AUD/USD Forecast: Initial hurdle comes at 0.6585

- AUD/USD came under strong selling pressure.

- The US Dollar regained traction and weighed on the pair.

- The corrective move in the commodities also kept AUD offered.

Tuesday saw a resurgence of buying pressure on the US Dollar (USD), which kept AUD/USD on the defensive, prompting it to retreat after six consecutive daily gains, including a move to three-week highs around 0.6580 on April 29.

Meanwhile, the Greenback faced renewed bid bias as traders seem to have already digested the suspected intervention by the Japanese Ministry of Finance (MoF) on Monday after USD/JPY hit a new 34-year tops beyond 160.00.

The Australian dollar's additional losses were fueled by corrective moves in commodity prices, where copper prices receded after reaching levels last seen in March 2022, while iron ore edged a tad higher above the $110.00 mark.

Regarding monetary policy, investors are anticipating a rate cut by the Reserve Bank of Australia (RBA) later in the year, especially after inflation figures released last week exceeded expectations. Market sentiment now indicates a 90% probability of a 25 bps rate cut in 2024, compared to the approximately 50 bps of easing earlier this month.

Furthermore, both the RBA and the Federal Reserve are expected to begin their easing cycles later than most of their G10 counterparts.

Considering the Fed's commitment to tightening monetary policies and the potential for the RBA to initiate an easing cycle later this year, the likelihood of sustained AUD/USD gains is deemed limited at present.

Moreover, recent Chinese economic data has not provided clear signals of a robust recovery, which is crucial for supporting a significant rebound in the Australian dollar.

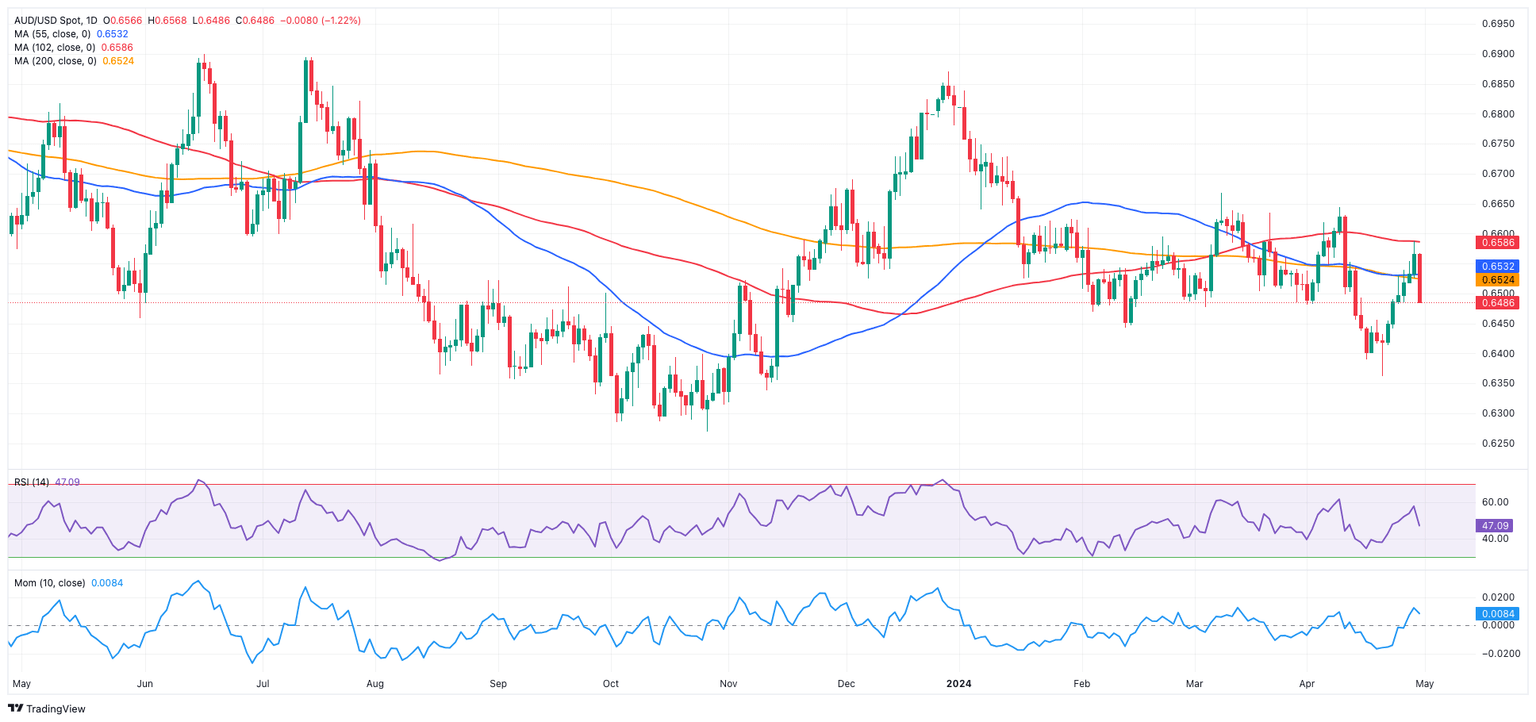

AUD/USD daily chart

AUD/USD short-term technical outlook

Extra gains may cause AUD/USD to revisit the April peak of 0.6644, followed by the March high of 0.6667 (March 8) and the December 2023 top of 0.6871. Further north, the July 2023 peak of 0.6894 (July 14) precedes the June 2023 high of 0.6899 (June 16) and the critical 0.7000 level.

Meanwhile, if sellers take control, the AUD/USD may retest its 2024 low of 0.6362 (April 19), which precedes the 2023 bottom of 0.6270 (October 26) and the round milestone of 0.6200.

Looking at the larger picture, a sustained break above the crucial 200-day SMA would likely result in more gains.

On the 4-hour chart, the recent upside momentum seems to have met some resistance around 0.6585. Further up comes 0.6644 and 0.6667. On the downside, the 55-SMA at 0.6484 comes first seconded by 0.6441 and 0.6362. In addition, the RSI tumbled to the sub-40 area.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.