AUD/USD Price Forecast: Recovery needs a stronger driver

- AUD/USD traded in a vacillating note just above the 0.6200 mark.

- The US Dollar weakened once again on data, dovish comments.

- The Australian labour market came in on a strong note in December.

The US Dollar (USD) seesawed on Thursday, with the US Dollar Index (DXY) dipping below 109.00 in response to discouraging United States (US) data releases and dovish remarks from the Federal Reserve's (Fed) Waller. Meanwhile, the Australian Dollar (AUD) faltered once again in the mid-0.6200s, ending the day marginally on the defensive after three consecutive daily advances.

What's driving the Australian Dollar's rebound?

Although the Australian Dollar has struggled against the strong US Dollar, it has regained some ground recently, helped by a slight pullback in the Greenback. The US Dollar's rally, which began in October alongside the so-called "Trump trade," had significantly pressured the Aussie.

Domestically, the Reserve Bank of Australia (RBA) is considering a February rate cut as it grapples with slow economic growth and easing inflationary pressures. Market expectations of a cut are currently around 60%.

Further weighing on the Aussie were some loss of momentum in domestic fundamentals and confidence gauges, as well as concerns over China’s slowing economy, which is critical for Australian exports. Tepid commodity prices have added to these challenges.

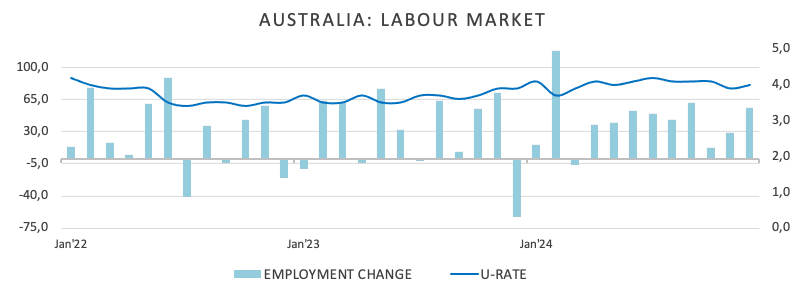

On Thursday, December’s Australian jobs report printed quite a rosy picture after the Employment Change increased more than expected by 56.3K individuals, although the jobless rate ticked a tad higher to 4.0% (from 3.9%). Additional data Down Under saw the Consumer Inflation Expectations ease to 4.0% in January (from 4.2%), according to the Melbourne Institute.

Market signals: RBA remains cautious

At its December meeting, the RBA left rates unchanged at 4.35% but hinted at possible cuts in the future, citing signs of easing inflation. RBA Governor Michele Bullock stressed that upcoming decisions will depend heavily on economic data.

Challenges and opportunities for AUD/USD

The AUD/USD pair faces headwinds from a dominant US Dollar, weak domestic fundamentals, and China’s lacklustre recovery. However, the pair could benefit if the Federal Reserve signals an ongoing rate-cutting cycle, which might weaken the USD.

Technical outlook

AUD/USD remains vulnerable, with critical support at 0.6130. A break below this level could see the pair drop to the psychologically significant 0.6000 mark. On the upside, resistance is seen at 0.6301, with additional barriers at 0.6401 and 0.6549. Momentum indicators are mixed; the RSI looks stuck in the middle of the range around 42, but the ADX above 33 still points to some strength in the trend.

AUD/USD daily chart

What to watch this week

Market attention now shifts to the release of key data in China on Friday, which could influence the AUD’s price action.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.