Market Overview

As traders position for a potentially outlook changing session, all eyes are on the FOMC tonight. It is extremely likely that the Federal Reserve will raise interest rates by another 25 basis points in what could be the first of three rate hikes this year. However could that become the first of four rate hikes? There is a new Fed chair in place in Jerome Powell, whilst other Fed speakers have been leaning more hawkishly recently. The initial signal for what may lie ahead will come in the Projection Materials which show the outlook for Fed members on growth, unemployment, and perhaps more crucially inflation and the “dot plots” (or interest rate expectations). Changes to inflation projections higher and also raised expectations on the dots would point towards a more hawkish balance on the FOMC. This could be a move that would require the market to price in perhaps four rate hikes in 2018. Furthermore, how will Fed chair Powell come across in his inaugural press conference? Powell was notably surprisingly hawkish in his Congressional testimonies and if this is again the case in the press conference at 1830GMT (especially compared to his predecessor Janet Yellen, the again the market could move sharply. US Treasury yields would react higher and perhaps 3.0% on the 10 year yield comes back into play in the coming days. The US dollar would also jump higher on a hawkish lean. Already we have seen Treasury yields pulling higher in recent days despite a distinctly risk negative feel to equity markets. The dollar has positioned for strength too. With several markets positioned at or close to a crossroads, this could be a key moment that signals a near tm medium term dollar recovery. However, equally, the market is not breaking ahead of the decision and this would suggest that if the FOMC does not signal a hawkish lean in the dots, there could be renewed selling pressure on the dollar that would simply resume the longer term dollar sell-off. Whatever way it will be a crucial meeting tonight.

Wall Street closed slightly higher last night with the S&P 500 +0.1% at 2717, whilst Asian markets were cautious (Nikkei was closed for a public holiday) and in Europe, the early outlook is also mixed, but again FTSE 100 seems to be underperforming. In forex, it is interesting to see the dollar weaker across the majors, but this is mostly just unwinding some of yesterday’s gains which in aggregate looks like jostling for position ahead of the crucial Fed meeting. In commodities the dollar slip is helping gold to find some support, whilst oil is also supported again as the Saudi prince meets President Trump in a move that could be seen as stoking the tensions with Iran again.

The big focus will be on the Fed today but in front of that there is more tier one UK data for traders to digest. At 0930GMT, UK employment data is announced with UK Unemployment expected to remain at 4.4%, however the real volatility on UK assets will come on Average Weekly Earnings (ex-bonus) which are expected to improve to +2.6% (from +2.5% las month). The US Current Account deficit is at 1230GMT and is expected to show a deterioration to -$125.0bn in Q4 2017 (from -$101.0bn in Q3 2017) which would be the largest deficit since Q2 2016. The US Existing Home Sales are at 1400GMT and are expected to improve by around 0.5% to 5.41m (from 5.38m). The EIA Oil Inventories are at 143GMT and are expected to show crude stocks building once more by +3.0m barrels (from a build of +5.0m barrels last week), distillates in drawdown by -1.8m (from a larger than expected drawdown of -4.4m last week) and gasoline stocks also in drawdown by -2.4m (from a larger than expected drawdown of -6.3m barrels last week). The FOMC monetary policy announcement is at 1800GMT and is expected to show a 25 basis points increase to a Fed Funds range of 1.50% / 1.75%. The press conference is at 1830GMT. However there is also the Reserve Bank of New Zealand monetary policy announcement at 2000GMT which is expected to remain unchanged at 1.75%.

