Are earnings and manufacturing about to rise?

Highlights:

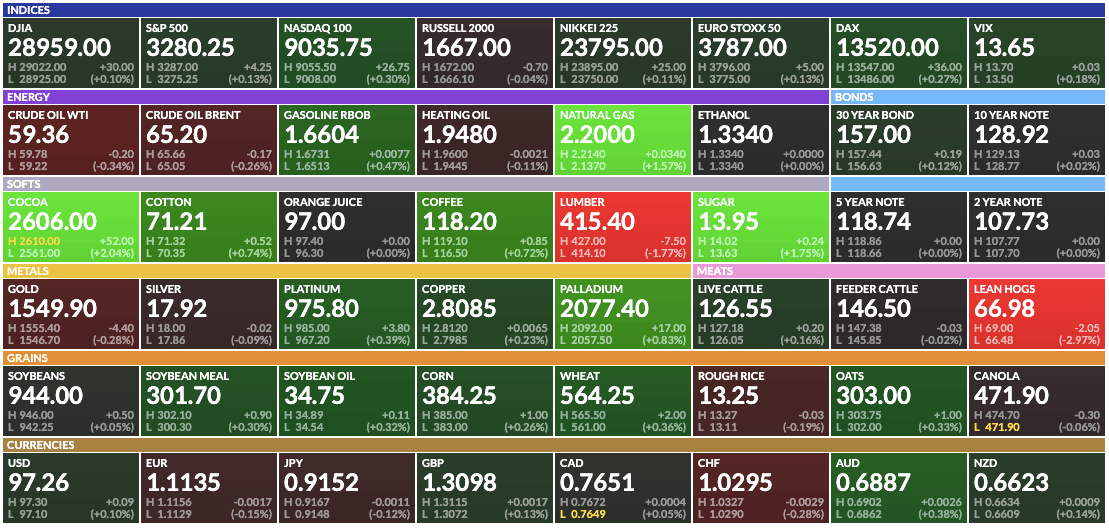

Market Summary: Markets were higher yesterday as the S&P 500 rose 0.67%. The top performing equity market was emerging markets, which moved up 1.62%. Interest rates dropped 2 basis points on the 10-year yield and bonds went up as a result. The dollar was also stronger by 0.17%. Gold, copper, and oil fell as a result of dollar strength. Small caps also moved lower, diverging from other equities.

Economic Data: Yesterday, initial jobless claims came in at 214k, down from 223k previous. Continuing jobless claims were up to 1803k from 1728k.

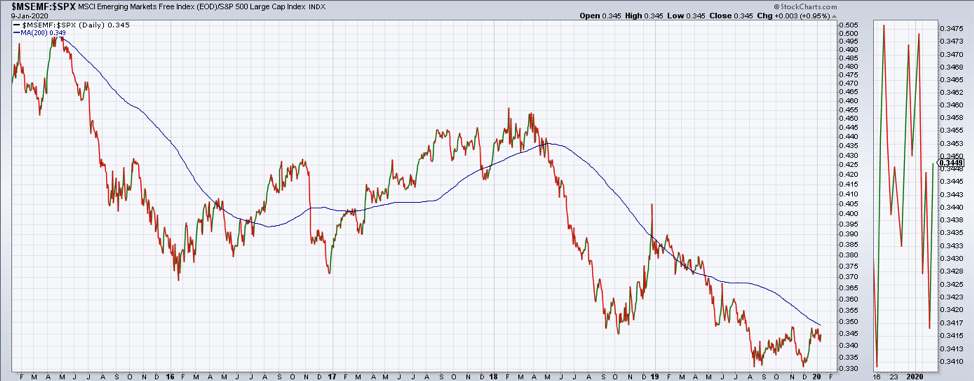

Emerging Markets: Emerging markets rallied against the S&P 500 yesterday, beating the U.S. market by 0.95%. The ratio of emerging markets to the S&P 500 is still in a negative trend, below its 200-day moving average. If global growth was accelerating, we would expect this ratio to move upward.

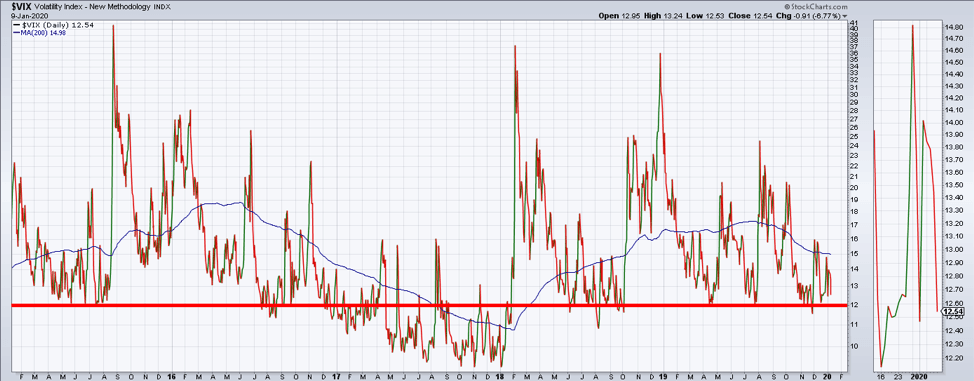

Volatility: The VIX retreated back to below 13 and is close to testing support again. The VIX failed to rally above the 200-day moving average and made another lower high. It is surprising that the VIX index has not sustained a break below 12 and moved to new lows. The VIX has not made a new low since the beginning of 2018.

