WTI Price Forecast: Bounces off two-week low, seems vulnerable near $68.00 mark

- WTI attracts some follow-through sellers and dives to a two-week trough on Thursday.

- News that Saudi Arabia will raise output and demand worries weigh on the commodity.

- The technical setup favors bears and supports prospects for a further depreciating move.

West Texas Intermediate (WTI) US crude Oil prices remain under heavy selling pressure for the second straight day and retreat further from a multi-week high, around the $72.20 region touched on Tuesday. The downward trajectory drags the commodity to a two-week low, around the $67.00/barrel mark during the first half of the European session and is sponsored by fresh concerns about global oversupply.

The Financial Times reported that Saudi Arabia – the world's biggest crude exporter – is preparing to abandon its price target of $100/barrier as it prepares to increase output. This comes on top of a potential return of Libyan supply and turns out to be a key factor exerting downward pressure on Crude Oil prices. In fact, Libya's factions took an initial step to resolve the dispute and signed an agreement on the process of appointing a central bank governor.

Furthermore, a hurricane threatening the US Gulf Coast has changed its course – away from oil and gas-producing areas near Texas, Louisiana and Mississippi – and is expected to hit Florida as a 'catastrophic' Category 4 storm. This further eases worries over supply disruptions, which overshadows signs of firmer fuel demand in the US – the world's top oil consumer – and further contributes to the fall amid lingering fuel demand concerns from China.

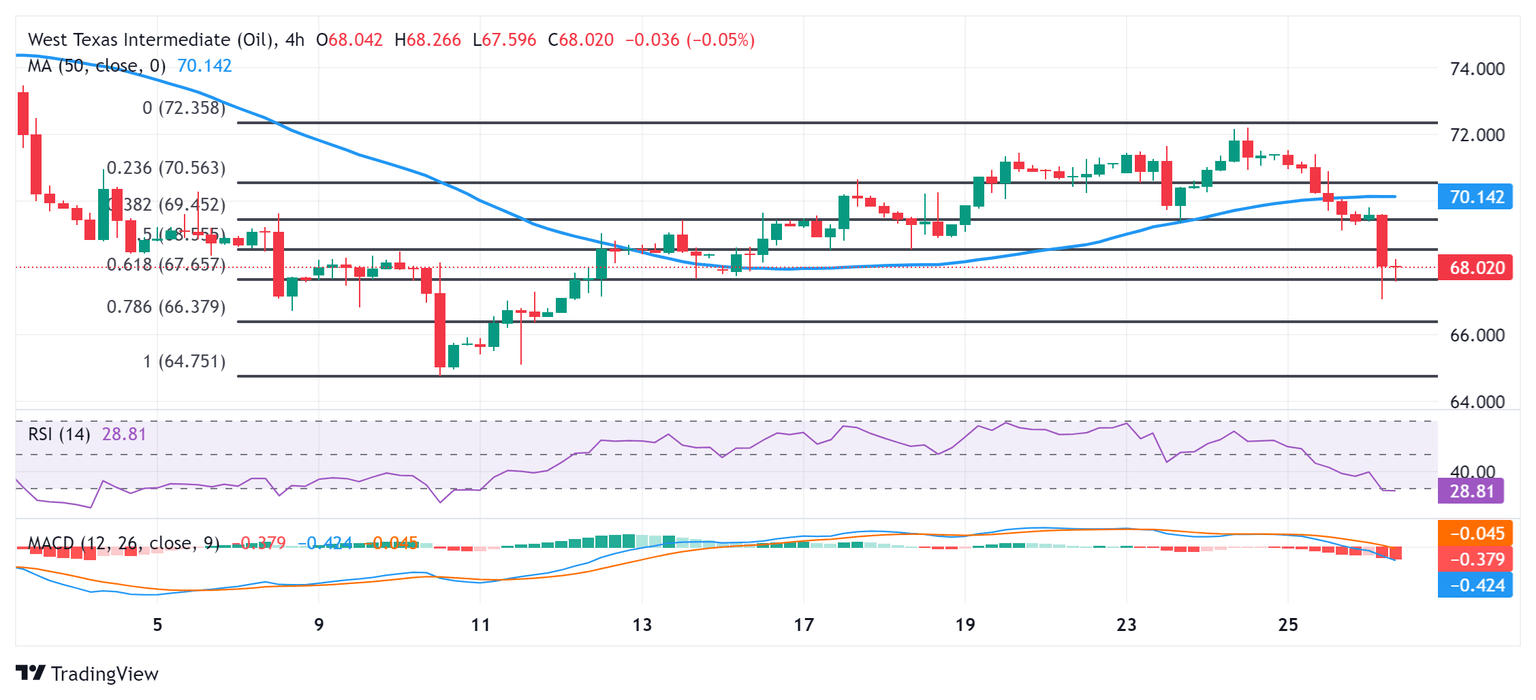

From a technical perspective, Crude Oil prices showed some resilience below the 61.8% Fibonacci retracement level of the recent recovery from the lowest level since May 2023 touched earlier this month and bounced back to the $68.00 round-figure mark. That said, the lack of follow-through buying, along with the fact that oscillators on the daily chart are holding in negative territory, suggests that the path of least resistance for the commodity is to the downside.

Bearish traders, however, need to wait for a sustained break below the $67.00 round figure before positioning for further losses. Crude Oil prices might then weaken further below the $66.45 area, or the 61.8% Fibo. level, towards the $66.00 mark and the $65.75-$65.70 horizontal support. The downward trajectory could drag the commodity further towards the $65.00 psychological mark en route to the YTD low, around the $64.75 region.

WTI 4-hour chart

WTI Oil FAQs

WTI Oil is a type of Crude Oil sold on international markets. The WTI stands for West Texas Intermediate, one of three major types including Brent and Dubai Crude. WTI is also referred to as “light” and “sweet” because of its relatively low gravity and sulfur content respectively. It is considered a high quality Oil that is easily refined. It is sourced in the United States and distributed via the Cushing hub, which is considered “The Pipeline Crossroads of the World”. It is a benchmark for the Oil market and WTI price is frequently quoted in the media.

Like all assets, supply and demand are the key drivers of WTI Oil price. As such, global growth can be a driver of increased demand and vice versa for weak global growth. Political instability, wars, and sanctions can disrupt supply and impact prices. The decisions of OPEC, a group of major Oil-producing countries, is another key driver of price. The value of the US Dollar influences the price of WTI Crude Oil, since Oil is predominantly traded in US Dollars, thus a weaker US Dollar can make Oil more affordable and vice versa.

The weekly Oil inventory reports published by the American Petroleum Institute (API) and the Energy Information Agency (EIA) impact the price of WTI Oil. Changes in inventories reflect fluctuating supply and demand. If the data shows a drop in inventories it can indicate increased demand, pushing up Oil price. Higher inventories can reflect increased supply, pushing down prices. API’s report is published every Tuesday and EIA’s the day after. Their results are usually similar, falling within 1% of each other 75% of the time. The EIA data is considered more reliable, since it is a government agency.

OPEC (Organization of the Petroleum Exporting Countries) is a group of 13 Oil-producing nations who collectively decide production quotas for member countries at twice-yearly meetings. Their decisions often impact WTI Oil prices. When OPEC decides to lower quotas, it can tighten supply, pushing up Oil prices. When OPEC increases production, it has the opposite effect. OPEC+ refers to an expanded group that includes ten extra non-OPEC members, the most notable of which is Russia.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.