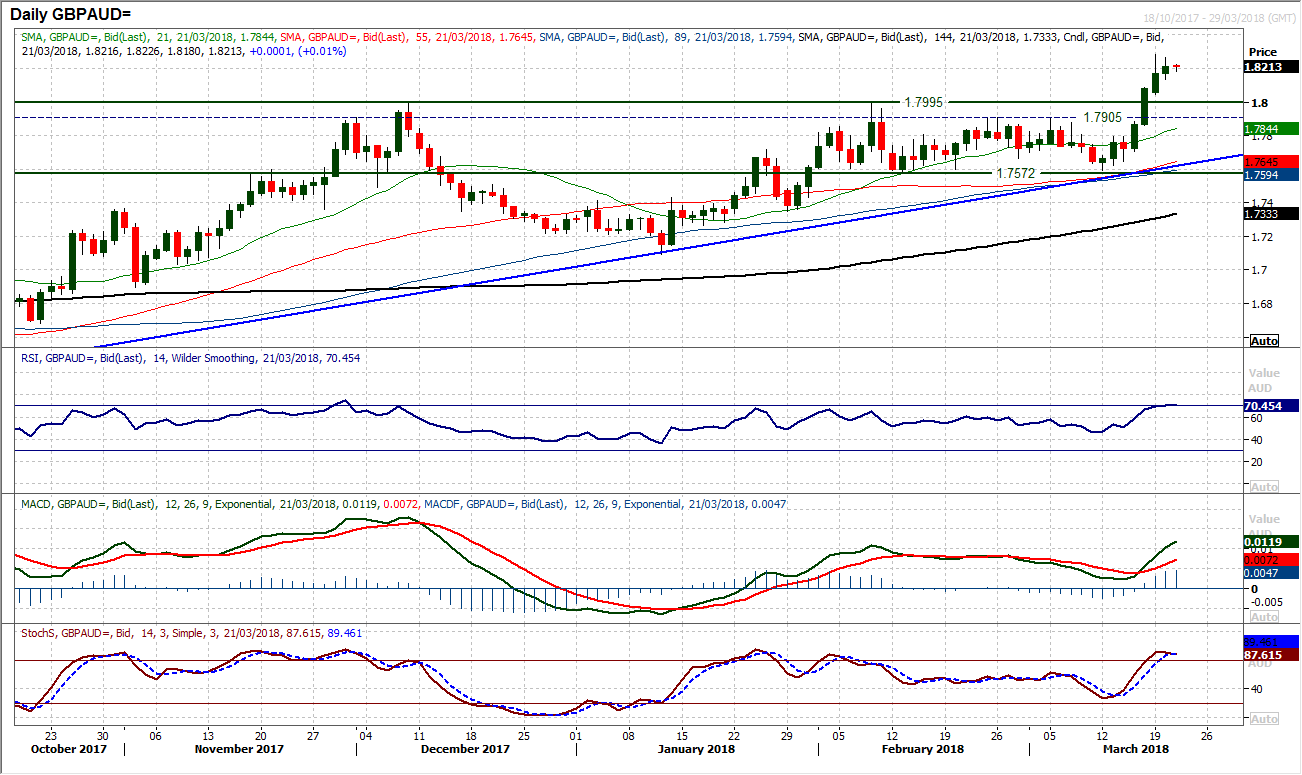

Chart of the Day – GBP/AUD

Brexit is still on the agenda with a transition deal expected to be confirmed today, whilst recent strong performance of sterling has driven a decisive breakout on Sterling/Aussie. A move above 1.7995 has been confirmed in the past couple of sessions with some strong bull candles that have taken the pair to a level not seen since the volatility of the day of Brexit on 24th June 2016. This comes with the pair in an uptrend since September, whilst the breakout at 1.7995 now becomes a basis of support. Momentum indicators are now ticking higher, with the RSI at its strongest level since December and with upside potential the strong runs of September and December into the mid-high 70s. However, the candles have been losing magnitude in recent sessions and this may result in a near term slip back. Corrections into support are now a chance to buy. Yesterday’s low at 1.8135 is the initial support, but a retreat towards 1.8000 could easily be seen if momentum slips. There is a band of support 1.7905/1.7995 as a buy zone now. Monday’s high at 1.8283 is the initial resistance, but above there is little real resistance until 1.9000.

