Nonfarm Payrolls Preview: Markets fear depressing data, three scenarios for the US Dollar

- Economists expect the US to announce an increase of 240,000 jobs in February, a USD-positive scenario.

- Investors are wary of significantly softer growth, a USD-negative outcome, but lower wages could turn things around.

- A shocking labor loss would trigger safe-haven flows favoring the USD against almost all currencies.

The correlations, they are a-changin – the US Dollar attracts funds on every downbeat release, as investors fear a recession rather than rate hikes. While the Greenback's new reaction mechanism may seem counterintuitive, more logic may be found in stock markets. Bad news for the US economy means equities stumble.

A bigger test awaits markets now – the Nonfarm Payrolls report for March, due out on Friday, April 7, at 12:30 GMT. Here is what how it could play out, with three scenarios:

1) Nonfarm Payrolls meet economists' expectations, sending the US Dollar up

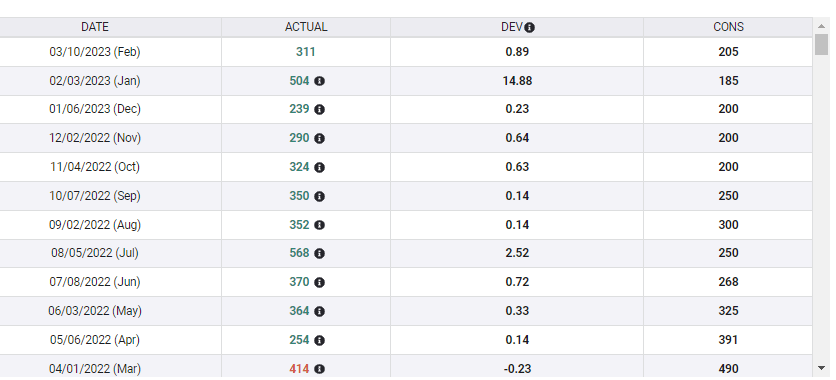

The NFP has beaten expectations in the past 11 months – a stunning winning streak. Upside surprises have likely pushed economists to expect another relatively robust increase of 240,000 jobs in March 2023. While that figure is below last month's 311,000, is would still be above the pre-pandemic average of just under 200,000.

Source: FXStreet

If the NFP merely meets these expectations, Federal Reserve (Fed) officials will likely support raising interest rates in the May meeting and leaving it at elevated levels. In case the report scores a twelfth consecutive win over economists, Fed estimates would rise even further.

A rosy scenario for American workers is also good news for the US Dollar, which would draw demand related to rates, and also their contribution to a recession. That would come despite evidence from the labor market pointing to no immediate damage to the economy from the banking crisis.

2) NFP shows poor job growth, in line with investors' estimates, weighing on the Greenback

The ISM Purchaisng Managers' Indexes (PMIs) came out below estimates, and their employment components also pointed to softer hiring. These forward-looking surveys have not only impacted markets but also lowered expectations for the Nonfarm Payrolls. ADP's weak private-sector jobs report added fuel to the fire.

If the NFP shows weak job growth of no more than 150,000 positions, it will serve as solid evidence that the US economy is weakening – something the Fed would be unable to ignore. The central bank has two mandates, price stability and full employment.

Prospects of lower interest rates would be adverse for the US Dollar and good news for stocks. However, there is another factor to consider in this scenario.

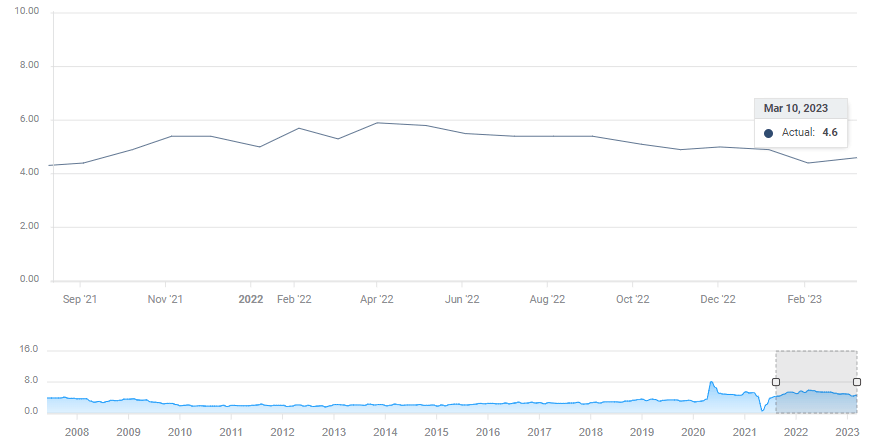

Average Hourly Earnings are expected to drop 4.3% YoY in March after bouncing to 4.6% in February:

