WEN Stock Price: The Wendy's Company soars as WallStreetBets takes a big juicy bite

- WEN shares popped a mouth-watering 26% on Tuesday.

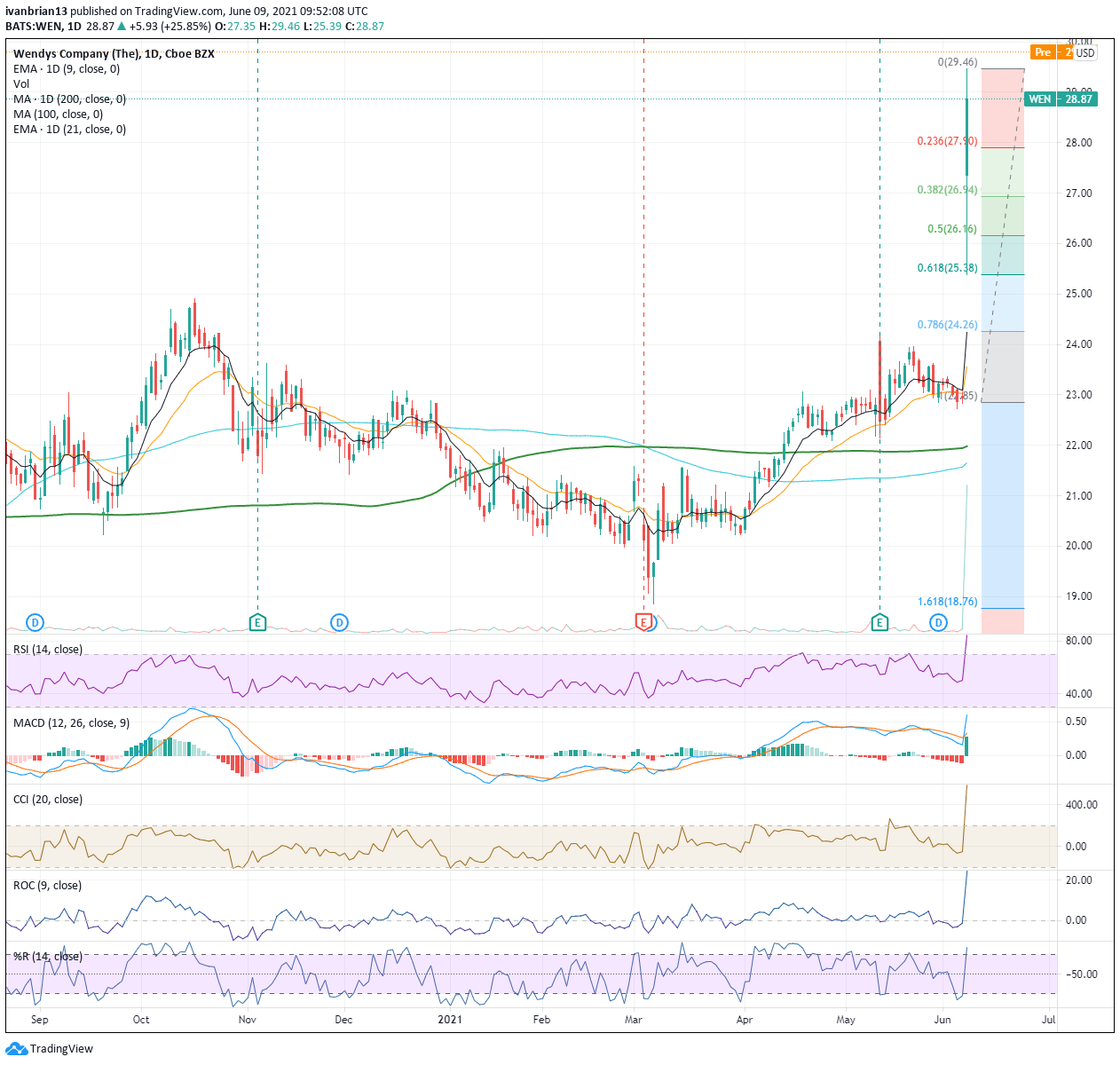

- $25.38 is the heavily-watched 61.8% retracement.

- WEN surged to record 30-year highs on the rally.

Another day, another mind-blowing rally as the new era of speculative frenzy shows no signs of abating. The new era will take some getting used to, but options market makers should be happy with increased volatility to sell occasionally, so long as they can manage their delta and gamma positions. The advent of handheld smartphone trading apps has unleashed a tidal wave of new aggressive hungry traders on the stock market and this trend shows no sign of moving on just yet. Particularly with Bitcoin continuing to suffer. Call it what you will, frenzy, groupthink in excess, or even a Ponzi scheme, but the fact is this new retail force is a powerful change to Wall Street's staid traditions.

AMC and GameStop (GME) have been the noted meme stocks in 2021, but now the net is spreading and Wendy's went and got itself all flame grilled up on Tuesday, soaring to close the session at $28.87 for a neat 26% gain. Wendy's had been close to breaching $30 at one point. It appears the reasoning is down to some posting on Reddit's WallStreetbets forum talking about the reopening prospects for the fast-food chain as well as a new salad lineup and chicken tenders. All that added a few billion to the market cap. Nice work, apes! Wendy's needs no introduction as a fast food chain and blew past all previous levels, hitting a near 30-year high and breaking the old high from 2006.

