USD/INR Price News: Indian rupee bears catch a breather around 75.50 key support

- USD/INR prints mild losses despite recently bouncing off intraday low.

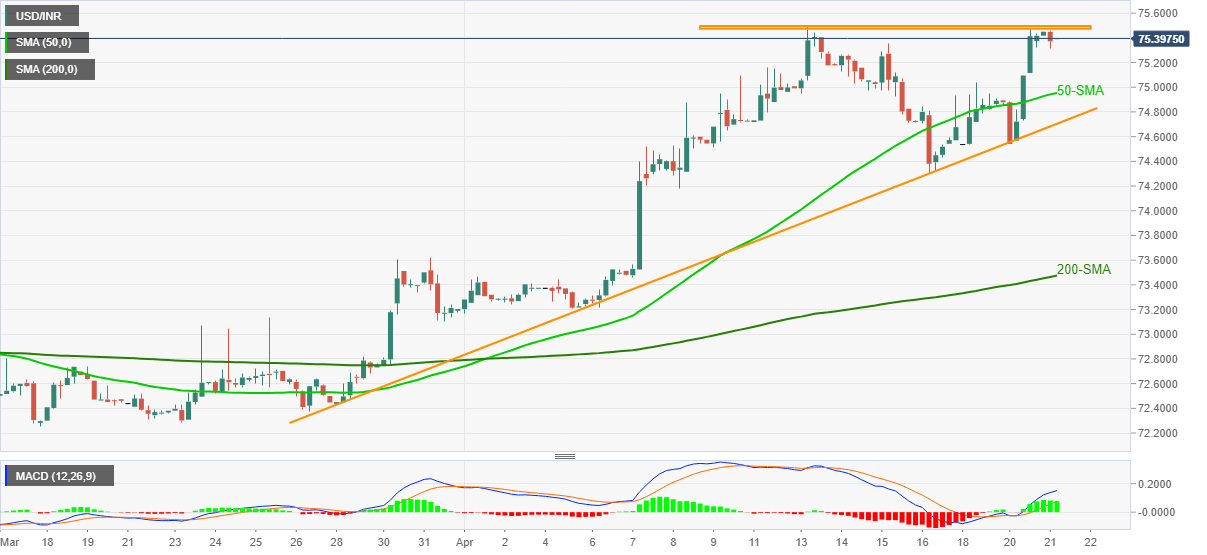

- Bullish MACD, ascending triangle and sustained trading beyond 50-SMA back the buyers.

- Bears have a bumpy road unless breaking 74.20.

USD/INR picks up bids to 75.39, down 0.07%, amid Thursday’s trading. Although markets in India are off, broad US dollar gains, backed by the coronavirus (COVID-19) woes, keeps the pair bulls hopeful despite the recent consolidation around the one-week top.

Also supporting the upside momentum are the bullish MACD signals and the pair’s sustained trading beyond 50-SMA, not to forget the rising triangle formation.

However, a clear break of 75.50, comprising the upper line of the stated triangle, becomes necessary for the USD/INR buyers targeting 75.80 levels, including 61.8% Fibonacci Expansion (FE) of the early April run-up, followed by pullback moves to April 16.

In a case where the quote remains firm above 75.80, the 76.00 round-figure and June 2020 peak surrounding 76.55 will be in the spotlight.

Meanwhile, pullback moves become less worrisome until breaking the stated triangle’s support line, around 74.68, a break of which can recall 200-SMA level of 73.46 on the chart.

Though, the 50-SMA level of 74.95 and the 74.00 are likely intermediate halts to watch should the pair mark a surprise drop.

USD/INR four-hour chart

Trend: Bullish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.