USD/JPY Price Forecast: Downtrend resumes, yet buyers recover 143.00

- USD/JPY remains pressured near 143.39, with momentum indicators favoring a bearish continuation toward 143.00 and 142.50 support levels.

- Failure to decisively clear 143.44 may offer a recovery opportunity for USD bulls if US Nonfarm Payrolls data impresses.

- Key resistance sits at 145.03 (Tenkan-Sen), with further hurdles at 145.73 (Kijun-Sen) and the 150.00 figure.

USD/JPY extended its losses for the third consecutive day, hitting a four-week low of 142.85, yet traders lifted the pair, which closed Thursday's session with losses of 0.21%. As Friday’s Asian session begins, the pair trades at 143.39, virtually unchanged.

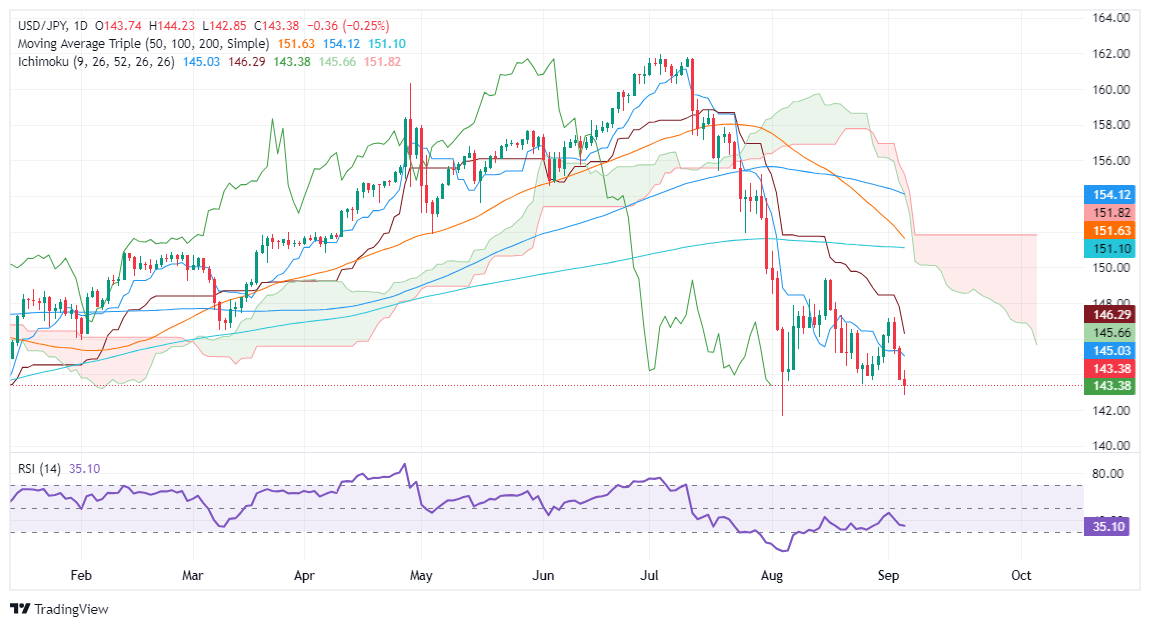

USD/JPY Price Forecast: Technical outlook

The USD/JPY fell toward multi-week lows but failed to decisively clear the August 26 swing low of 143.44. This can pave the way for a recovery for USD bulls, who struggled with the drop in the US 10-year T-note yield.

Despite this, momentum favors further downside, as shown by the Relative Strength Index (RSI). With this and first-tier US August’s Nonfarm Payrolls report looming, the path of least resistance is for a bearish continuation.

The USD/JPY's first support would be the August 26 daily low of 143.44. A breach of the latter would expose key psychological support levels, like the 143.00 mark. This would be followed by the current week's low of 142.85, ahead of key psychological levels, the 142.50 mark and 142.00.

Conversely, an upbeat US jobs report will expose key resistance levels. First, the Tenkan-Sen will be at 145.03, followed by the Kijun-Sen at 145.73, before reclaiming the 150.00 figure above the latest cycle high of 149.39.

USD/JPY Price Action – Daily Chart

Japanese Yen PRICE Today

The table below shows the percentage change of Japanese Yen (JPY) against listed major currencies today. Japanese Yen was the strongest against the Swiss Franc.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.00% | 0.02% | -0.04% | -0.00% | -0.01% | 0.00% | 0.03% | |

| EUR | 0.00% | 0.02% | -0.06% | -0.02% | 0.02% | -0.01% | 0.02% | |

| GBP | -0.02% | -0.02% | -0.06% | -0.02% | -0.02% | -0.01% | 0.00% | |

| JPY | 0.04% | 0.06% | 0.06% | 0.05% | 0.05% | 0.03% | 0.07% | |

| CAD | 0.00% | 0.02% | 0.02% | -0.05% | -0.01% | 0.00% | 0.02% | |

| AUD | 0.00% | -0.02% | 0.02% | -0.05% | 0.00% | -0.01% | 0.01% | |

| NZD | -0.00% | 0.00% | 0.01% | -0.03% | -0.01% | 0.00% | 0.01% | |

| CHF | -0.03% | -0.02% | -0.01% | -0.07% | -0.02% | -0.01% | -0.01% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Japanese Yen from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent JPY (base)/USD (quote).

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.