AUD/USD Forecast: Aussie trims losses, could still post lower lows

AUD/USD Current Price: 0.6662

- The United States CPI was broadly in line with expectations in August.

- Australia will release September Consumer Inflation Expectations on Thursday.

- AUD/USD recovers from intraday lows, is still at risk of falling.

The AUD/USD pair spent the first half of the day consolidating near 0.6640, the weekly low, amid the absence of relevant data. The US Dollar shed some ground amid Japanese Yen (JPY) strength, which surged to a fresh 2024 high against its American rival, yet Aussie gains were limited by comments from Reserve Bank of Australia (RBA) Assistant Governor Sarah Hunter. Hunter said the officials have been surprised by the “limited” easing this year in some key employment indicators, noting the labor market is still “tight relative to full employment.” Her words aligned with the RBA’s hawkish stance, with no rate cuts in sight in the Asian country.

AUD/USD finally broke lower following the release of the United States (US) Consumer Price Index (CPI), as the figures diluted hopes for a Federal Reserve (Fed) 50 basis points (bps) rate cut when the central bank met next week. CPI figures were broadly in line with expectations, yet the annual core CPI rose by 0.3%, surpassing the expected and previous 0.2%. Financial markets turned risk-averse, and AUD/USD fell to a fresh September low of 0.6621 as Wall Street plunged.

Nevertheless, the pair managed to trim losses as US indexes bounced and heads into the Asian opening, trading above the 0.6650 mark. This Thursday, Australia will release September Consumer Inflation Expectations, previously at 4.5%. Later in the day, the US will publish Initial Jobless Claims for the week ended September 6 and the August Producer Price Index (PPI).

AUD/USD short-term technical outlook

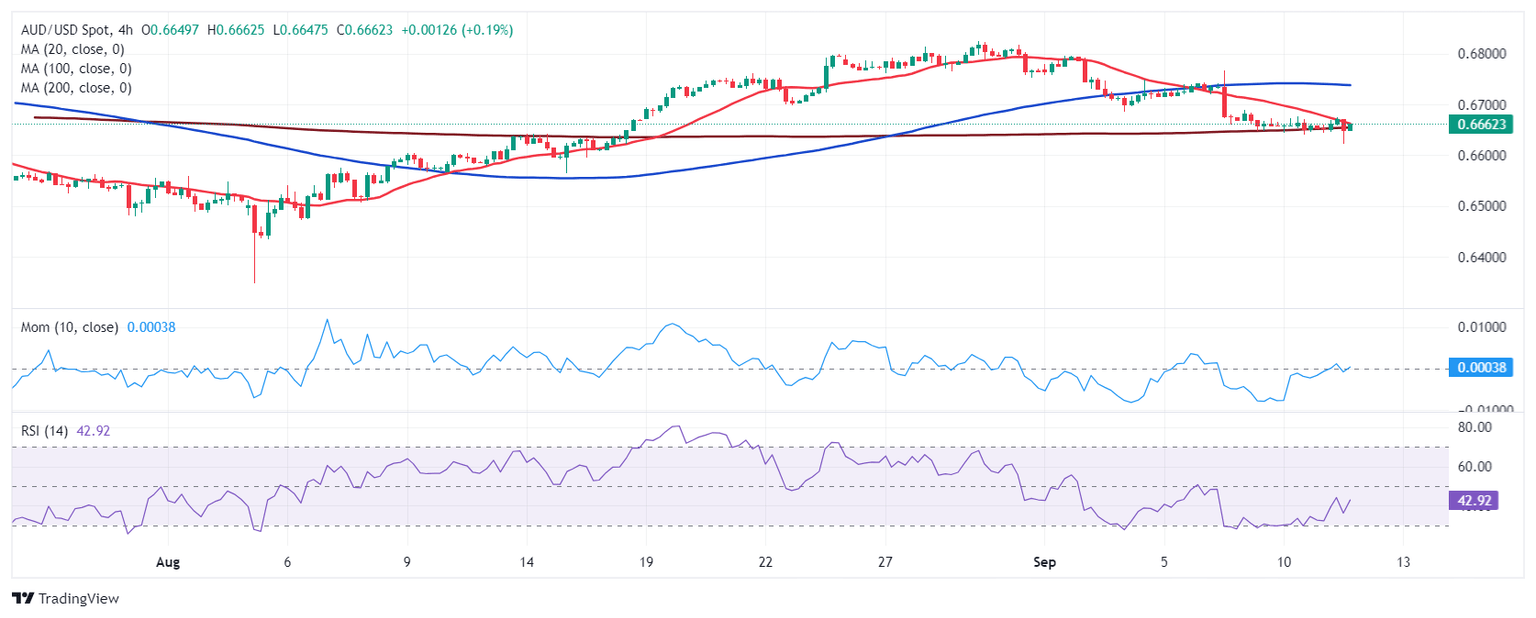

From a technical point of view, the AUD/USD pair is still at risk of falling. The pair posted a lower low and a lower high on a daily basis, while the same chart shows the pair has flirted with a flat 200 Simple Moving Average (SMA). At the same time, the pair has fallen far below its 20 SMA, a sign that bears retain control. Finally, technical indicators have lost their directional strength but consolidate within negative levels. The bearish case could be dismissed on a steady recovery above the 0.6710 price zone.

In the near term, and according to the 4-hour chart, AUD/USD offers a neutral-to-bearish stance. The pair barely holds above a flat 200 SMA while a bearish 20 SMA limits advances a handful of pips above the longer one. Should the 20 SMA extend its slide, the risk of a downward extension would increase. At the same time, technical indicators have turned flat. The Momentum indicator hovers around its 100 line, while the Relative Strength Index (RSI) indicator consolidates around 42, which skews the risk to the downside.

Support levels: 0.6620 0.6590 0.6550

Resistance levels: 0.6675 0.6710 0.6745

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.