Oil Priced in Gold: If you look at West Texas Intermediate Crude oil, priced in gold, it becomes clear that this ratio remains in a negative trend and well below the highs of 2018. It has made a series of lower highs since that peak and is below the 200-day moving average. The recent breakdown has us questioning whether the inflationary move we have seen recently is just a flash in the pan.

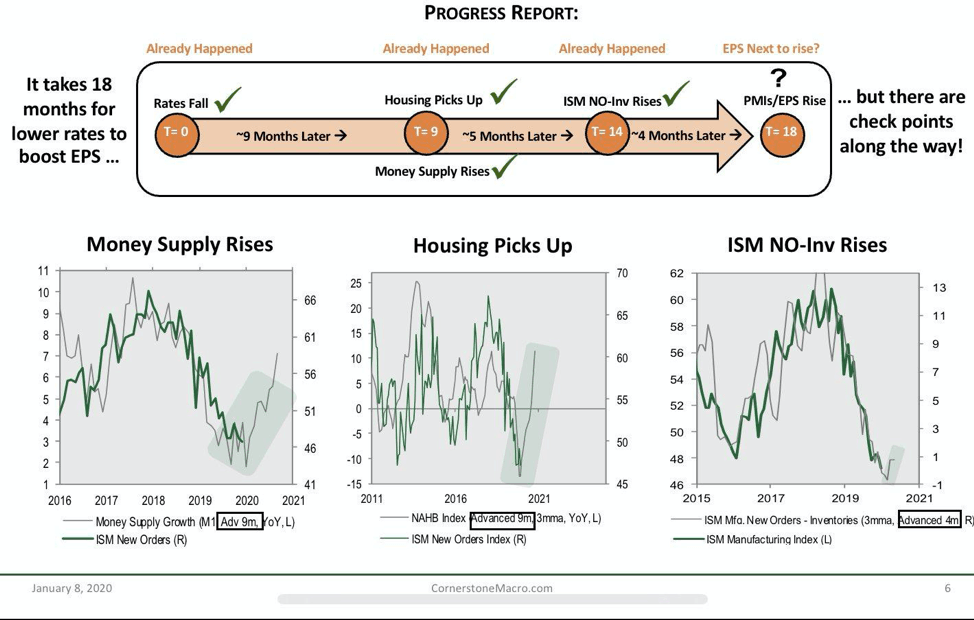

Chart of the Day: Are earnings and manufacturing about to rise? Cornerstone macro outlines several indicators, like interest rates, money supply growth, and housing that suggest that is precisely what should happen.

Futures Summary:

News from Bloomberg:

The Boeing jet that crashed near Tehran wasn't shot down, Iran said, putting it at odds with Canada, the U.K. and Australia, which say the claim is backed by intelligence. Iran said the allegations were "psychological warfare," and called on the countries to prove it. Still, Iran invited Canada and the U.S. to help in the probe. The U.S. National Transportation Safety Board is monitoring the situation.

The House voted to curb President Trump's authority to hit Iran in a mostly symbolic move the Republicans claim endangers national security. The bill says Congress should be consulted before the conflict with Iran escalates. The Senate can now consider it or discuss a different version from Senator Tim Kaine. Here's a look at who has the say on the U.S. going to war.

The 737 Max was "designed by clowns" who are "supervised by monkeys," a Boeing pilot wrote in 2016, internal company messages show. Staff had issues with in-flight simulators too. The emails show how far Boeing would go to to evade scrutiny from regulators, flight crews and the public, said Representative Peter DeFazio, who chairs a panel probing the plane.

Blackstone's Byron Wien sees little progress on the trade front after the phase one U.S.-China deal is signed, but that won't stop Chinese stocks rebounding further. "We are going to have trouble getting a phase two deal," he said. But "I'm positive on China." He advised institutional investors to allocate 10% of assets to emerging markets and expects Indian stocks to rise 20% in 2020.

Risk assets are ending a volatile week on a high, with S&P 500 futures rising with equities in Europe and Asia. Treasury yields and the dollar were steady before the payrolls report. Gold slipped with the yen. Oil headed for its first weekly loss since November.

Author

Clint Sorenson, CFA, CMT

WealthShield