US economic data will make headlines on Wednesday, as investors assess the latest inflation and retail sales trends for the world’s largest economy.

The economic calendar picks up at 07:00 GMT with reports on German consumer inflation and fourth quarter GDP. Inflation in Europe’s largest economy is forecast to fall 0.7% in January, resulting in a year-over-year gain of 1.6%. Germany’s economic expansion is also expected to slow to 0.4% in the December quarter, down from 0.8% in Q3.

The Italian and Portuguese governments will also report Q4 GDP numbers throughout the day, leading to the official Eurozone figures at 10:00 GMT. The euro area economy likely expanded 0.6% quarter-on-quarter and 2.7% annually, based on a median forecast.

Shifting gears to North America, the US government will report on CPI inflation and retail sales at 13:30 GMT. Consumer inflation is forecast to slow to an annualized rate of 1.9% in January, down from 2.1% the previous quarter. Meanwhile, retail receipts are expected to climb 0.2%.

The inflation report will be closely watched by market participants looking to make sense of the latest selloff in US stocks. The market’s precipitous drop was triggered by a nonfarm payroll report on 2 February that showed an unexpected surge in average hourly earnings. The sharp rise in earnings was perhaps the clearest signal yet that inflationary pressures were building, which may compel the Federal Reserve to raise interest rates faster than previously expected.

Earlier in the day, Japan reported a much smaller than expected rise in fourth quarter GDP, as the world’s third-largest economy expanded just 0.5% in October-December. Analysts in a median estimate called for a gain of 0.9% Despite the miss, Japan’s economy has been in acceleration mode for eight straight quarters, the longest streak in 28 years.

EUR/USD

Europe’s common currency has been regaining momentum this week, as the dollar continues to backtrack against world peers. The EUR/USD exchange rate climbed 0.3% at the start of Wednesday trading to reach 1.2382. Since bottoming at multi-week lows Friday, the EUR/USD has gained roughly 150 pips.

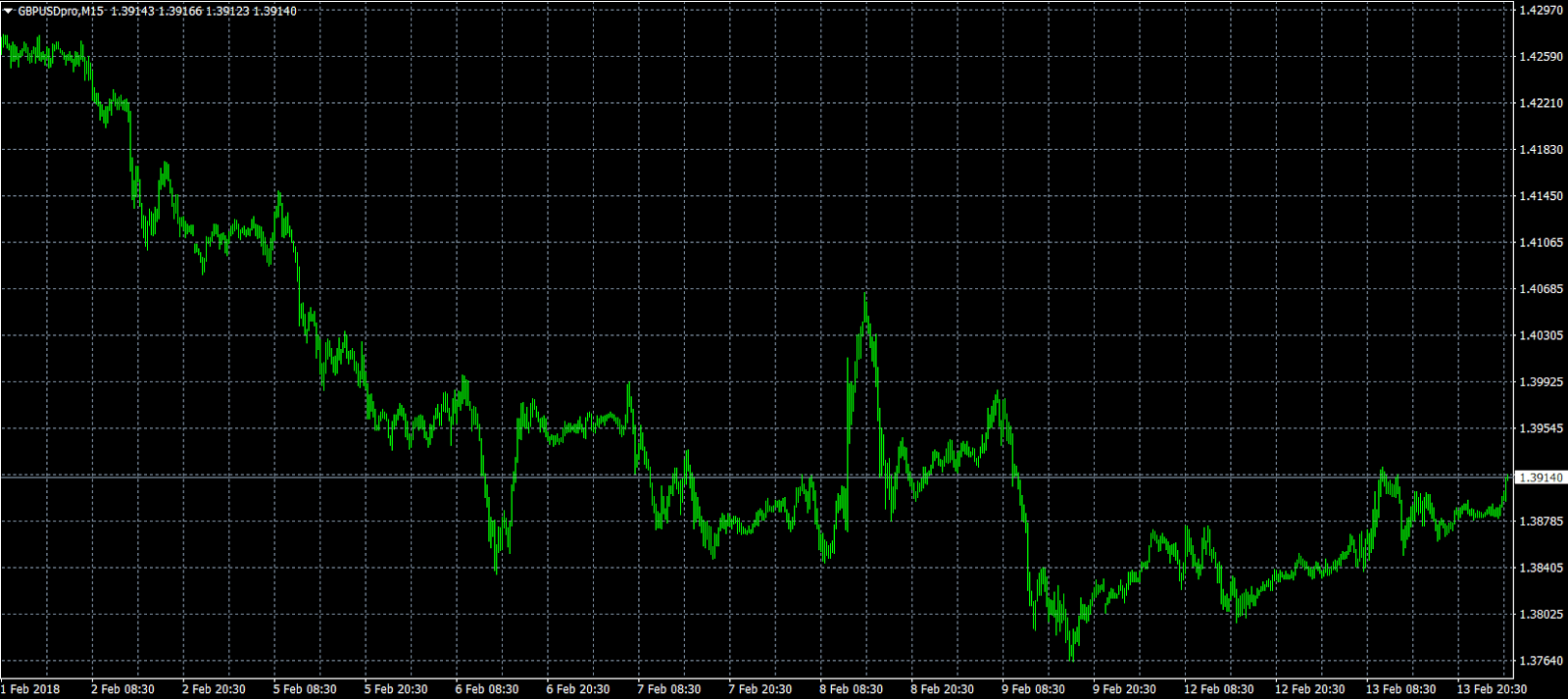

GBP/USD

Cable is also finding its footing again after a week of declines through Friday. The GBP/USD rose 0.2% on Wednesday to 1.3915. The bulls appear to be regaining control of the market but will need to clear multiple hurdles to new highs. The first major resistance test is likely found at the psychological 1.4000 level.

