AUD/USD Forecast: Immediately to the upside comes 0.6700

- AUD/USD rose to four-month highs and approached 0.6700.

- The lower US CPI kept the Dollar under heavy pressure.

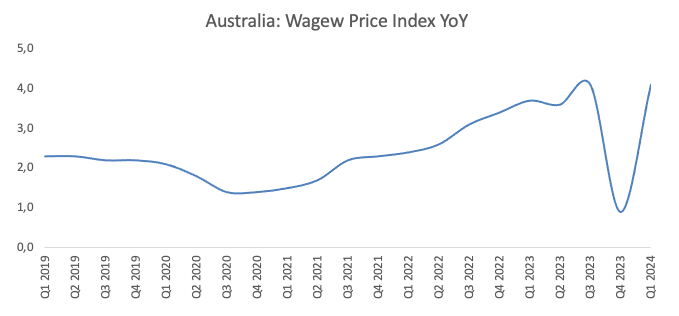

- The Australian Wage Price Index missed consensus in Q1.

Continued downward pressure on the US Dollar (USD) added to the recovery in risk-associated assets, driving AUD/USD to the boundaries of the key 0.6700 the figure, or four-month tops on Wednesday.

Furthermore, the USD added to the ongoing bearish sentiment after US inflation data tracked by the Consumer Price Index (CPI) showed another downtick in April, bolstering investors’ view of the potential start of the Fed’s easing programme at some point in the second half of the year.

The latter was also propped up by the drop to multi-week lows in US yields across the curve.

The lower US CPI prints added to Chief Jerome Powell's remarks earlier in the week, when he ruled out a rate hike at the time when he expressed expectations for inflation to remain subdued this year.

Domestically, the Aussie dollar met extra support from a new high in copper prices vs. some side-lined trading in iron ore prices midweek.

In terms of monetary policy, the Reserve Bank of Australia (RBA) chose to maintain its interest rate at 4.35% during its May 7 meeting, reiterating its neutral policy stance and signalling flexibility. The RBA updated its economic projections, foreseeing elevated inflation rates until Q2 2025, primarily driven by ongoing service price inflation. However, the bank anticipates inflation to eventually return to the target range of 2%–3% by the latter part of 2025, reaching the midpoint by 2026.

During the subsequent press briefing, Governor Michele Bullock maintained a balanced perspective, hinting at potential rate adjustments at the current meeting, stating, "We might have to raise, we might not."

Presently, the swaps market has largely discounted the likelihood of further rate hikes in the next six months, with expectations of a decline in the subsequent six months.

Moreover, both the RBA and the Federal Reserve are expected to implement their easing measures later than many of their other G10 counterparts.

Considering the Fed's commitment to monetary policy tightening and the potential for RBA easing later in the year, sustained upward movements in AUD/USD are expected to face constraints.

On the domestic calendar, the Wage Price Index rose by 4.1% YoY in the January–March period.

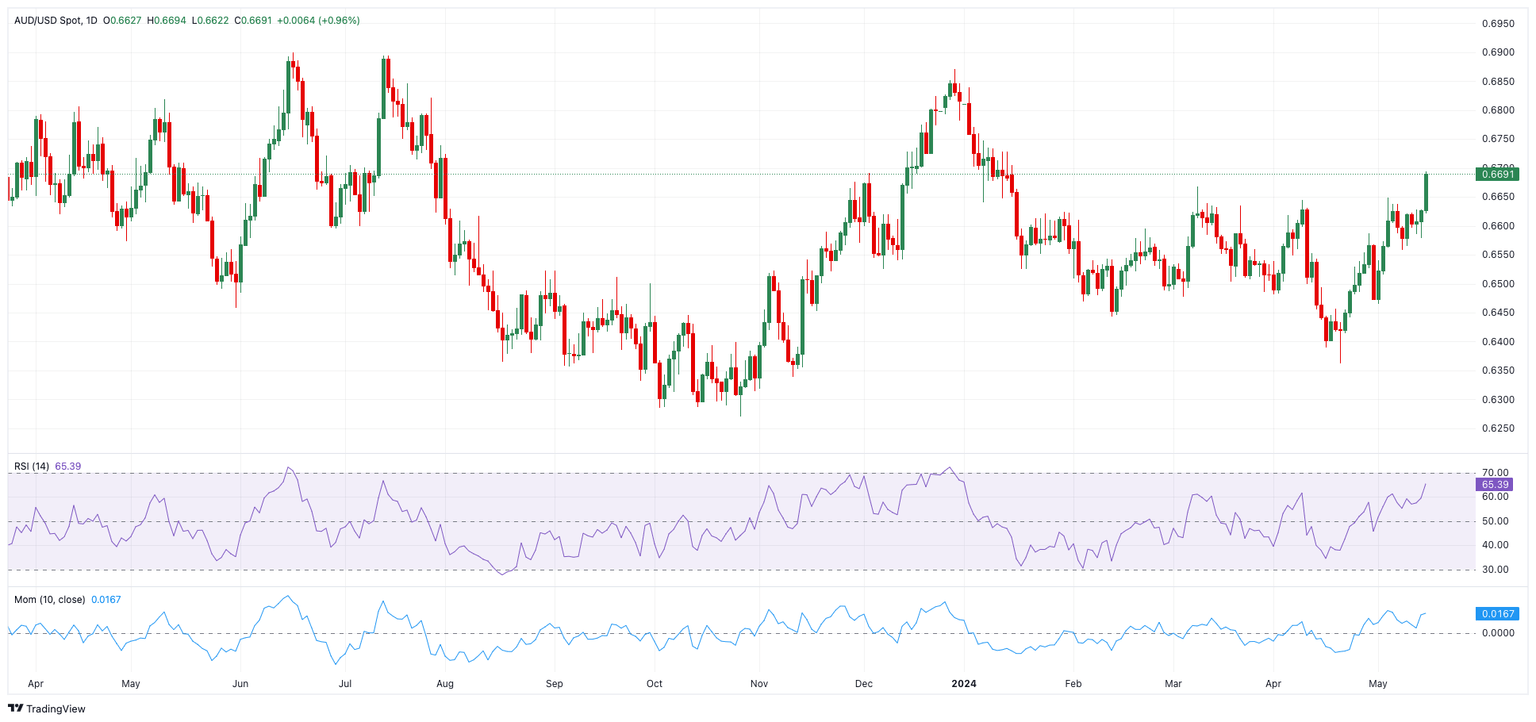

AUD/USD daily chart

AUD/USD short-term technical outlook

Extra gains might push the AUD/USD to initially test the round level of 0.6700 prior to the December 2023 peak of 0.6871 and the July 2023 high of 0.6894 (July 14), all ahead of the key 0.7000 yardstick.

Meanwhile, if bears retake control, there is some short-term resistance at the 100-day and 55-day SMAs of 0.6569 and 0.6545, respectively, before the more critical 200-day SMA of 0.6521, all before falling to the May low of 0.6465 and the 2024 bottom of 0.6362 (April 19).

Looking at the big picture, more gains are on the table as long as spot trades remain above the 200-day SMA.

On the four-hour chart, the buying momentum appears to be regaining strength. However, early resistance forms around 0.6700 before 0.6871. On the downside, 0.6571 is an immediate support level, just ahead of the 200-SMA of 0.6536. The RSI climbed to around 80.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.