AUD/USD Forecast: Risk skewed to the upside additional confirmations needed

AUD/USD Current Price: 0.7585

- Tensions between Canberra and Beijing escalate, weighing on the aussie.

- Soaring equities kept AUD/USD afloat and near the weekly highs.

- AUD/USD consolidating weekly gains, risk skewed to the upside.

The AUD/USD pair advanced for a fourth consecutive day but was unable to move past the 0.7600 level. The aussie was backed by soaring US equities, boosted by news indicating that US representatives have reached a deal on President Joe Biden’s spending program. On the other hand, the upside was limited by headlines indicating that China has sued Australia over anti-dumping measures on some Chinese goods. Tensions between the two nations keep escalating after Canberra launched an investigation on the origins of covid.

Meanwhile, gold prices came under pressure amid ruling risk-appetite, with the bright metal down on a daily basis. The Australian macroeconomic calendar has nothing to offer on Friday.

AUD/USD short-term technical outlook

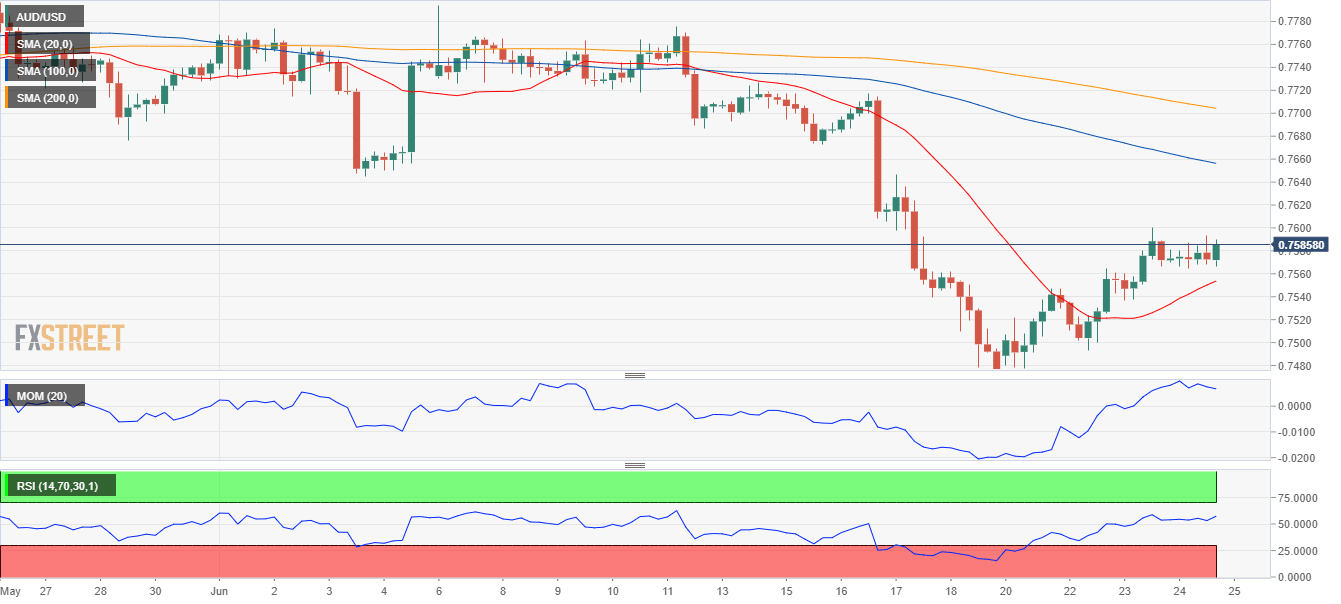

The AUD/USD pair consolidates near the upper end of its weekly range. The near-term picture is neutral-to-bullish, as, in the 4-hour chart, the pair is well above a bullish 20 SMA, while technical indicators consolidate within positive levels. Still, the pair needs to extend its gains beyond the 0.7630 resistance level to turn bullish heading into the weekly close.

Support levels: 0.7540 0.7500 0.7460

Resistance levels: 0.7595 0.7630 0.7675

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.