AUD/USD Price Forecast: 0.6700 confluence hurdle holds the key for bulls ahead of US PPI

- AUD/USD gains traction for the second successive day amid the upbeat market mood.

- Reduced bets for a larger Fed rate cut move boost the USD and might cap the upside.

- Traders now look forward to the release of the US PPI report for short-term impetus.

The AUD/USD pair builds on the overnight goodish rebound from the vicinity of the 200-day Simple Moving Average (SMA), around the 0.6620 region, or a nearly four-week low and gains some follow-through traction on Thursday. The momentum lifts spot prices to a fresh weekly peak during the early European session and is sponsored by the upbeat market mood, which tends to benefit the risk-sensitive Australian Dollar (AUD). The global risk sentiment gets a boost after the crucial US Consumer Price Index (CPI) report reaffirmed market bets for an imminent start of the Federal Reserve's (Fed) policy easing cycle.

In fact, the US Bureau of Labor Statistics reported that the headline CPI rose 0.2% in August and the yearly rate decelerated more than anticipated, from 2.9% to 2.5%, marking the smallest increase since February 2021. Adding to this, a soft reading on Japan's Producer Price Index (PPI) undermined hawkish signals from the Bank of Japan (BoJ) and further boosted investors' appetite for riskier assets. That said, the core US CPI (excluding volatile food and energy prices) was up 0.3% during the reported month and remained at 3.2% in the 12 months through August, matching the increase recorded in July and consensus estimates.

The latter suggested that the underlying inflation remains sticky and dashed hopes for an outsized, 50 basis points (bps) Fed rate cut move next week. According to the CME Group's FedWatch tool, the markets are currently pricing in an 87% chance of a 25 bps rate cut at the next FOMC policy meeting on September 17-18 as compared to 71% before the US CPI data. This leads to a modest uptick in the US Treasury bond yields and pushes the US Dollar (USD) back closer to the monthly peak, which, in turn, could keep a lid on any meaningful appreciating move for the AUD/USD pair amid worries about a slowdown in China.

The aforementioned fundamental backdrop makes it prudent to wait for strong follow-through buying before confirming that the recent corrective decline from a multi-month peak, around the 0.6825 region touched in August, has run its course. The market focus now shifts to the release of the US PPI print, due later during the early North American session. Apart from this, the US bond yields will drive the USD demand, which, along with the broader risk sentiment, should contribute to producing short-term trading opportunities around the AUD/USD pair.

Technical Outlook

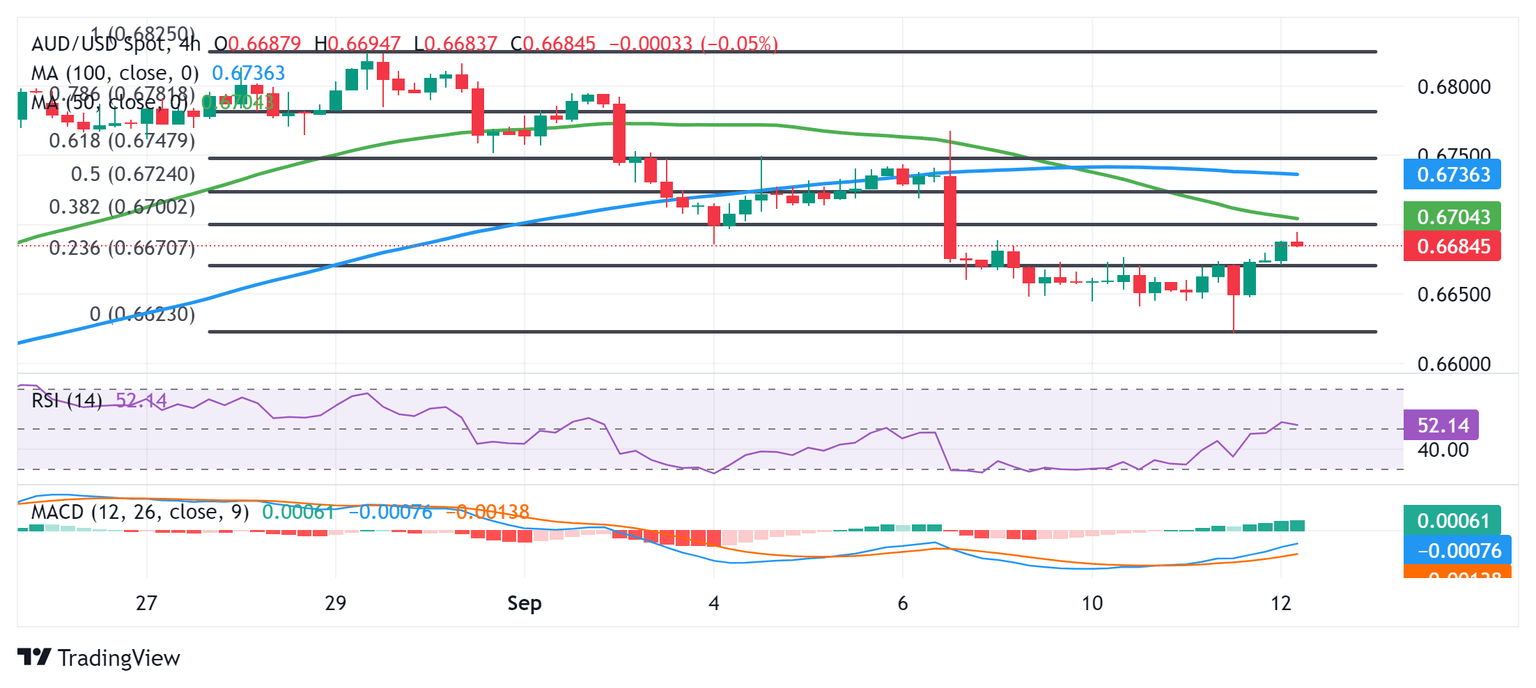

From a technical perspective, the 0.6700 confluence hurdle– comprising of the 38.2% Fibonacci retracement level of the recent leg down and the 50-period Simple Moving Average (SMA) on the 4-hour chart – now seems to act as a pivotal point. A sustained strength beyond will set the stage for a further near-term appreciating move and lift the AUD/USD pair beyond the 0.6725 region (50% Fibo. level), towards the 0.6740 supply zone. The latter coincides with the 100-period SMA on the 4-hour chart, which if cleared decisively will shift the bias back in favor of bullish traders. Spot prices might then accelerate the momentum towards the 0.6765-0.6770 region en route to the 0.6800 mark and 0.6825 area, or the multi-month peak touched in August.

On the flip side, the 100-day SMA, currently pegged near the mid-0.6600s, is likely to protect the immediate downside ahead of the 0.6620 area, or the 200-day SMA. A convincing break below key technical moving averages will be seen as a fresh trigger for bearish traders and make the AUD/USD pair vulnerable to weaken further below the 0.6600 mark, towards the next relevant support near the 0.6570-0.6565 region. The downward trajectory could extend further towards challenging the 0.6500 psychological mark.

AUD/USD 4-hour chart

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.