USD/JPY Price Forecast: Decisively breaches key resistance yet bearish signs persist

- USD/JPY decisively breaks above a critical level in a bullish sign.

- It may also have completed a three-wave correction of the medium-term downtrend with more bearish implications.

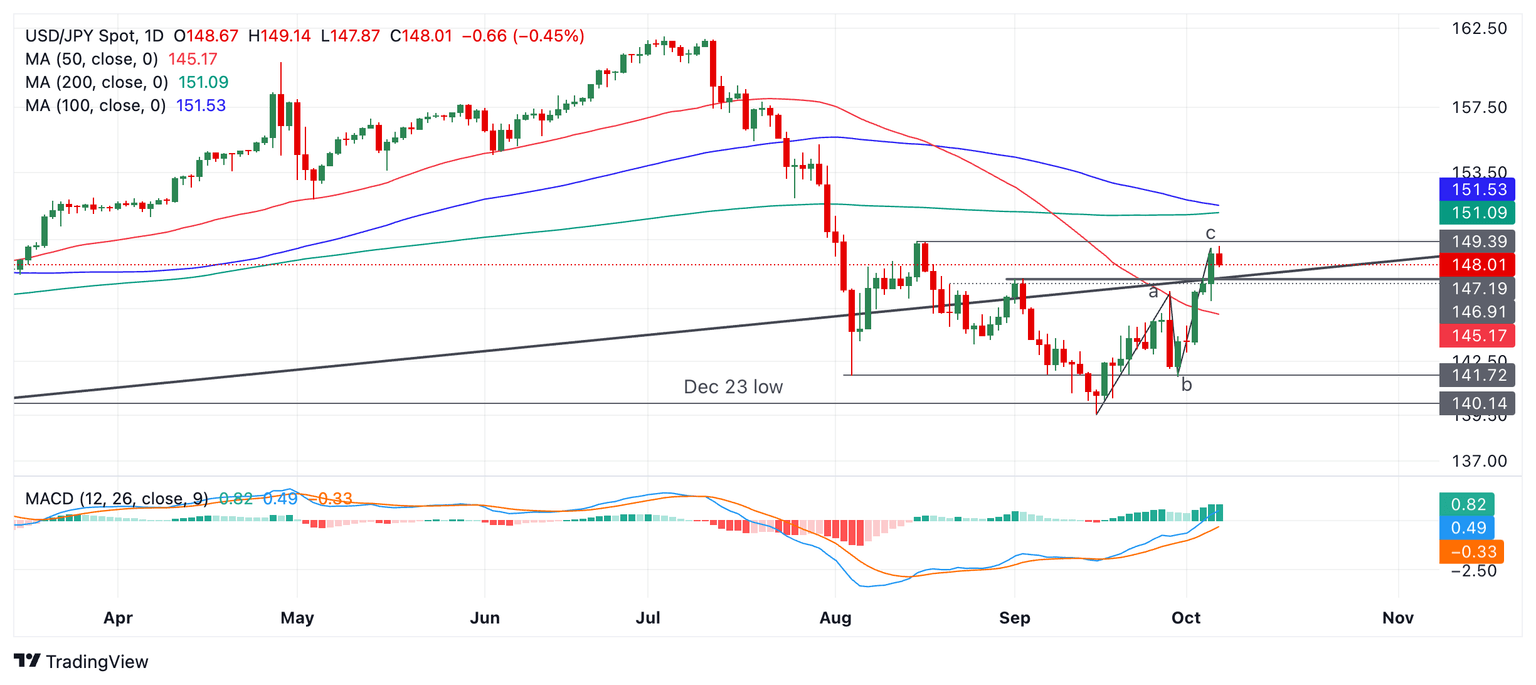

USD/JPY decisively pieces and closes above both its long-term trendline and key upside obstacle in the form of the 147.24 October 3 high. This lends credence to the bullish view and suggests a possible continuation of the short-term uptrend to a tentative target at the next key resistance level of 149.40, the August 15 high.

USD/JPY Daily Chart

Momentum is broadly bullish since the August bottom and the Moving Average Convergence Divergence (MACD) indicator has consistently converged with price during September, and is now in positive territory.

A close above 149.40 would provide more confirmation of an extension of the short-term uptrend higher, with the next target potentially at 151.09 and the 200-day Simple Moving Average (SMA).

Yet bullish enthusiasm should be tempered by the possibility that USD/JPY may have formed a three-wave “abc” corrective pattern of the medium-term downtrend during July. If so, the pair may start to decline again as the longer-term bearish cycle starts to take hold. However, it is still too early to say with any confidence and price action itself is not evidencing any weakness yet.

A close below the 50-day SMA at 145.24 would probably indicate a resumption of the medium-term downtrend from the summer. Such a move would be expected to reach the wave B lows at around 141.72.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.