WTI Price Analysis: Oil bears struggle to keep the reins, $78.00 is the key

- WTI crude oil remains pressured at the lowest levels in 13 days, prints four-day downtrend.

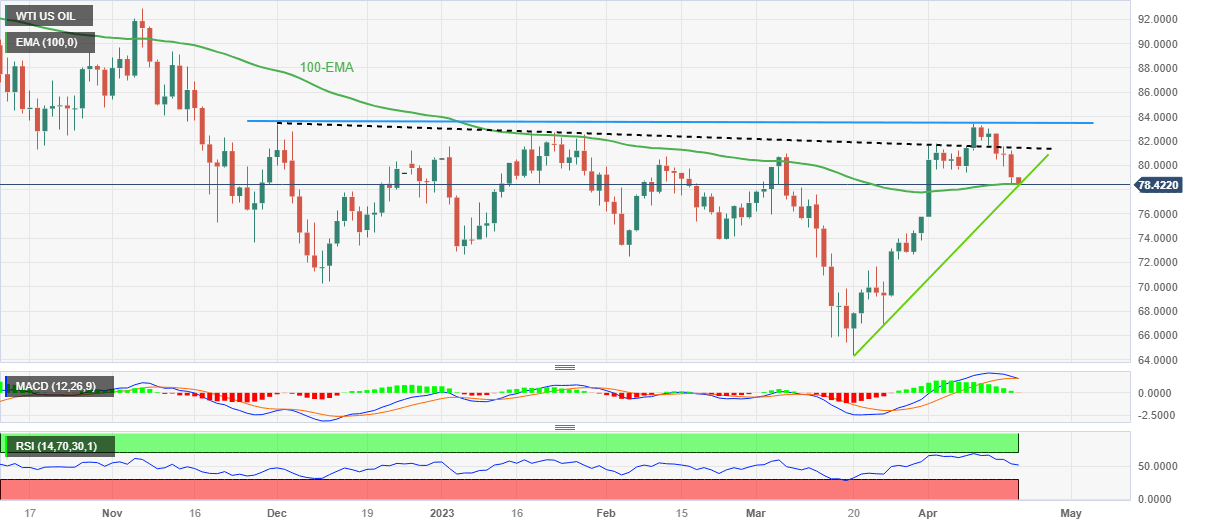

- 100-EMA, one-month-old ascending support line challenge energy bears.

- Looming bear cross on MACD, RSI retreat keeps Oil sellers hopeful.

- Oil price uptrend remains elusive below $83.30-40 resistance zone.

WTI crude oil renews a two-week low to around $78.30 as it drops for the fourth consecutive day heading into Thursday’s European session. In doing so, the energy benchmark prods the 100-day Exponential Moving Average (EMA) while also approaching an upward-sloping support line from March 20.

That said, the quote’s U-turn from $83.40, as well as a downward-sloping of the previous resistance line from early December 2022, keeps the Oil bears hopeful. Adding strength to the downside bias is the impending bear cross on the MACD and RSI (14) retreat.

Even so, the black gold needs to provide a clear downside break of the 100-day EMA and the one-month-old ascending trend line, respectively near $78.40 and $78.00, to convince the bears.

Following that, February’s low of $72.50 will gain the market’s attention, a break of which could recall the $70.00 psychological magnet to the chart.

On the flip side, the $80.00 round figure restricts the immediate upside of the Oil prices ahead of a downward-sloping-resistance line from the last December, near $81.50.

Following that, the WTI crude oil can change a horizontal area surrounding $83.30-40 that holds the key for the buyer’s conviction.

WTI: Daily chart

Trend: Further upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.