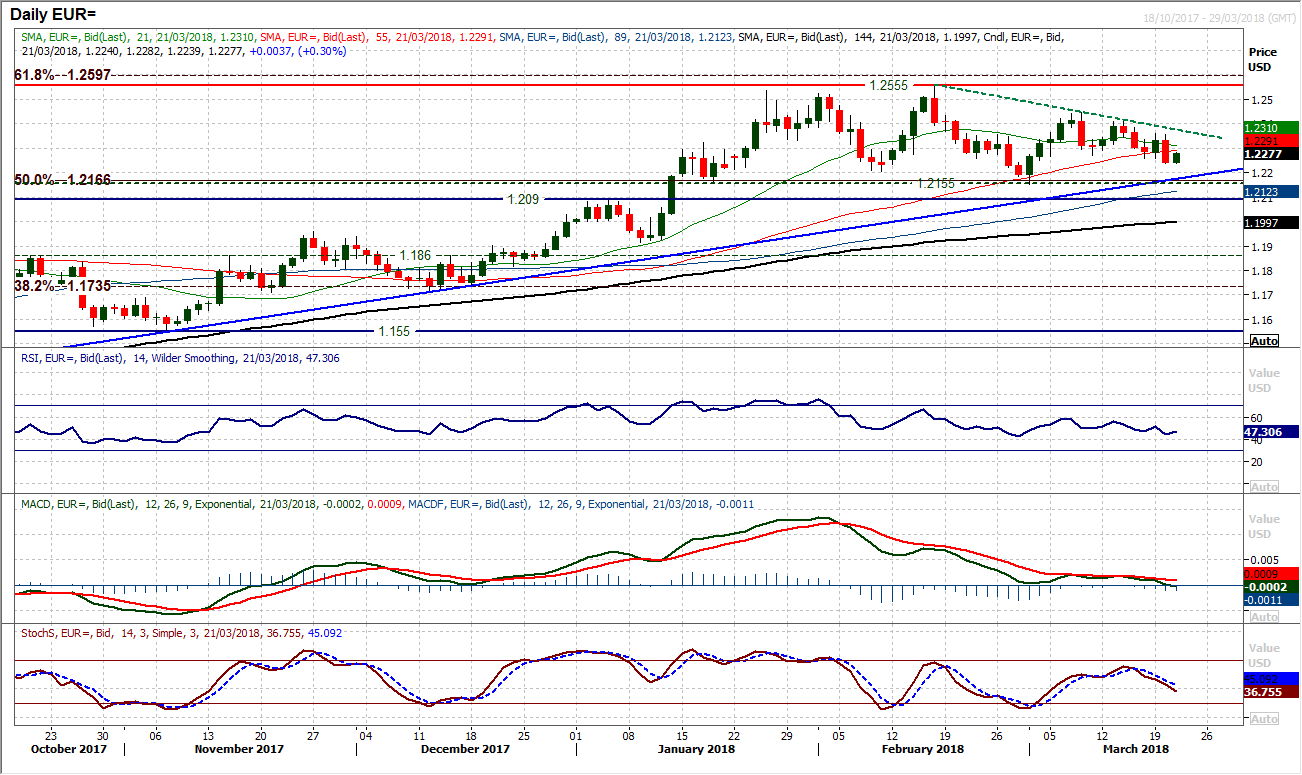

EUR/USD

The euro was hit yesterday with a surprisingly low German ZEW reading which drove significant underperformance across the majors and leaves the single currency a little bruised in front of tonight’s crucial Fed announcement. Technically, we see EUR/USD has slipped back and despite the minor early rebound this morning, yesterday’s close at a two week low means the market is threatening a move back towards a test of the key support at $12155. The primary uptrend support comes in at $1.2175 today and there is a confluence of support around $1.2155 that is key to maintaining the positive outlook. EUR/USD has been in a 400 pip range for the past couple of months but a close below $1.2155 tonight would be a significant blow for the bulls. Daily momentum indicators are swinging lower. The Average True Range is 84 pips on EUR/USD currently but there is a significant likelihood of greater volatility on tonight’s FOMC.

