NENAD KERKEZ

NENAD KERKEZ

PROFILE

• Current Job: Analyst and Full Time Trader at Admiral Markets

• Career: Holds a MSc Degree in Economics at the John Naisbitt University (formerly known as Megatrend). Works as Senior lecturer and market analyst for Admiral Markets

View profile at FXStreet

View profile at FXStreet

Nenad Kerkez is an analyst and trader who has been in the market since 2008 and works closely with Admiral Markets as their Head Lecturer and Market Analyst. He is well known in the FX Community, ranking in the top 10 traders and analysts in the Forex Factory High Impact Members Ranking.

Nenad covers over 25 currencies on an intraday basis and has a Masters in economics. He also developed CAMMACD TM, a proprietary trading and analysis strategy. Further, he is the co-founder and head of Elite Currensea Trading, an educational website for currency traders.

What currency pair do you expect to be more volatile during this August holiday period?

GBP/JPY aka the Dragon. This pair has been my favorite pair to trade last couple of months as the movement is huge along with exceptional volatility, and I like it! J Unlike the EUR/USD aka the Fiber, the Dragon’s ATR has been very solid. This time the volatility is due to the uncertainty of the GBP due to upcoming Brexit, which makes it a sensitive combination, with the already sensitive Yen due to stimulus in Japan and bullish trends in Equities. The dragon also presents the gauge for risk-off moves as carry-trades gets reversed. Don’t forget when there is a risk-off environment, the JPY appreciates as foreign flows from Japan are repatriated back to their local currency. Additionally, appreciation of JPY during risk off scenarios is exponentially stronger due to exchange rate misalignment and restrictions on international capital flows.

USD doesn't seem to get any clear direction with US data coming in different directions. Do you believe in a Fed rate hike this year?

The majority of USD data has been strong of late, with the exception of PPI and US Retail Sales data of recent. Nonetheless, one core component of the Fed’s rate decision is based on a 2% Inflation rate; yet, with the Inflation still at 1% YoY, it is likely to delay further rate hikes this year.

What are the key levels for the GBPUSD?

Short term: 1.2860, 1.2808 and 1.2722 to the downside. 1.2967, 1.3020 and 1.3094 to the upside.Mid Term: 1.2512 as support (If 1.2800 breaks) and 1.3592 (If 1.3405 breaks).

Do you expect more rate cuts from RBA or RBNZ in the future to avoid AUD and NZD strength and stimulate exports?

Yes, it is likely that the RBA and RBNZ may cut further.Both suffer from high property prices which have nonetheless been stimulated by rate cuts.I think it is more likely that the RBA may cut further than the RBNZ, given Australia’s exposure to the Commodities sector, but it could also mean that the RBNZ is forced to cut rates should the RBA cut further to protect its major export market, being Australia.

