USD/JPY Price Analysis: Bears seek a run to 112.08 while bulls look to 113.20

- USD/JPY bulls are testing the commitments of the bears from key hourly support.

- Bears need to break the double bottom lows for a run to the 112.08 daily target.

USD/JPY bears are in control from a daily basis while below 113.20 but are stalling in what could be hourly accumulation. The following illustrates the market structure and prospects of either a downside continuation towards daily targets 112.08/111.77 or a retest of 113.20 for the near term.

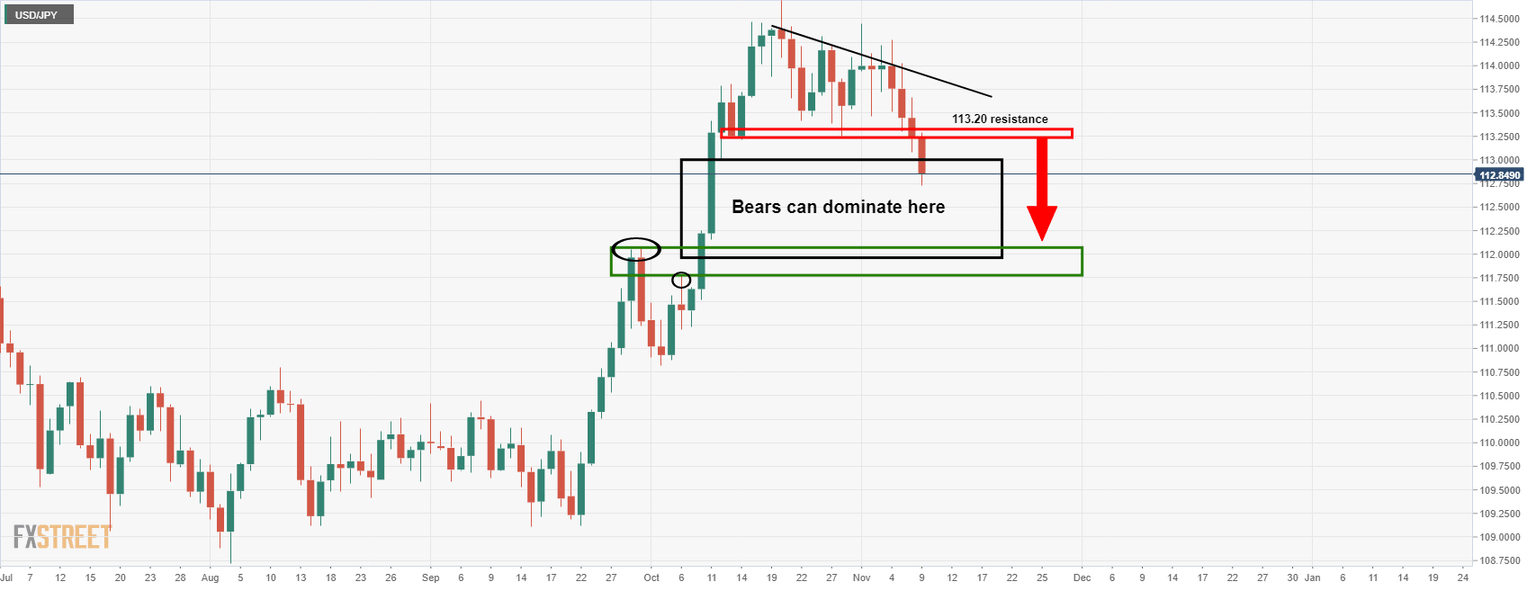

USD/JPY daily chart

As illustrated, the price is on the verge of a run towards the old higher of 112.08 and 111.77 below there.

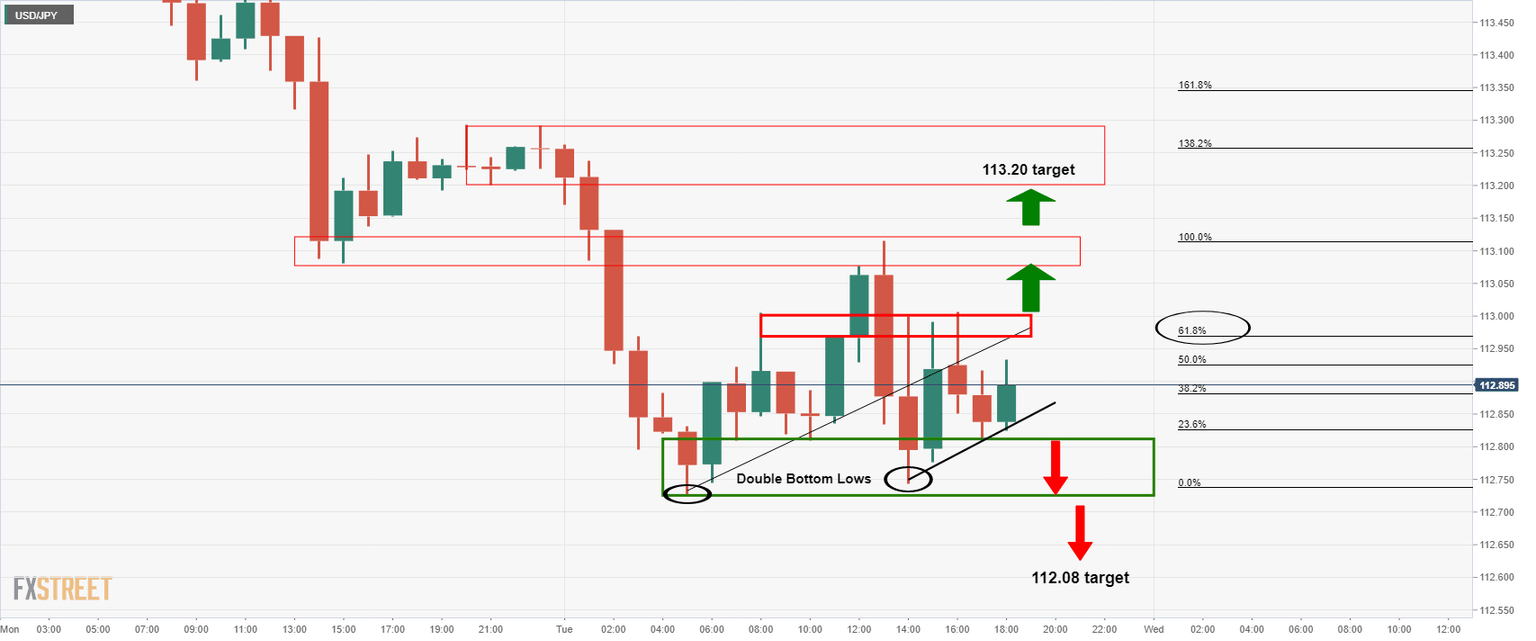

USD/JPY H1 chart

USD/JPY is consolidating on the hourly time frame and is quite a mess. However, there is structure when breaking it down. The current trendline support will need to give out to the bears to expose the daily targets of 111.77/112.08.

However, given the double bottom lows, this is looking less likely as the price move into accumulation. With that being said, the old trendline support is now expected to act as a counter trendline resistance for which price closed below it on two occasions following a test of the 61.8% ratio. Until that trendline is broken, bears remain in the game and eye 112.08/111.77. If the price breaks 113 the figure and closes above on an hourly basis, then 113.20 will be vulnerable as the next area of interest.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.