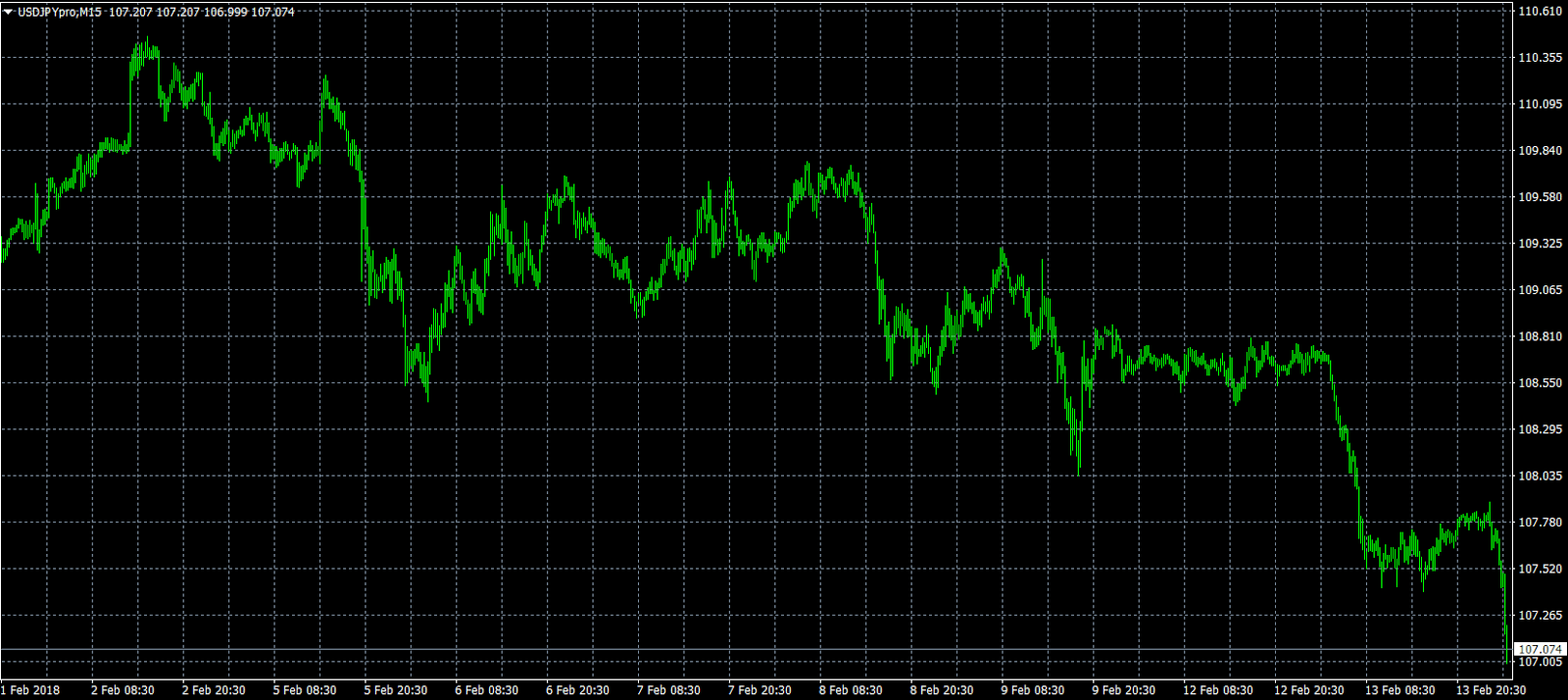

USD/JPY

Japan’s GDP miss wasn’t enough to spark a rally in the USD/JPY, which extended losses on Wednesday. The pair fell 0.5% to 107.30, its lowest since 2014. The sharp downside exposes the USD/JPY to more losses. The pair is currently testing a key support level; another breakdown would likely lead to a test of the 106.80 region.

General Risk Warning for FX & CFD Trading. FX & CFDs are leveraged products. Trading in FX & CFDs related to foreign exchange, commodities, financial indices and other underlying variables, carry a high level of risk and can result in the loss of all of your investment. As such, FX & CFDs may not be appropriate for all investors. You should not invest money that you cannot afford to lose. Before deciding to trade, you should become aware of all the risks associated with FX & CFD trading, and seek advice from an independent and suitably licensed financial advisor. Under no circumstances shall we have any liability to any person or entity for (a) any loss or damage in whole or part caused by, resulting from, or relating to any transactions related to FX or CFDs or (b) any direct, indirect, special, consequential or incidental damages whatsoever.

Recommended Content

Editors’ Picks

USD/JPY jumps above 156.00 on BoJ's steady policy

USD/JPY has come under intense buying pressure, surging past 156.00 after the Bank of Japan kept the key rate unchanged but tweaked its policy statement. The BoJ maintained its fiscal year 2024 and 2025 core inflation forecasts, disappointing the Japanese Yen buyers.

AUD/USD consolidates gains above 0.6500 after Australian PPI data

AUD/USD is consolidating gains above 0.6500 in Asian trading on Friday. The pair capitalizes on an annual increase in Australian PPI data. Meanwhile, a softer US Dollar and improving market mood also underpin the Aussie ahead of the US PCE inflation data.

Gold price flatlines as traders look to US PCE Price Index for some meaningful impetus

Gold price lacks any firm intraday direction and is influenced by a combination of diverging forces. The weaker US GDP print and a rise in US inflation benefit the metal amid subdued USD demand. Hawkish Fed expectations cap the upside as traders await the release of the US PCE Price Index.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

US economy: Slower growth with stronger inflation

The US Dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.