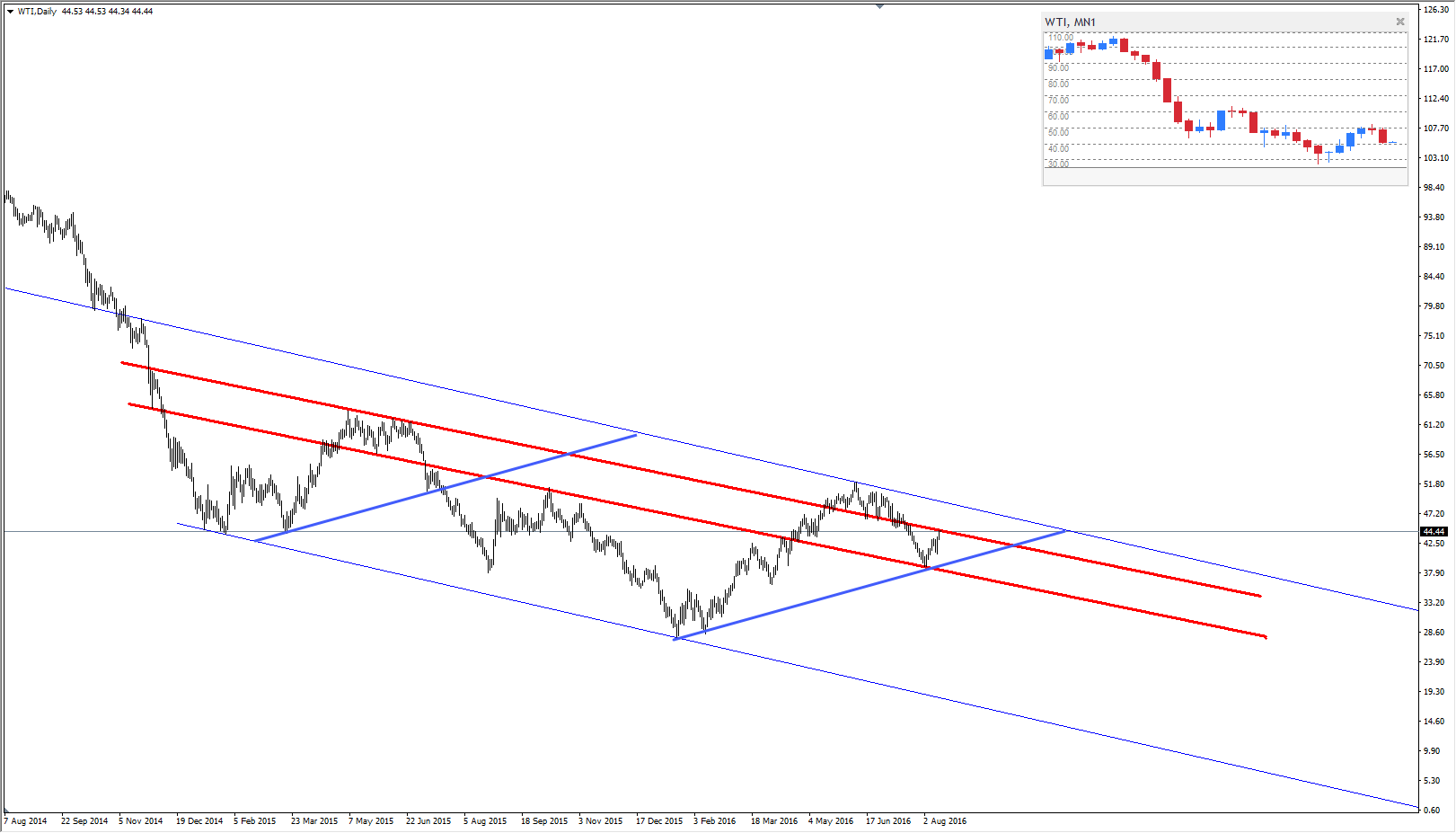

Oil price has made some interesting moves during the last weeks. Are you bullish or bearish on crude markets?

Crude oil stocks are still on the increase in the USA, so I am far from bullish at the moment with the Oil price. Nonetheless, the Oil price bounced nicely from the recent swing low and swing high 50% Fib. I think the Oil price will consolidate around the USD40/bbl region for some months to come. One must pay attention to the inner trend lines that form resistance and support within the downward channel that has been in play since 2014.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD retreats toward 1.0850 on modest USD recovery

EUR/USD stays under modest bearish pressure and trades in negative territory at around 1.0850 after closing modestly lower on Thursday. In the absence of macroeconomic data releases, investors will continue to pay close attention to comments from Federal Reserve officials.

GBP/USD holds above 1.2650 following earlier decline

GBP/USD edges higher after falling to a daily low below 1.2650 in the European session on Friday. The US Dollar holds its ground following the selloff seen after April inflation data and makes it difficult for the pair to extend its rebound. Fed policymakers are scheduled to speak later in the day.

Gold climbs to multi-week highs above $2,400

Gold gathered bullish momentum and touched its highest level in nearly a month above $2,400. Although the benchmark 10-year US yield holds steady at around 4.4%, the cautious market stance supports XAU/USD heading into the weekend.

Chainlink social dominance hits six-month peak as LINK extends gains

-637336005550289133_XtraSmall.jpg)

Chainlink (LINK) social dominance increased sharply on Friday, exceeding levels seen in the past six months, along with the token’s price rally that started on Wednesday.

Week ahead: Flash PMIs, UK and Japan CPIs in focus – RBNZ to hold rates

After cool US CPI, attention shifts to UK and Japanese inflation. Flash PMIs will be watched too amid signs of a rebound in Europe. Fed to stay in the spotlight as plethora of speakers, minutes on tap.