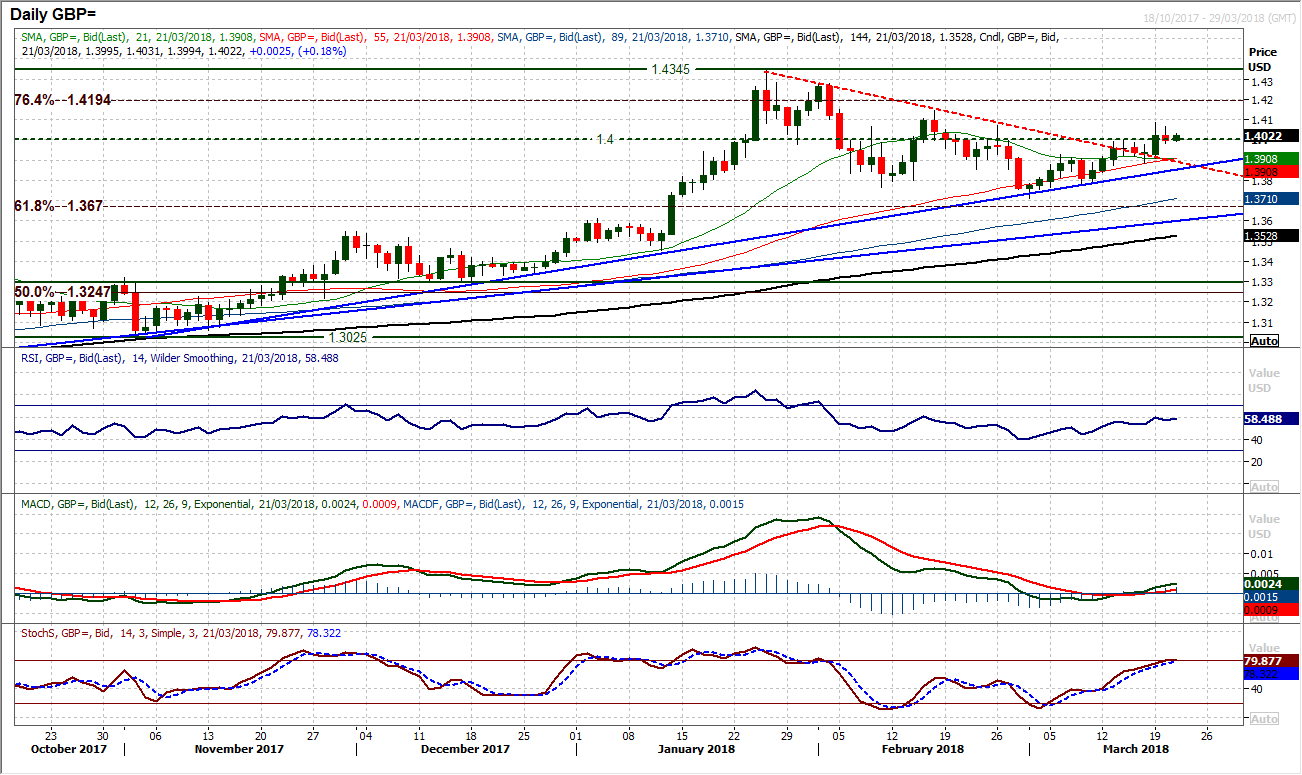

GBP/USD

The breakout above the psychological $1.4000 is being questioned in front of the FOMC as yesterday’s retracement candle just pulled back some of the exuberance of Monday’s breakout. Cable looks technically strong on momentum indicators, whilst the long term uptrend remains a strong underlying support for the higher lows. Having decisively broken the seven week trend lower, the outlook has improved significantly, but can the bulls hold this move on the FOMC tonight. The early move is one of consolidation today and although there is key UK earnings growth data this morning, the market is unlikely to take much of a view ahead of the Fed tonight, where there is likely to be elevated volatility. A move back above $1.4087 opens $1.4145 as the next lower high to be tested, however, a hawkish Fed would pull the pair lower, and in this scenario perhaps the uptrend at $1.3850 comes under threat again.

