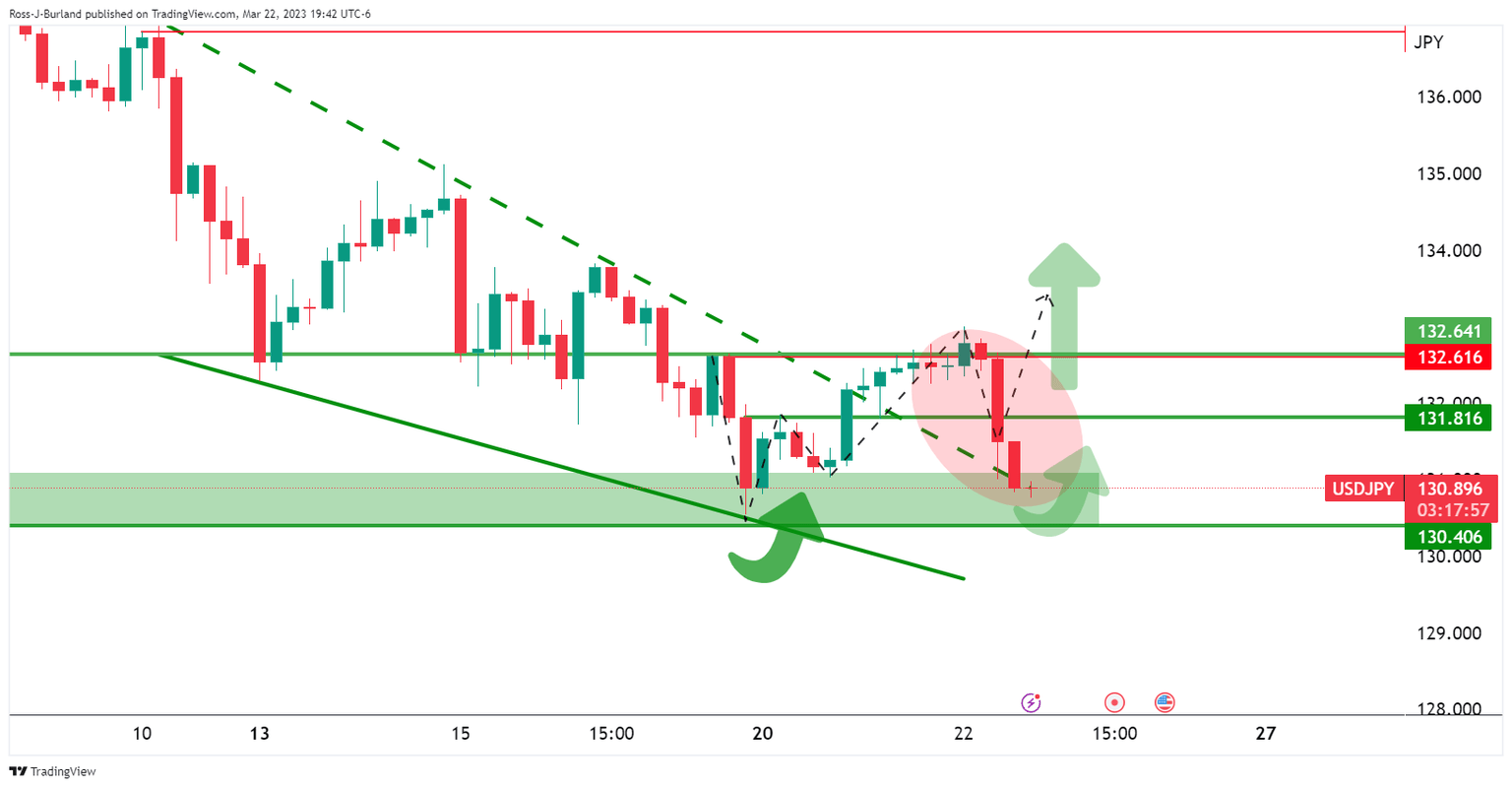

USD/JPY Price Analysis: Bulls about to make their move with eyes on 61.8% retracement

- USD/JPY downside decelerates after strong sell-off due to dovish Fed.

- Bulls could target a 61.8% Fibonacci retracement into the neckline of the M-formation.

As per the prior analysis, USD/JPY Price Analysis: Bulls are up to test key resistance near 132.60, 50% reversion and support eyed, the bears stepped in as forecasted according to the W-formation´s draw on the price. However, the move was accentuated during the Federal Reserve event.

USD/JPY prior analysis

It was stated that ´´the W-formation shows the price meeting prior resistance and a retest of the neckline, which would be expected to act as support, could be the final show from the bears as bulls take control.´´

USD/JPY update

While the price did indeed fall into the neckline, it vaulted the support on the back of a very weak US Dollar during the Fed event:

The price is moving into the lower support and the bulls could be committed near the 130.70s for a retest of the prior support as follows:

Bulls could target a 61.8% Fibonacci retracement into the neckline of the M-formation.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.