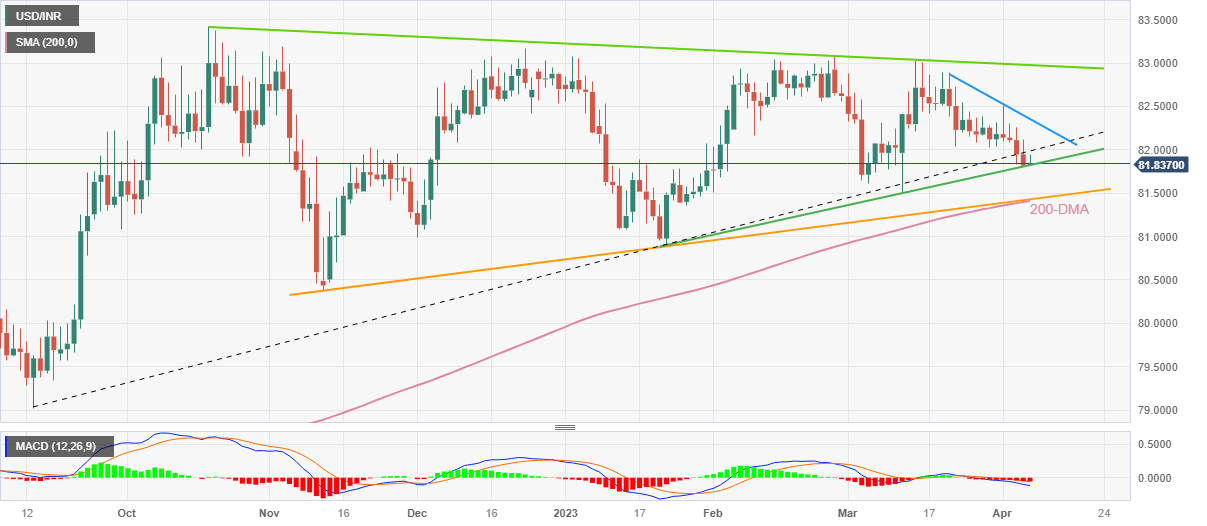

USD/INR Price Analysis: Indian Rupee prods key hurdle for bulls around 81.80 with eyes on US NFP

- USD/INR stays well-set for three-week losing streak, down for the fourth consecutive day.

- Indian Rupee buyers take a breather at 11-week-old ascending trend line.

- Clear break of upward-sloping previous support line from September 2022, bearish MACD signal favor USD/INR sellers.

- Convergence of Five-month-old support line, 200-DMA appears a tough nut to crack for pair bears.

USD/INR bears poke a multi-day-old support line around 81.80 as it braces for the third consecutive weekly loss on early Friday. Apart from the stated support line, the Good Friday holiday and cautious mood ahead of the US Nonfarm Payrolls (NFP) release also challenge the Indian Rupee (INR) pair.

Also read: Nonfarm Payrolls Preview: Markets fear depressing data, three scenarios for the US Dollar

It’s worth noting, however, that a daily closing below the support-turned-resistance line from the last September, around 82.00 by the press time, joins the bearish MACD signals to keep USD/INR sellers hopeful of breaking the immediate 81.80 support.

Following that, the quote can quickly drop to the previous monthly low of around 81.50.

Though, a convergence of the 200-DMA and a five-month-old ascending trend line, close to 81.40 at the latest, appears a tough nut to crack for the USD/INR bears afterward.

Meanwhile, USD/INR recovery remains elusive unless the pair stays below the 82.00 previous support.

Even if the quote rises past 82.00, a downward-sloping resistance line from March 22, around 82.35 at the latest, can test the USD/INR bulls.

Above all, USD/INR buyers should remain cautious unless witnessing a daily close beyond the descending resistance line from October 2022, near 83.00 by the press time.

USD/INR: Daily chart

Trend: Further downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.