USD/JPY Price Analysis: Ready to fly above 140.40 as upbeat US NFP accelerates hawkish Fed bets

- USD/JPY has comfortably established above 140.00 inspired by upbeat US Employment data.

- Friday’s upbeat US NFP data have accelerated the odds of more interest rate hikes by the Fed.

- USD/JPY has climbed back above the 50% Fibonacci retracement at 139.66.

The USD/JPY pair has shifted its auction comfortably above the crucial resistance of 140.00 in the Asian session. The major is expected to extend its gains firmly as Friday’s upbeat United States Nonfarm Payrolls (NFP) data have accelerated the odds of more interest rate hike announcements by the Federal Reserve (Fed).

S&P500 futures are showing some losses in the Asian session but settled the previous week on a solid note, portraying a minor caution in the overall risk-appetite mood. The US Dollar Index (DXY) is confidently balancing above 104.00 and is expected to extend its upside journey after scrolling above the immediate resistance of 104.20.

On the Japanese Yen front, investors are anticipating that the Bank of Japan (BoJ) could tweak its Yield Curve Control (YCC) to keep monetary policy expansionary.

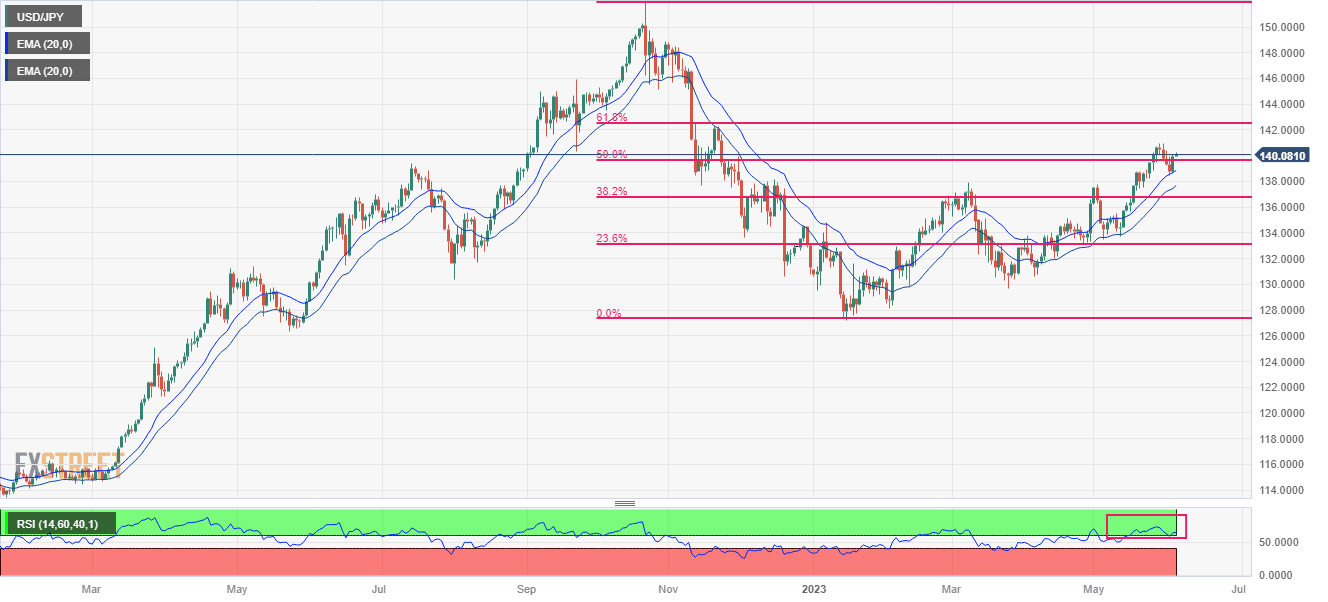

USD/JPY has climbed back above the 50% Fibonacci retracement (plotted from 21 October 2022 high at 151.94 to 16 January 2023 low at 127.22) at 139.66. The asset has rebounded after finding support near the 20-period (High-Low) Exponential Moving Average (EMA) band.

The Relative Strength Index (RSI) (14) is oscillating in the bullish range of 60.00-80.00, indicating more upside ahead.

Going forward, a break above May 31 high at 140.42 will drive the asset toward May 30 high at 140.93. A break above the latter will expose the asset to a fresh six-month high of around 141.61, which is 23 November 2022 high.

On the flip side, a downside move below March 08 high at 137.92 will drag the asset toward March 02 high at 137.10 followed by a 38.2% Fibo retracement at 136.81.

USD/JPY daily chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.