USDCAD bulls eye a significant correction

- USDCAD is on the brink of a move higher as the US Dollar firms.

- WTI pressured on Covid cases in China, denting CAD.

USDCAD is making tracks on the upside on Monday, partly as oil prices fall and the greenback rallies against a basket of major currencies. The US Dollar is accumulating as investors kept their focus on the Federal Reserve's interest rate hiking path. Ahead of the open, a Fed member poured cold water over the US consumer Price Index upside surprise, arguing it was too soon to call for a pivot.

At the time of writing, USDCAD is trading at 1.3286, up 0.27% on the day having traded between a low of 1.3239 and 1.3309 so far. The US Dollar index, DXY, is up some 0.2% having climbed from a low of 106.41 and reached a high of 107.27 so far, supported by comments from Federal Reserve Governor Christopher Waller. He crossed the wires and said Friday's inflation report was "just one data point," and that markets are "way out in front".

Key comments

- Will need to see a run of CPI reports to take a foot off the brake.

- Positive that goods prices came down with some moderation in services, but it needs to continue.

- US policy rate is "not that high" given level of inflation.

- Rate hikes so far has not "broken anything.

- The US housing market needed to slow down.

- Signal was to pay attention to the endpoint not the pace of rate increases, and until inflation slows the endpoint is "a ways out".

Meanwhile, both US and Canadian government bond yields have been mixed following the Remembrance and Veterans Day holidays on Friday. In this regard, we will have the Canadian inflation data for October, due on Wednesday. This could offer clues on the Bank of Canada's policy outlook. Money markets expect the central bank to raise interest rates by at least 25 basis points at its Dec. 7 policy announcement.

Elsewhere, the price of oil has been falling since the start of the day. The reports of surging new Covid-19 infections in China, even after the country relaxed some of its quarantine policies last week, have dented the market's stability. West Texas Intermediate crude is down some 3.3% falling from a high of $89.82 to a low of $85.68. The drop came, as Reuters reports, following the news agency's report that ''new Covid-19 infections were surging in Beijing and other cities even as the country, the world's No.1 oil importer last week relaxed some of the Zero-Covid policies that shut-down major cities for weeks at a time, cutting in demand, while the new policies are seen as supportive for the country's economy.''

