AUD/USD Price Forecast: Outlook remains negative below 0.6630

- AUD/USD reversed part of the weekly drop and revisited 0.6500.

- The US Dollar faced a renewed sell-off on month-end adjustments.

- The RBA’s Monthly CPI Indicator held steady at 2.1% in October.

The US Dollar (USD) came under marked downside pressure on Wednesday, setting aside Tuesday’s advance and pushing toward the lower end of its weekly trading range. This came as investors continued to assess President-elect Donald Trump’s announcement of sweeping tariffs on imports from Mexico, China, Europe, and Canada in combination with month-end flows prior to the Thanksgiving Day holiday.

In contrast, the Australian Dollar (AUD) regained balance and revisited the key 0.6500 hurdle, mirroring the generalised recovery in the risk complex, while key Australian exports like copper and iron ore managed to advance a tad despite lingering scepticism about the effectiveness of China’s economic stimulus measures—a critical driver of Australian trade.

The Reserve Bank of Australia (RBA) remains cautious in its stance. Earlier this month, the central bank held interest rates steady at 4.35%, balancing its focus on curbing inflation with concerns over slowing economic growth. Governor Michele Bullock reiterated that tight monetary policy would persist until inflation demonstrates consistent and sustainable improvement.

Back to Oz, the RBA’s Monthly CPI Indicator remained at 2.1% in October. Still, the central bank has made it clear—one good quarter doesn’t make a trend, and rate cuts remain off the table for now.

Looking ahead, AUD/USD could find relief if the Federal Reserve (Fed) signals a shift toward rate cuts. However, risks loom large. Inflationary pressures from US policy changes and the USD’s resilience could keep the Aussie under pressure.

On top of that, China’s economic struggles continue to weigh heavily on Australia’s outlook, despite a steady domestic labour market. October’s unemployment rate remained stable at 4.1%, with 16,000 new jobs added—a small win for the economy.

Market expectations suggest the RBA will tread cautiously, with a possible rate cut pencilled in for Q2 2025, contingent on steady progress in reining in inflation. Policymakers have stressed the importance of seeing sustained improvement before considering any policy easing.

Moving forward, traders will be keeping an eye on upcoming reports, including Private Capital Expenditures and a speech by Governor Bullock on Thursday, both of which could offer fresh insights into the central bank’s next moves.

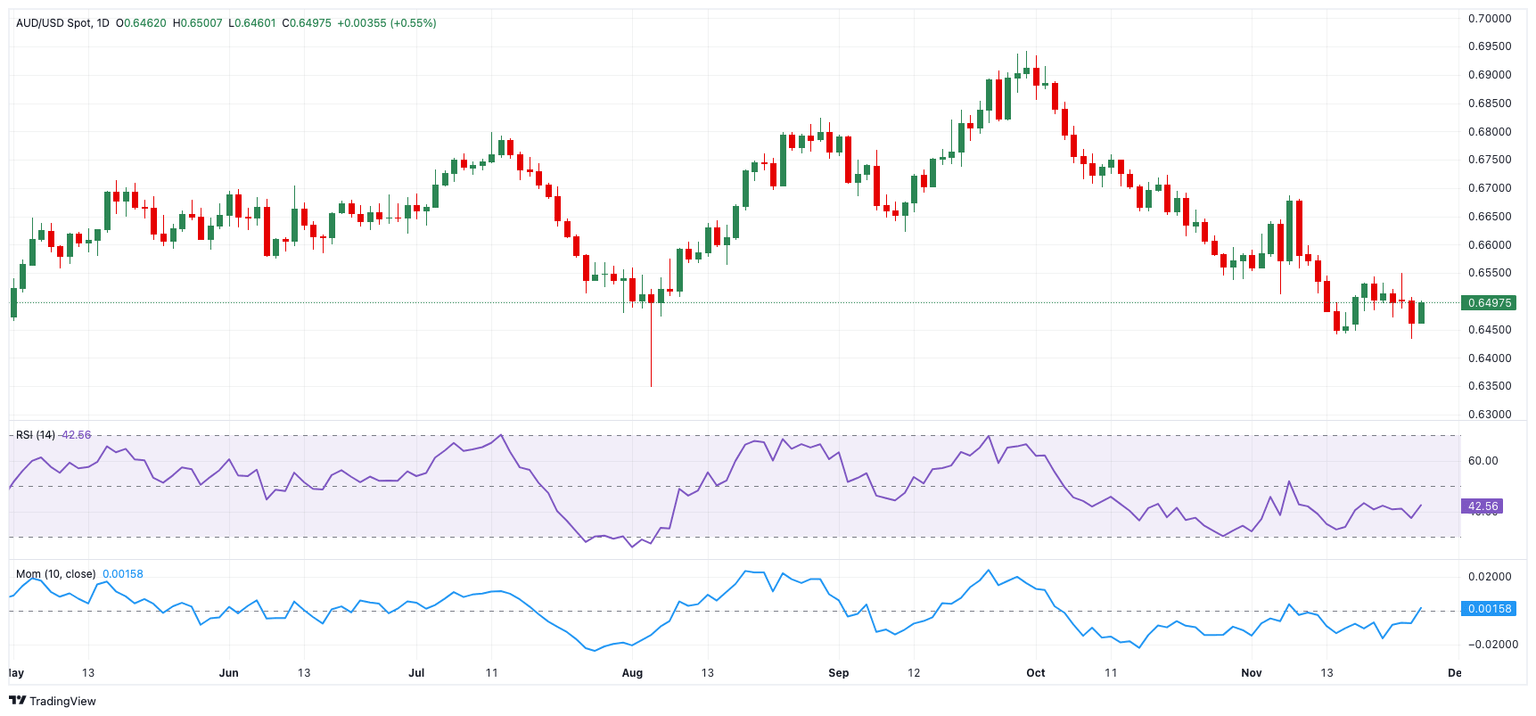

AUD/USD daily chart

Technical Outlook for AUD/USD

If bulls recover control in the short term, the next resistance level will be the weekly high of 0.6549 (November 25), followed by the key 200-day SMA at 0.6627 and the November high of 0.6687 (November 7).

On the other hand, the initial support comes from the November low of 0.6433 (November 26), which precedes the 2024 bottom of 0.6347 (August 5).

The four-hour chart indicates a resumption of the upward bias. The initial support is 0.6433, which comes before 0.6347. Meanwhile, the initial resistance level is projected to be 0.6549, prior to the 200-SMA of 0.6586. The RSI rose to around 52.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.