When are the UK data releases and how could they affect GBP/USD?

The UK Economic Data Overview

The UK docket has the monthly GDP release today, alongside the releases of the Kingdom’s Trade Balance and Industrial Production, all of which will drop in at once later in Europe at 0930 GMT.

The United Kingdom GDP is expected to arrive at +0.1% MoM in October while the Index of Services (3M/3M) for October is seen at +0.5% vs. +0.4% previous.

Meanwhile, the manufacturing production, which makes up around 80% of total industrial production, is expected to show MoM no change at 0% in October, improving slightly from a drop of 0.4% recorded in September. The total industrial production is expected to come in at +0.2% MoM in Oct as compared to the previous reading of -0.3%.

On an annualized basis, the industrial production for Oct is expected to have dropped 1.2% versus -1.4% previous, while the manufacturing output is also anticipated to have declined by 1.4% in the reported month versus -1.8% last.

Separately, the UK goods trade balance will be reported at the same time and is expected to show a deficit of £11.650 billion in Oct vs. £12.541 billion deficit reported in Sept.

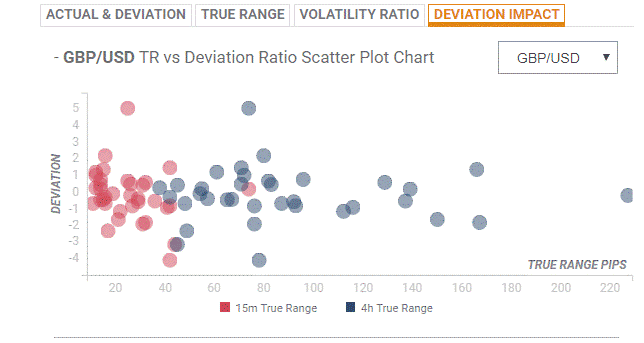

Deviation impact on GBP/USD

Readers can find FX Street's proprietary deviation impact map of the event below. As observed the reaction is likely to remain confined around 20-pips in deviations up to + or -2, although in some cases, if notable enough, a deviation can fuel movements in excess of 60-70 pips.

How could affect GBP/USD?

At the press time, the GBP/USD pair has ticked a few pips higher and trades near session highs of 1.3161, as the sentiment around the pound remains buoyed by a potential Conservatives majority, as highlighted by several UK election opinion polls. The UK heads for polls on Dec. 12th, Thursday.

An upbeat UK GDP report could offer fresh impetus to the GBP bulls, pushing the Cable further towards the 1.32 handle on a break above the 1.3180 eight-month highs reached on Monday.

According to the AceTrader Research Team: “Cable's intra-day rebound from 1.3135 suggests the pullback from yesterday's high at 1.3180 has ended there and trading from long side for a resumption of MT uptrend is favored. Bids are now seen at 1.3140/50 and more below at 1.3120/30 with stops building up below there whilst initial offers are noted at 1.3210/20.”

Key Notes

UK GDP and German ZEW amongst market movers today – Danske Bank

GBP/USD is capped after Boris has a bad day— Confluence Detector

UK Election Preview: GBP bulls to hold their horses

About the UK Economic Data

The Gross Domestic Product released by the Office for National Statistics (ONS) is a measure of the total value of all goods and services produced by the UK. The GDP is considered as a broad measure of the UK economic activity. Generally speaking, a rising trend has a positive effect on the GBP, while a falling trend is seen as negative (or bearish).

The Manufacturing Production released by the Office for National Statistics (ONS) measures the manufacturing output. Manufacturing Production is significant as a short-term indicator of the strength of UK manufacturing activity that dominates a large part of total GDP. A high reading is seen as positive (or bullish) for the GBP, while a low reading is seen as negative (or bearish).

The trade balance released by the Office for National Statistics (ONS) is a balance between exports and imports of goods. A positive value shows trade surplus, while a negative value shows trade deficit. It is an event that generates some volatility for the GBP.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.