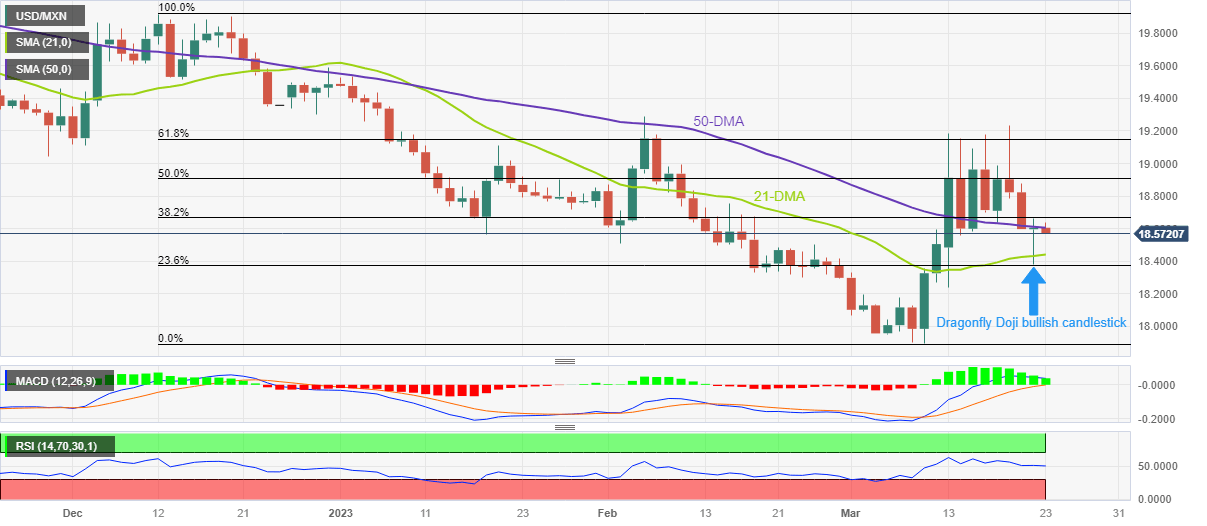

USD/MXN Price Analysis: Ignores Wednesday’s Dragonfly Doji to retreat to 18.60

- USD/MXN fades bounce off one-week low as 50-DMA pushes back bullish bias.

- Bullish candlestick formation, clear bounce off 21-DMA challenges sellers.

- MACD, RSI conditions suggest further grinding towards the south.

- Buyers need successful break of 61.8% Fibonacci retracement for conviction.

USD/MXN takes offers to refresh intraday low near 18.57 during early Thursday, reversing the previous day’s rebound from the 21-DMA.

In doing so, the Mexican Peso (MXN) pair fails to justify Wednesday’s Dragonfly Doji bullish candlestick while dropping back towards the lowest levels since March 13 marked on the previous day.

It’s worth noting that the USD/MXN pair’s failure to cross the 50-DMA during late Wednesday’s corrective bounce keeps the sellers hopeful. Adding strength to the downside bias is the downward-sloping MACD line and the RSI (14) retreat.

As a result, the USD/MXN is likely to drop back to the 21-DMA support of 18.44 before highlighting the 18.30 support.

In a case where the Mexican Peso pair drops below 18.30, the 18.00 threshold could act as the last defense of the bulls before highlighting the odds of witnessing a fresh low since 2017, currently 17.90.

Alternatively, recovery moves need validation from the 50-DMA hurdle of 18.60 to renew upside momentum targeting the 50% and 61.8% Fibonacci retracements of the USD/MXN pair’s fall from December 2022 to March, respectively near 18.90 and 19.15.

Should the USD/MXN pair rises past 19.15, February’s high of 19.30 can challenge the buyers for the one last time.

USD/MXN: Daily chart

Trend: Further downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.