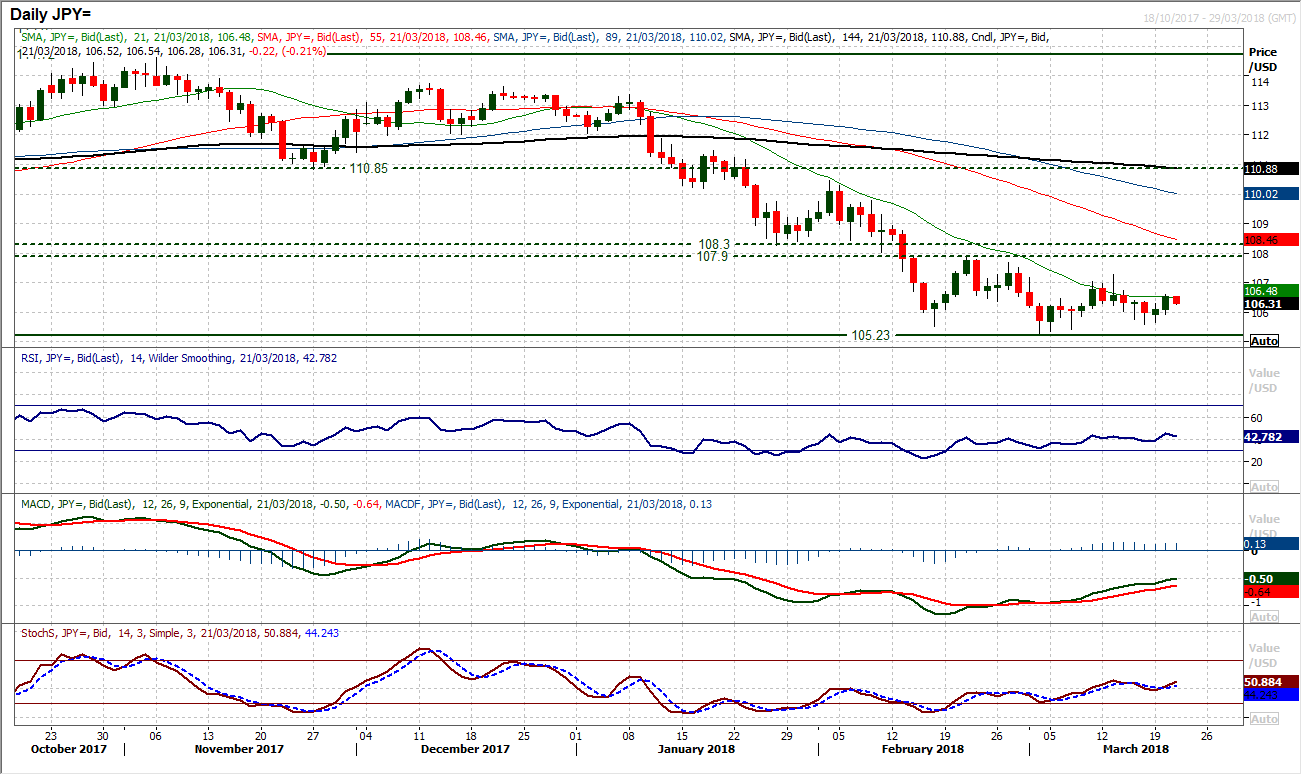

USD/JPY

The dollar has picked up ahead of the FOMC tonight as the market has formed a couple of successive positive candles in a row. It is incredible to see that every time the market gets close to the 105.50 area of support there is renewed buying interest. This has happened on three separate occasions now. The recovery this time is also now taking the momentum indicators with it, as the MACD lines begin to find proper traction in a recovery and the Stochastics are also ticking higher from a positive base now. The market seems to be more confident now in front of the Fed. The hourly chart shows more positive momentum configuration and a move back above the 106.35 near term pivot area. Although the market has just slipped back a touch this morning, there is unlikely to be any real direction ahead of tonight. Key support remains in place between 105.23/105.60, whilst resistance of the lower highs is at 107.30/107.65/107.90.

