AUD/USD Forecast: Extra upside appears on the cards

- AUD/USD could not sustain a move to the 0.6630 zone.

- Further gains in the Greenback weighed on the Aussie dollar.

- The Australian labour market report surprised to the upside.

Renewed and robust buying pressure on the US Dollar (USD) spurred a reversal in AUD/USD on Thursday, prompting it to give away initial gains to multi-day peaks in the 0.6630-0.6635 band.

The renewed upward bias in the Greenback came pari passu with further investors’ adjustments to the FOMC event and Chairman Powell's adoption of a dovish stance during his press conference, all following the Federal Reserve's decision to maintain interest rates at their consensus level on Wednesday.

While USD-dynamics remained the pair’s exclusive driver for the time being, it is worth noting that the persistent weakness in copper prices and iron ore emerged as another factor to bear in mind when it comes to the AUD’s price action.

Moreover, the economic situation in China is also anticipated to have effects on the AUD. Although potential stimulus measures by both the government and the PBoC might provide temporary relief , sustained improvements in economic indicators are crucial for strengthening the Australian currency and potentially initiating a significant uptrend in AUD/USD.

In the interim, AUD/USD managed to recover from several sessions of losses, which were exacerbated after the Reserve Bank of Australia (RBA) unexpectedly adopted a dovish stance at its recent meeting (March 19). Meanwhile, it is noteworthy that the RBA is one of the last G10 central banks to consider adjusting interest rates this year.

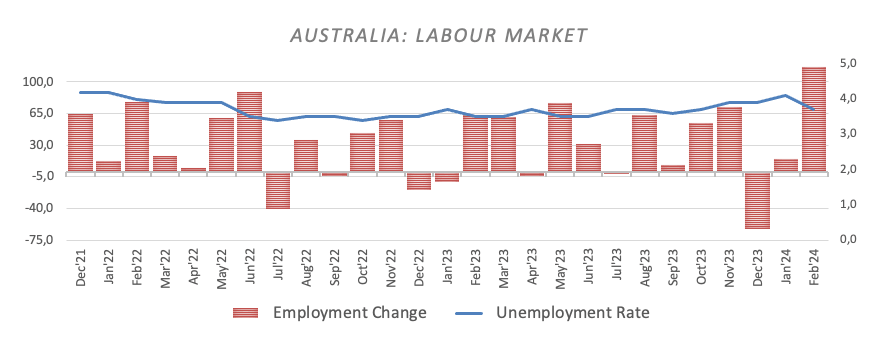

Reinforcing the above, the initial solid gains in the pair were propped up by auspicious prints from the Australian labour market for the month of February. On this, the Unemployment Rate ticked lower to 3.7% and the Employment Change increased above estimates by 116.5K individuals.

Considering the differing timelines for monetary policy adjustments between the RBA and the Fed, the Australian dollar may gather momentum later in the year, potentially leading to further gains in AUD/USD. If the pair surpasses the peak of 0.6871 from December 2023, it could aim for the significant level of 0.7000 in the near term.

AUD/USD daily chart

AUD/USD short-term technical outlook

Further upward movement in AUD/USD could see a break over the March peak of 0.6667 (March 8) ahead of the December 2023 high of 0.6871 (December 28), followed by monthly tops of 0.6894 (July 14) and 0.6899 (June 16), all before the important 0.7000 level.

If sellers regain the upper hand, the pair might reach the weekly low of 0.6503 (March 19). Once this zone is cleared, the spot price is expected to fall to the March low of 0.6477 (March 5), followed by the 2024 low of 0.6442 (February 13). Breaking below this level may result in a visit to the 2023 low of 0.6270 (October 26), followed by the round level of 0.6200 and the 2022 low of 0.6169 (October 13).

Looking at the broader picture, extra gains in the pair look likely while above the key 200-day SMA at 0.6555.

On the four-hour chart, the pair seems to have lost some upside impetus as of late. Against this, more losses might drive the pair to retest the 200-SMA at 0.6543 ahead of 0.6503, then 06477, and eventually 0.6442. On the other hand, the initial resistance is at 0.6634, which is closely followed by 0.6638 and 0.6667. Furthermore, the MACD flirted with the positive territory, and the RSI eased to the 50 threshold.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.