Source: FXStreet

Such an outcome would be closer to investors' real estimates and would allow them to pay some attention to salaries. If wage growth slows, it would be a "Goldilocks" scenario for equities – lower interest rates and a drop in company costs. For the US Dollar, it would serve as another sign of falling inflation, adding to the Greenback's retreat.

Yet another scenario is weaker job growth but ongoing, fast wage increases. Headlines would scream "stagflation," sending stocks down and the US Dollar up on fears of higher rates.

What is stagflation? The term, coined in the 1970s, means stagnation in the economy and jobs while inflation remains painfully high. Bad news all around.

Nonfarm Payrolls FAQs

What are Nonfarm Payrolls?

Nonfarm Payrolls (NFP) are part of the US Bureau of Labor Statistics monthly jobs report. The Nonfarm Payrolls component specifically measures the change in the number of people employed in the US during the previous month, excluding the farming industry.

How does Nonfarm Payrolls influence the Federal Reserve monetary policy decisions?

The Nonfarm Payrolls figure can influence the decisions of the Federal Reserve by providing a measure of how successfully the Fed is meeting its mandate of fostering full employment and 2% inflation.

A relatively high NFP figure means more people are in employment, earning more money and therefore probably spending more. A relatively low Nonfarm Payrolls' result, on the either hand, could mean people are struggling to find work.

The Fed will typically raise interest rates to combat high inflation triggered by low unemployment, and lower them to stimulate a stagnant labor market.

How does Nonfarm Payrolls affect the US Dollar?

Nonfarm Payrolls generally have a positive correlation with the US Dollar. This means when payrolls' figures come out higher-than-expected the USD tends to rally and vice versa when they are lower.

NFPs influence the US Dollar by virtue of their impact on inflation, monetary policy expectations and interest rates. A higher NFP usually means the Federal Reserve will be more tight in its monetary policy, supporting the USD.

How does Nonfarm Payrolls affect Gold?

Nonfarm Payrolls are generally negatively-correlated with the price of Gold. This means a higher-than-expected payrolls' figure will have a depressing effect on the Gold price and vice versa.

Higher NFP generally has a positive effect on the value of the USD, and like most major commodities Gold is priced in US Dollars. If the USD gains in value, therefore, it requires less Dollars to buy an ounce of Gold.

Also, higher interest rates (typically helped higher NFPs) also lessen the attractiveness of Gold as an investment compared to staying in cash, where the money will at least earn interest.

Sometimes NonFarm Payrolls trigger an opposite reaction than what the market expects. Why is that?

Nonfarm Payrolls is only one component within a bigger jobs report and it can be overshadowed by the other components.

At times, when NFP come out higher-than-forecast, but the Average Weekly Earnings is lower than expected, the market has ignored the potentially inflationary effect of the headline result and interpreted the fall in earnings as deflationary.

The Participation Rate and the Average Weekly Hours components can also influence the market reaction, but only in seldom events like the "Great Resignation" or the Global Financial Crisis.

3) NFP shows a shocking loss of jobs, boosting the US Dollar on safe-haven flows

After 11 months of outstanding job gains, the world's largest economy may have suffered a shrinkage in its labor market. That last happened in December 2020, when the second significant covid wave hit the world. That loss was followed by massive hiring – but nothing lasts forever.

Markets are far from ready for an outright loss in jobs. Such an outcome would rattle investors, triggering recession fears and sinking stocks. For the US Dollar, it implies strength, as shocks in America cause aftershocks elsewhere.

This scenario is the least likely one, but after a string of downbeat data, its probability has risen.

Final thoughts

The upcoming Nonfarm Payrolls report comes in the wake of weak US data, and investors are bracing for a weaker report than what the economic calendar shows.

This NFP is released on Good Friday, when most markets are closed for the Easter holiday, meaning exceptionally low liquidity and risks of big spikes. Trade with care.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.