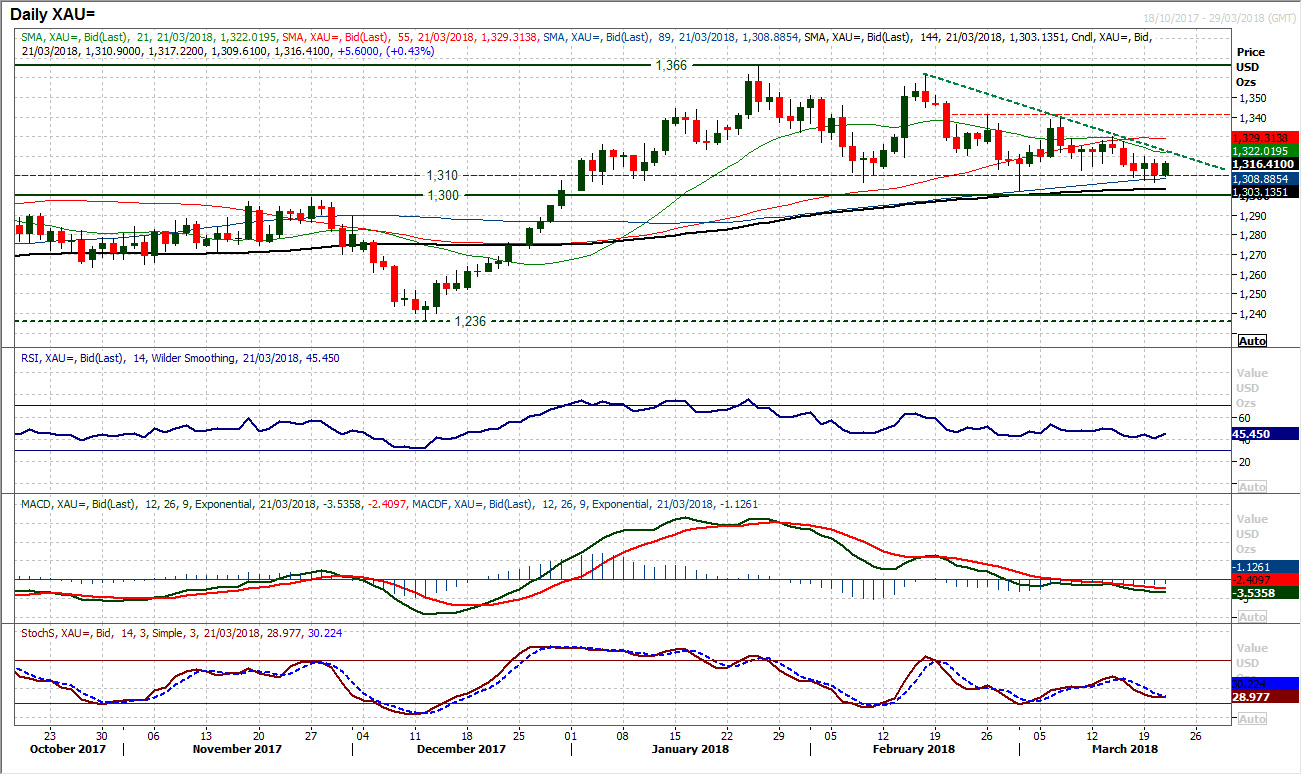

Gold

On the one hand, there is an increasing threat of gold breaking the long term pivot at $1300 and moving to the downside. On the other, it is a testament to the strength of the support of the long term pivot band $1300/$1310 that the sellers are still being kept at bay. The decisive move is likely to come in the wake of the Fed meeting tonight. Technically, momentum indicators are teetering on the brink with the RSI still holding up above 40 and the Stochastics again threatening to plateau again. However there is a negative bias that has come in the past few sessions (as shown on the hourly chart where the hourly RSI is failing around 60/65 only to then push below 30) as the market continues to fall within the four week downtrend. With the lower high in place at $1330 the market now seems to be shying away from $1320. However again the market seems reluctant to take a view ahead of the FOMC. A hawkish move would drive a downside break of $1300 to complete a multi-month top of around $65. Alternatively, the bulls will be eying a less than hawkish move that could induce a rally above $1330.

