AUD/USD Price Forecast: Seems vulnerable amid RBA rate cut bets; Fed decision awaited

- AUD/USD attracts sellers for the third straight day and is pressured by a combination of factors.

- Softer Australian Q4 CPI print lifts bets for a February RBA rate cut and undermines the Aussie.

- China’s economic woes and trade war fears contribute to the slide ahead of the FOMC decision.

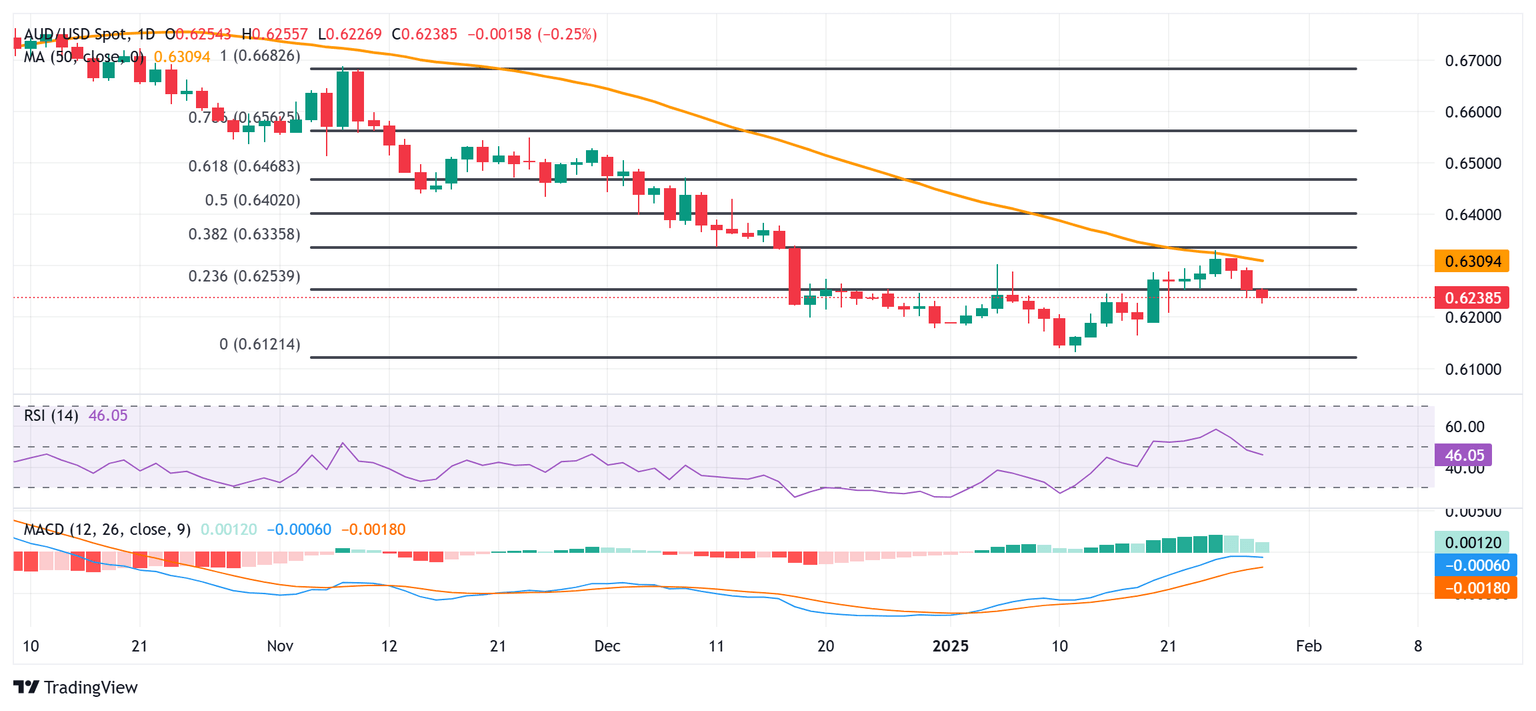

The AUD/USD pair extends its rejection slide from the 50-day Simple Moving Average (SMA), around the 0.6330 region, or its highest level since December 18touched last week and drifts lower for the third straight day on Wednesday. The downward trajectory drags spot prices to the 0.6225 area, over a one-week low and is sponsored by a combination of factors. The Australian Dollar (AUD) is undermined by softer domestic consumer inflation data, which rose at the slowest pace in almost four years in December and opened the door for a rate cut by the Reserve Bank of Australia (RBA) in February.

The Australian Bureau of Statistics reported that the headline Consumer Price Index (CPI) rose 0.2% QoQ in the fourth quarter (Q4) of 2024 and the annual inflation dropped to 2.4% from 2.8% in the previous quarter. Furthermore, the trimmed mean – a key measure of core inflation – increased by just 0.5% last quarter – marking the smallest rise since mid-2021 and the annual pace slowed to 3.2%. The markets were quick to react and are now pricing in an 80% probability that the RBA would cut the cash rate by a quarter basis point at its upcoming policy meeting on February 18. Apart from this, China's economic woes and US-China trade war fears further contribute to the offered tone surrounding the China-proxy Aussie.

In fact, China's official PMIs released earlier this week showed that manufacturing activity unexpectedly contracted in January and the growth in the non-manufacturing sector also slowed significantly during the reported month. This comes on top of US President Donald Trump's aggressive stance on trade policies and threats to impose 25% tariffs on imports from Mexico, Canada, China and the European Union as soon as February 1, which further undermines the AUD. That said, the emergence of some US Dollar (USD) selling lends support to the AUD/USD pair. Bets that the Federal Reserve (Fed) will lower borrowing costs further in 2025 triggers a fresh leg down in the US Treasury bond yields and weighs on the USD.

Traders also seem reluctant to place aggressive bets and opt to wait on the sidelines ahead of the key central bank event risk – the outcome of a two-day FOMC monetary policy meeting. The US central bank is scheduled to announce its decision later during the US session and is universally expected to keep its policy rate unchanged in the target range of 4.25%-4.50%. Hence, the focus will be on the accompanying policy statement and Fed Chair Jerome Powell's remarks at the post-meeting presser. Investors will closely look for any hints regarding the future direction of monetary policy, which will play a key role in influencing the near-term USD price dynamics and provide a fresh directional impetus to the AUD/USD pair.

AUD/USD daily chart

Technical Outlook

From a technical perspective, the recent failure near the 50-day SMA, which coincided with the 50% Fibonacci retracement level of the late November-January downfall, and the subsequent slide favor bearish traders. Moreover, oscillators on the daily chart have again started gaining negative traction, suggesting that the path of least resistance for the AUD/USD pair remains to the downside. Some follow-through selling below the 0.6200 mark will reaffirm the negative outlook and expose the 0.6130 area, or the lowest level since April 2024 touched earlier this month.

On the flip side, the 0.6270-0.6275 region now seems to act as an immediate hurdle ahead of the 0.6300 mark and the 0.6330 confluence – comprising the 50-day SMA and the 50% Fibo. level. A sustained strength beyond the latter might trigger a short-covering rally and assist the AUD/USD pair in aiming towards reclaiming the 0.6400 round figure. The momentum could extend further towards the 0.6450 intermediate hurdle en route to the 0.6500 psychological mark.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.