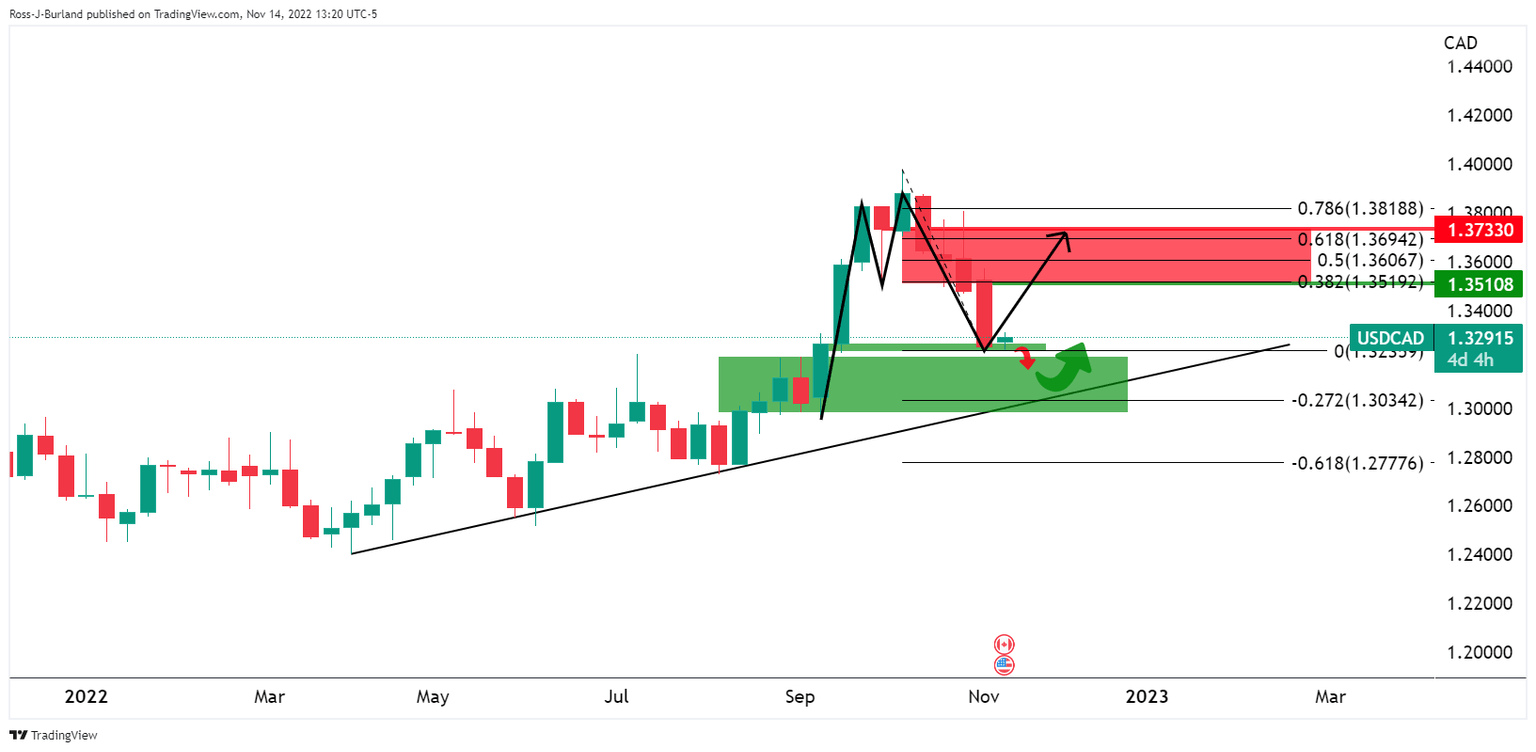

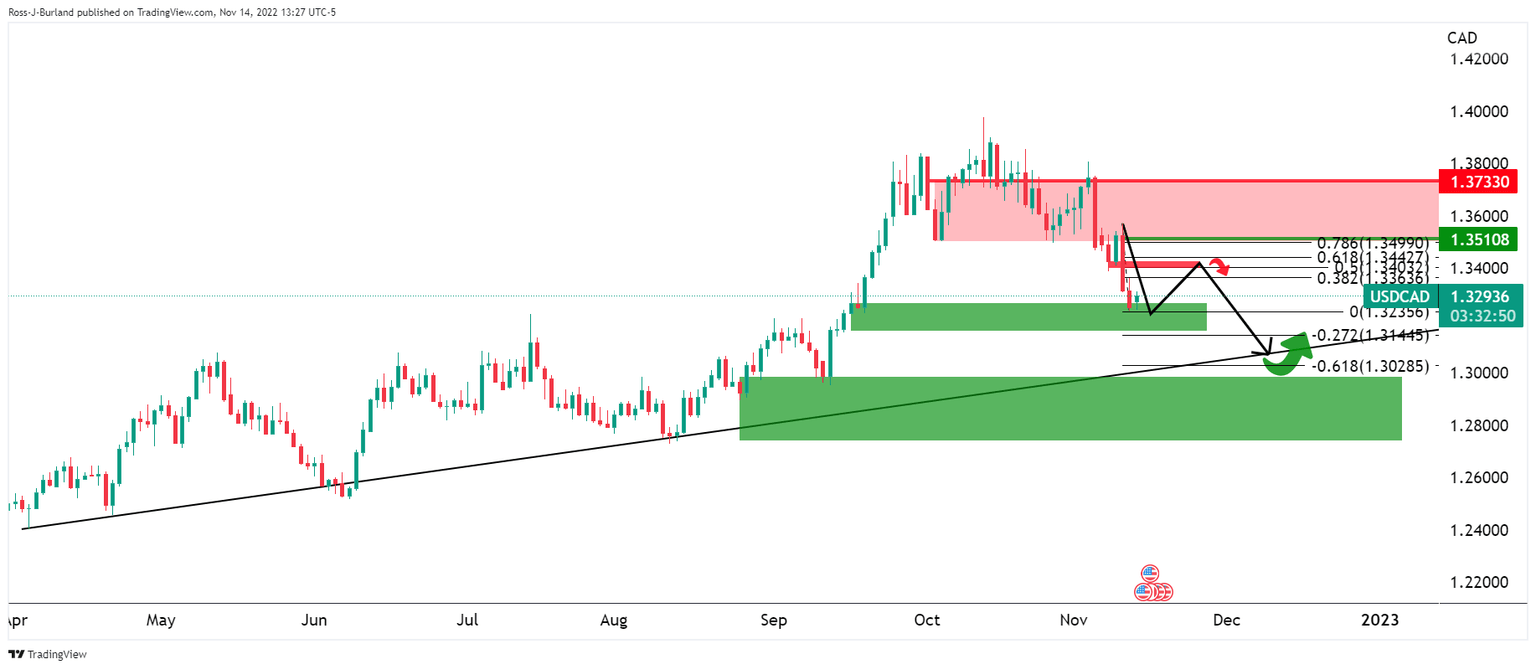

USDCAD weekly chart

The M-Formation is a compelling bullish feature, but there could still be some downside to come.

A break of the support opens up the way to dynamic trendline support.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.