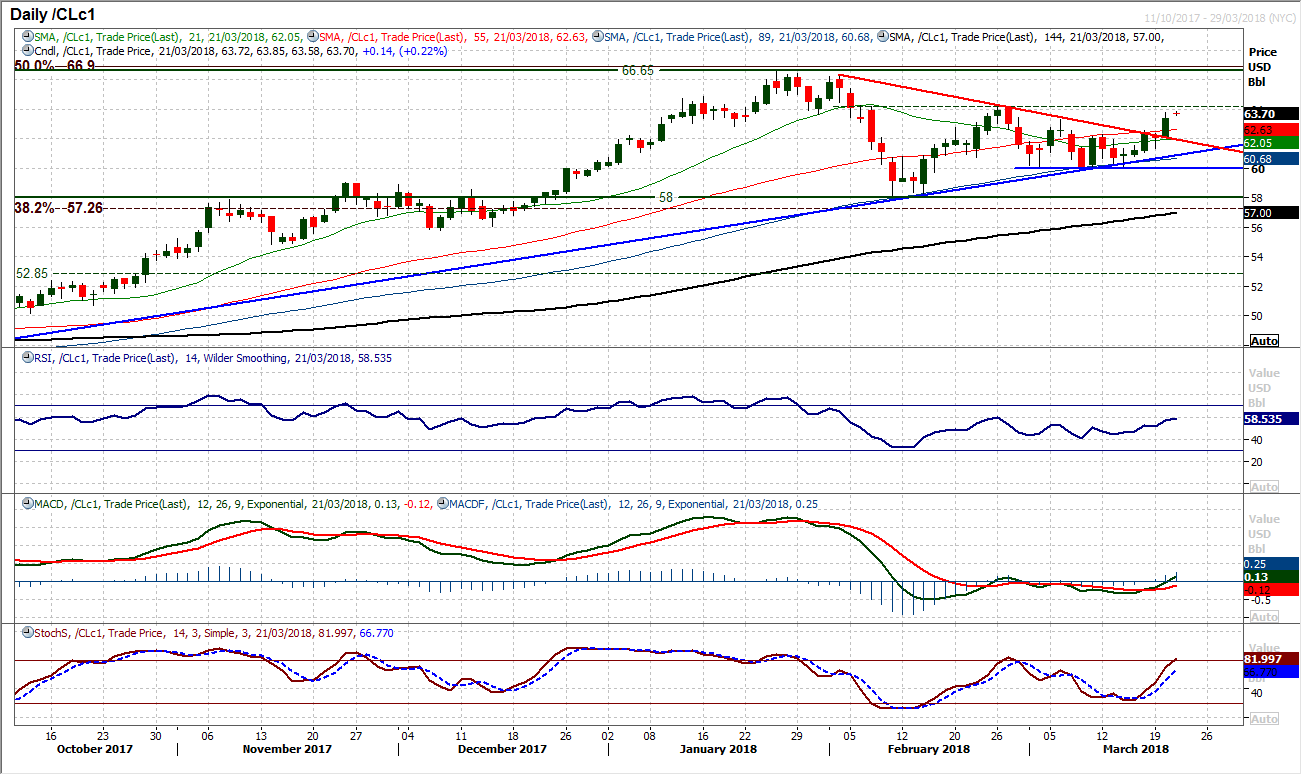

WTI Oil

The oil bulls have taken control of the market with a decisive bull candle yesterday which has broken a six week downtrend. The move has also seen the price breaking out above $63.30 resistance. Having consolidated for over two weeks this looks like the bulls breaking free now. The consolidation on the momentum indicators is now pulling decisively higher and confirms the move. The Stochastics are accelerating strongly now with the RSI rising above 50. This sets the bulls up for a test of the resistance at $64.25 which is the key reaction low that is the main barrier between here and a retest of the recent multi-year highs between $66.30/$66.65. The hourly chart shows strong configuration now on momentum with a break above $62.50 which is now a basis of support for a pullback, whilst the spike to $61.35 is now a key near term support. Corrections into support formation now look to be a chance to buy.