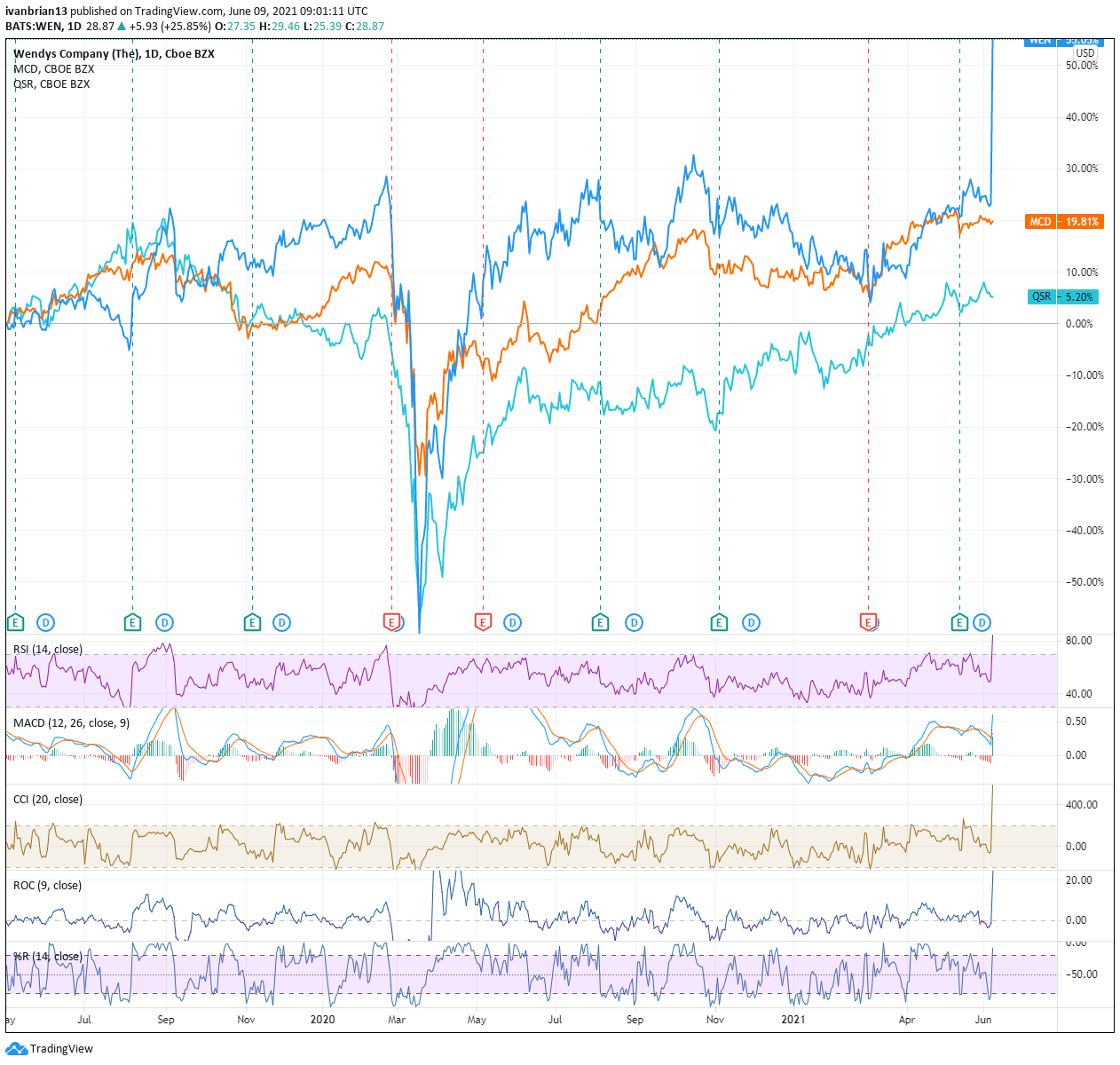

The interesting thing to note is the argument made by WallStreetBets for Wendy's (reopening, new menu, etc.) should also be directly applicable to McDonald's (MCD) shares and Restaurant Brands Burger King (QSR) shares. However, a quick glance at the chart below shows this is not the case. Why is this? Could it be this is a frenzy with no real reasoning behind it or does it matter?

Is Wendy's still a buy?

Firstly, FXStreet always begins our coverage of the majority of these meme stocks by saying how out of whack they have become with the underlying fundamentals. Investing, as in the Warren Buffet style of buying and holding for the long term, is governed by fundamental metrics such as the health of the balance sheet, sales and revenue generation, etc. Trading or speculating does not have to be subject to such underlying metrics as it is usually of a more short-term nature. So again, Wendy's has gone too far and is not attractive at this price. That is not to say it will not keep going higher, so trading the stock in the short term will have different metrics to look at. Momentum is clearly behind the name as is a wall of retail money. A 26% move is not actually that much when compared to some of the moves we have witnessed in other meme stocks: AMC, KOSS, GME, etc.

The difference with Wendy's is it does not have a larger short base to squeeze. Refinitiv data shows the short base around 3%. Wendy's does not have a low float like KOSS either. So two of the major crutches have been removed straight away. It is, however, a relatively small-cap stock, making it is easier to move. If the WallStreetBets crowd decided to apply their logic to Mcdonald's (MCD), they would be up against a much larger flow of money and find it harder to move the stock. They may succeed, but the effect would likely not be as long lasting. All the momentum indicators, Relative Strength Index (RSI), Commodity Channel Index (CCI) and Williams %R are showing massively overbought conditions. This usually signifies either a sell-off or at least price consolidation. But the history of AMC and GME shows that the squeeze can go on for longer than anticipated.

For such an explosive move, the only real technical analysis left in the toolkit is Fibonacci retracements, as all other support and resistance levels have been blown past. $26.94 is the 38.2% retracement, and $26.16 is the 50%, with $25.38 being the most watched at the 61.8% retracement.

As ever, use good risk management when trading these highly volatilie, highly speculative names.

- Skillz Stock News: SKLZ jumps 6% at open, continues swing high

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.