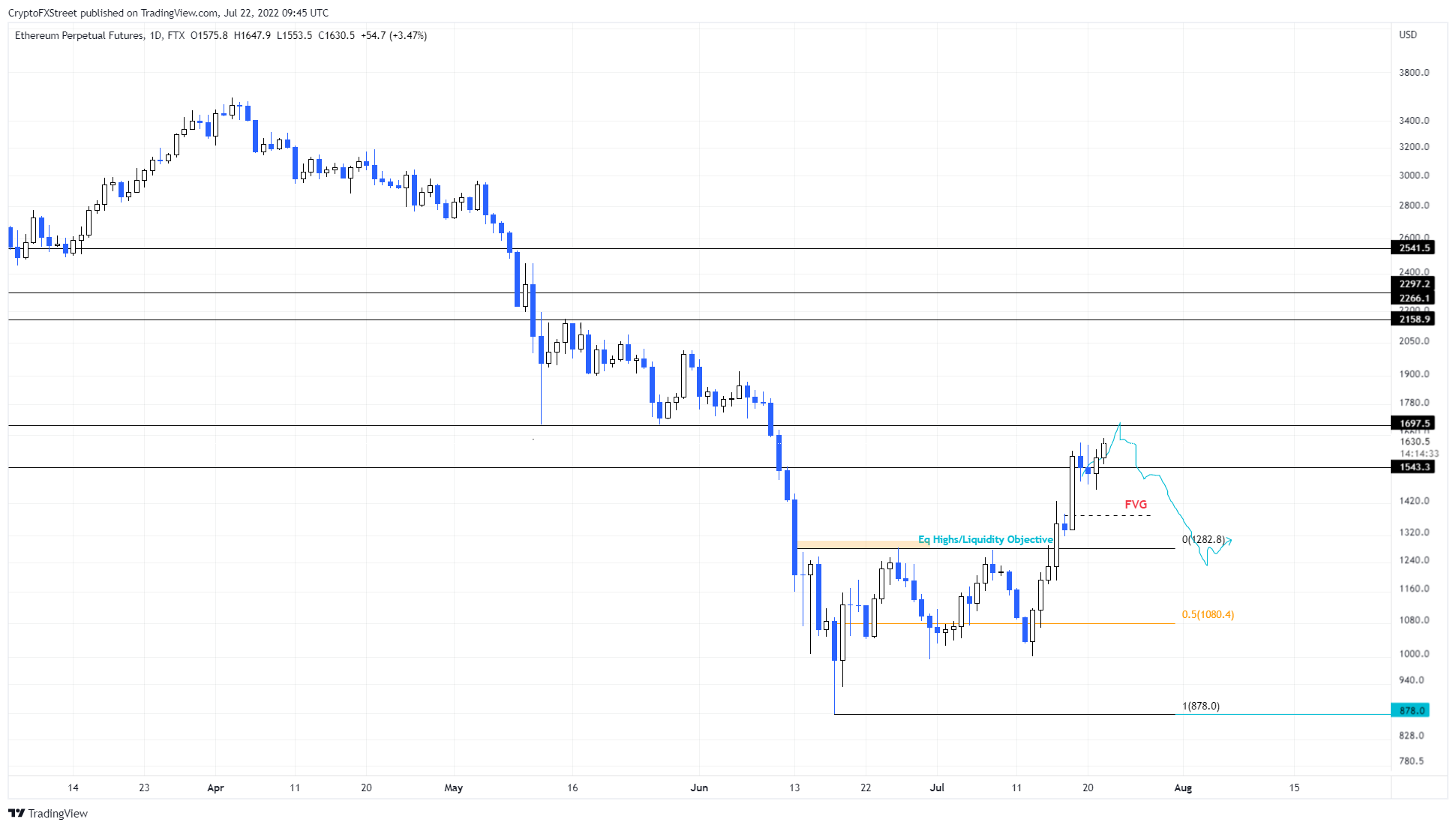

- Ethereum price is close to retesting the $1,700 hurdle, which could potentially exhaust buyers briefly.

- However, if bulls take control and flip $1,700 into a support floor, this run-up could extend to $2,000.

- A daily candlestick close below $1,282 will invalidate the bullish thesis for ETH.

Ethereum price and its gains since July 13 are currently being questioned as bulls hint at weakness. If certain requirements are met, however, things could develop in a way that favors buyers.

Ethereum price has more work to do

Ethereum price has rallied a whopping 65% since July 13 and has sliced through the $1,543 hurdle – it is currently grappling with the $1,700 hurdle. There is a high chance that ETH forms a local top here.

However, if two conditions are met, this run-up could go much higher.

- The sentiment around Bitcoin remains bullish, with price going up or sideways.

- Ethereum price manages to flip the $1,700 hurdle into a support level.

If these objectives are achieved, investors will turn euphoric and the resulting buying frenzy could send ETH to the next significant level - $2,000.

This psychological level will play a pivotal role in trapping late buyers by potentially retesting the $2,158 hurdle. Therefore, investors should be cautious around the $2,000 barrier as ETH could form a local top and retrace before exploring other bullish avenues.

ETH/USDT 1-day chart

On the other hand, if Ethereum price gets rejected at the $1,700 resistance barrier, leading to a breakdown of the $1,543 support level, it will indicate that the time for correction has come. In such a case, ETH could revisit the $1,282 support level.

Here, buyers have another chance at reviving the rally. However, a daily candlestick close below $1,282 will invalidate the bullish thesis for ETH. This development could further push ETH down to $1,080 or the midpoint of the $878 to $1,282 range

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin active addresses hit lowest level in five years, BTC ranges below $67,000

Bitcoin (BTC), the largest asset by market capitalization, has noted a decline in its active address count per data from Glassnode. A decline in active addresses is typical at a time during a surge in Bitcoin transaction fees.

SEC vs. Ripple lawsuit update: Regulator responds to letter regarding Terraform Labs judgment

Securities and Exchange Commission (SEC) responded to Ripple’s letter that quotes the reasons for the settlement amount being unreasonable. The payment firm had proposed a fine of $10 million, as opposed to the SEC’s $2 billion.

Gemini Earn creditors could recover their funds in coin as New York Attorney General recovers $50 million

Gemini exchange had terminated its Earn program after Genesis Global Capital did not return over $900 million in assets that it owed to the platform. New York Attorney General Letitia James’ office has recovered a total of $2.05 billion from the platform.

Here’s what you need to know about LayerZero ZRO token airdrop

LayerZero Labs CEO Bryan Pellegrino released details of the upcoming ZRO token airdrop in a recent tweet. ZRO total supply is 1 billion of which 23.8% will be directly allocated to the community and builders. LayerZero announced June 20 as a key date, it remains unclear whether this is the airdrop or entitlement date.

Bitcoin: Has BTC found a local price bottom?

Bitcoin (BTC) price looks set for a mild fall this week, weighed by slight outflows in the US spot ETFs and the US Federal Reserve (Fed) keeping a hawkish interest-rate outlook despite easing inflation. Technical indicators suggest that BTC could face a further 5% correction in the short term before resuming the uptrend.