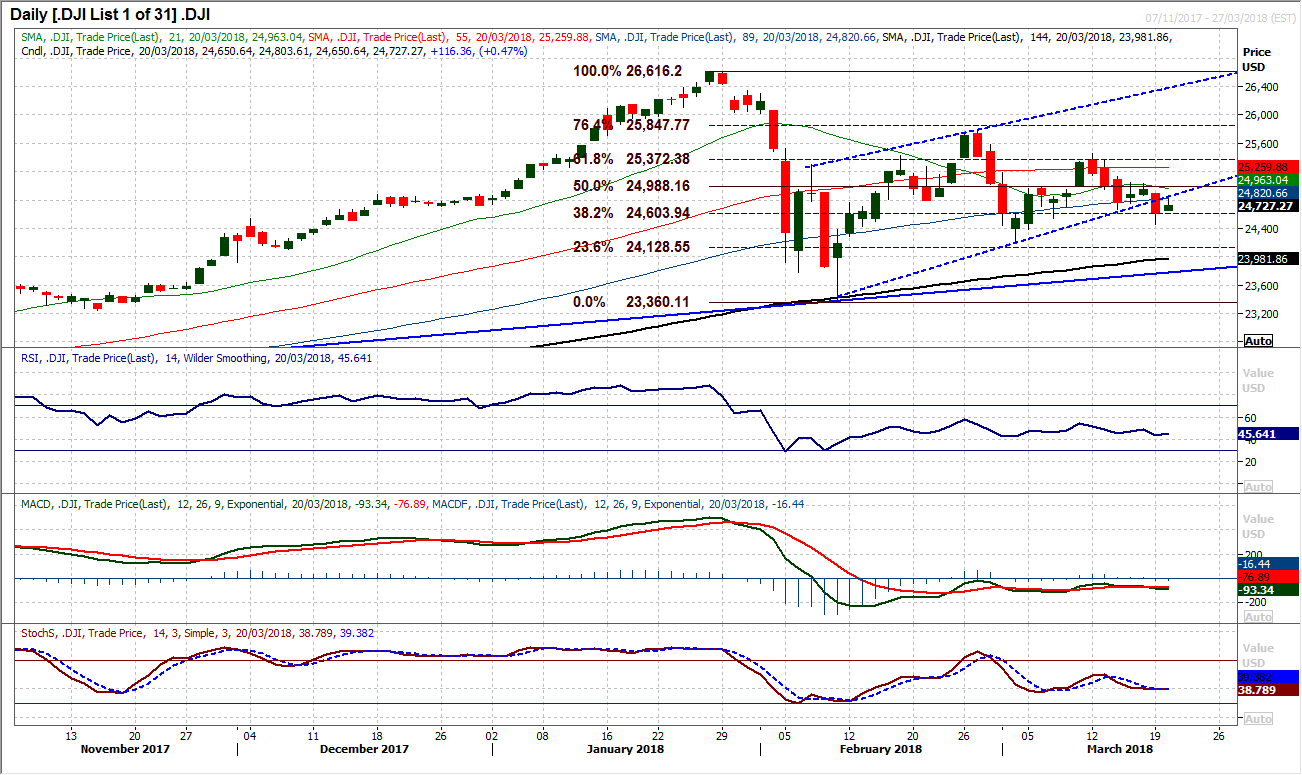

Dow Jones Industrial Average

There has been a shift in sentiment in the past week as the market has continued to fail at lower levels. A negative bias has formed which has now broken the five week recovery uptrend channel. Monday’s sharp negative candle meant that a lower high has been left at 25,053 and although the market rebounded yesterday there is far more that the bulls need to do to regain control. There is though support now in place at 24,453 in front of the FOMC. It now seems as though the reaction to tonight’s decision could be crucial for the near term outlook. Volatility could be elevated but a close above the resistance at 25,053 would help to reinvigorate the bulls now. However, closing below the support at 24,453 would equally confirm bear control. The momentum indicators suggest a slight negative bias but nothing that would suggest a decisive market in front of the Fed. The RSI falling into the 30s would be confirmation of a bear break.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD holds below 1.0750 ahead of key US data

EUR/USD trades in a tight range below 1.0750 in the European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays firm above 156.00 after BoJ Governor Ueda's comments

USD/JPY stays firm above 156.00 after surging above this level on the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.