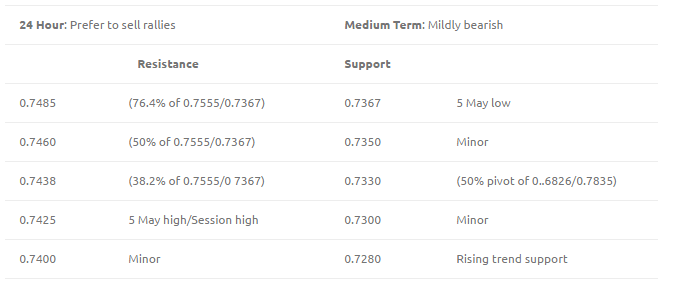

Technically, the short term momentum indicators look a little more mixed, with the 4 hour charts still suggesting that we may need another test of the topside, possibly hinting at further choppy consolidation. If 0.7400 can be regained we may then get another test of the 0.7425 session high. Beyond there, although unlikely, would allow a move back towards 0.7440, 0.7460 and 0.7485.

On the other hand, the dailies are pointing increasingly lower, suggesting any short term strength should be sold into. Back below the session low of 0.7377 would find good bids nearby at the Friday low of 0.7367, but a break of this would seem to have little to hold the Aud up until 0.7300 and the rising trend support, at 0.7285. Being short is still preferred, looking for another squeeze above 0.7400 to sell into. It may get volatile today, with the Retail Sales and the NAB Business Conditions/Confidence due. We then get the Budget tonight although that generally has little effect on the currency.

Economic data highlights will include:

Retail Sales, NAB Business Conditions/Confidence, Australian Budget

All content on this website, www.fxcharts.com.au (FX Charts PL) is a personal view only and offers absolutely no guarantee as to the correctness or otherwise of that opinion. The content here is of a “general nature” only and does not constitute personal or investment advice. The FX Charts website is not an inducement to trade Foreign Exchange (FX). No liability whatsoever is accepted for any loss or damage that may result, directly or indirectly, from any , comment, opinion, information or omission, whether negligent or otherwise, within the FX Charts Website. The information and any opinion or outlook expressed in this commentary may be based on assumptions or market conditions and may be liable change at any time, without notice.

Recommended Content

Editors’ Picks

EUR/USD retreats toward 1.0850 on modest USD recovery

EUR/USD stays under modest bearish pressure and trades in negative territory at around 1.0850 after closing modestly lower on Thursday. In the absence of macroeconomic data releases, investors will continue to pay close attention to comments from Federal Reserve officials.

GBP/USD holds above 1.2650 following earlier decline

GBP/USD edges higher after falling to a daily low below 1.2650 in the European session on Friday. The US Dollar holds its ground following the selloff seen after April inflation data and makes it difficult for the pair to extend its rebound. Fed policymakers are scheduled to speak later in the day.

Gold climbs to multi-week highs above $2,400

Gold gathered bullish momentum and touched its highest level in nearly a month above $2,400. Although the benchmark 10-year US yield holds steady at around 4.4%, the cautious market stance supports XAU/USD heading into the weekend.

Chainlink social dominance hits six-month peak as LINK extends gains

-637336005550289133_XtraSmall.jpg)

Chainlink (LINK) social dominance increased sharply on Friday, exceeding levels seen in the past six months, along with the token’s price rally that started on Wednesday.

Week ahead: Flash PMIs, UK and Japan CPIs in focus – RBNZ to hold rates

After cool US CPI, attention shifts to UK and Japanese inflation. Flash PMIs will be watched too amid signs of a rebound in Europe. Fed to stay in the spotlight as plethora of speakers, minutes on tap.