Wake Up Wall Street (SPY) (QQQ): Equities slide lower as retailers hold up

Here is what you need to know on Tuesday, November 22:

Equity markets continue to slide lower as news flow is light in a shortened week. At least The Wall Street Journal provided some volatility as a report it carried caused oil to collapse 5% before Saudi Arabia denied any planned OPEC increases. That saw oil stocks slide Monday, but they are up today in Europe and should follow suit in the US as oil steadies. Earnings overnight were mixed with retailers again performing alright, but the disappointing forecasts from Dell Technologies (DELL) created another storm cloud. The highlight this week is likely to be FOMC minutes, and given how hawkish Powell was in the presser it seems a good bet that those minutes should err on the side of the hawks.

The Dollar Index is lower this morning at 107.43 while Bitcoin continues to suffer at $15,700 now. Oil is back up to $81, and Gold is higher on the falling dollar at $1,747.

European markets: Eurostoxx -0.35%, FTSE +0.2% and Dax flat.

US futures: all flat for Nasdaq, Dow and S&P.

Wall Street top news

ECB Holzman looking for a 75bps hike.

Dell Technologies (DELL) beats, but the forecast is weak.

Best Buy (BBY) beats on earnings.

Dollar Tree (DLTR) releases earnings before the open.

GameStop (GME): Carl Icahn rumored to be short.

Tesla (TSLA) rumors circulate of price cut in China.

Burlington Stores (BURL) beats on strong earnings.

Reuters headlines

UK begins investigation into Apple (AAPL), Google's (GOOGL) mobile browser dominance.

China's Baidu (BIDU) beats Q3 revenue estimates as ad sales recover.

Medtronic (MDT): The company lowered its full-year profit outlook, blaming a stronger dollar.

Zoom Video Communications (ZM) lowered its annual revenue forecast.

Kroger Co (KR): Labor union International Brotherhood of Teamsters said on Monday a new national contract at the US grocery chain has been ratified with overwhelming support.

Novavax (NVAX): The drugmaker said on Monday it had delivered a written notice to GAVI, the Vaccine Alliance, terminating with immediate effect an agreement for the sale of the company's COVID-19 vaccine to low- and middle-income countries.

Walt Disney Co (DIS): A day after returning to the company, Chief Executive Bob Iger moved to undo a corporate structure put in place by his hand-picked successor.

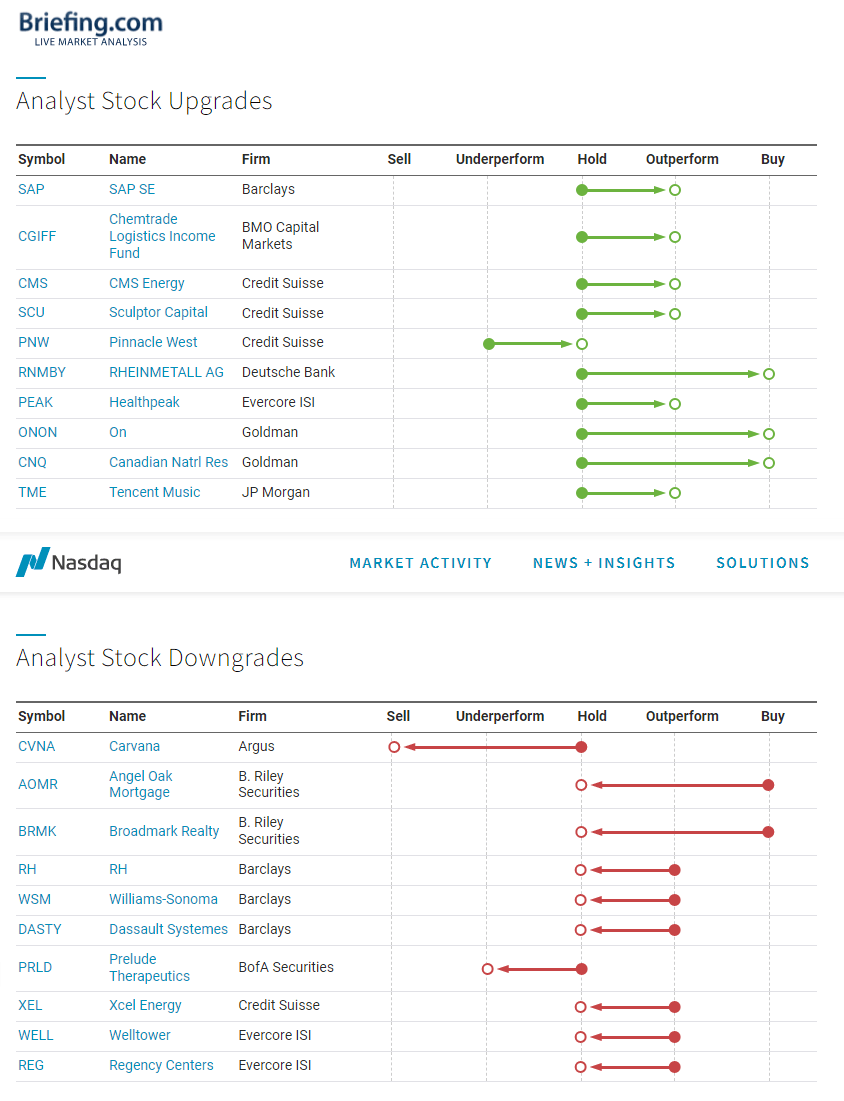

Upgrades and downgrades

Source: Nasdaq.com

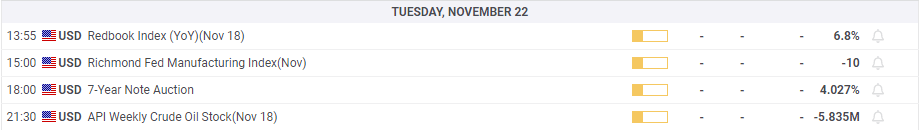

Economic releases due

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.