USD/JPY Price Analysis: Drops to an eight-week low, hovers around 147.50

- USD/JPY moves on the downward trajectory to an eight-week low.

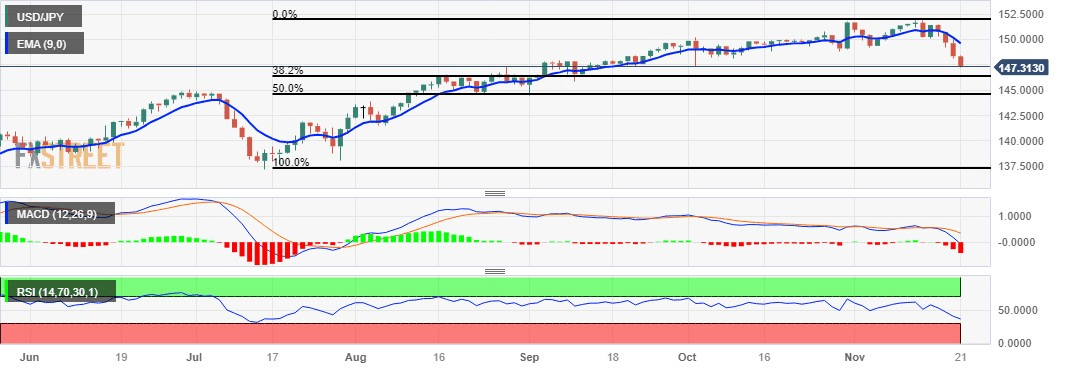

- 147.00 psychological level appears to be a key support following the 38.2% Fibonacci retracement.

- A breakthrough above the 148.00 level could support the pair to explore the region near the nine-day EMA.

USD/JPY extended the losing streak that began on Thursday and marked an eight-week low, trading around 147.40 during the European session on Tuesday. The 147.00 psychological level emerges as the immediate support following the 38.2% Fibonacci retracement at 146.32.

The US Dollar (USD) has plunged to a nearly three-month low, influenced by dovish expectations from the Federal Reserve (Fed). This development is a significant factor contributing to the decline of the USD/JPY pair.

The 14-day Relative Strength Index (RSI) lies below the 50 level, signaling a weaker sentiment for the USD/JPY pair. This could potentially prompt bearish movements toward the psychological support region around 146.00. If a decisive break occurs below this level, it may pave the way for the USD/JPY pair to navigate the area near the 50.0% retracement at the 144.60 level.

Moreover, the Moving Average Convergence Divergence (MACD) line is positioned below the centerline and diverges below the signal line, signaling a bearish momentum in the market for the USD/JPY pair.

On the upside, the major level at 147.50 serves as the immediate barrier, followed by the psychological level at 148.00. A breakthrough above the latter could provide support for the USD/JPY pair to explore the region around the 149.00 level following the nine-day Exponential Moving Average (EMA) at 149.62.

USD/JPY: Daily Chart

Author

Akhtar Faruqui

FXStreet

Akhtar Faruqui is a Forex Analyst based in New Delhi, India. With a keen eye for market trends and a passion for dissecting complex financial dynamics, he is dedicated to delivering accurate and insightful Forex news and analysis.