USD/INR trades flat ahead of Fed rate decision

- The Indian Rupee trades sideways in Wednesday’s Asian session.

- USD demand and cautious mood might undermine the INR, while lower crude oil prices and RBI intervention could limit losses.

- Investors will closely monitor the Federal Reserve’s (Fed) interest rate decision on Wednesday.

The Indian Rupee (INR) holds steady on Wednesday. The upside of local currency might be limited, largely driven by persistent US Dollar (USD) high demand for month-end payments, which dragged the INR lower near record lows over last few trading sessions. The cautious mood and escalating geopolitical tensions in the Middle East could weigh on the INR.

However, a further decline in crude oil prices could support the Indian Rupee as India is the third largest consumer of oil behind the US and China. The volatility might be limited as the Reserve Bank of India (RBI) is expected to continue intervening to limit sudden depreciation.

The US Federal Reserve (Fed) is widely anticipated to hold the interest rate in the range of 5.25%-5.50% at its two-day FOMC meeting that concludes on Wednesday. Traders will keep an eye on Fed Chair Jerome Powell’s press conference, which might offer some hints about the Fed’s potential rate cut plans. On the Indian docket, the final reading of HSBC Manufacturing PMI will be published on Thursday, which is projected to improve to 58.5 in July from the previous reading of 58.3.

Daily Digest Market Movers: Indian Rupee remains steady near record lows

- Foreign investors invested in Indian shares for about $509.9 million on July 26, while withdrawing from Indian bonds the same day for around $78.7 million.

- The RBI has implemented additional restrictions on foreign ownership of newly issued bonds. The focus is on the billions of dollars flowing into the local market due to the inclusion of Indian bonds in JPMorgan's emerging market index, per Bloomberg.

- The US Job Openings and Labor Turnover Survey (JOLTS) reported 8.184 million job openings in June, above the market expectation of 8.03 million but lower than May’s revised figure of 8.23 million.

- US Consumer Confidence rose to 100.3 in July from the revised figure of 97.8 in June. This figure came in above the market consensus of 99.7, according to the Conference Board on Tuesday.

- With inflation easing faster than estimated in June, the markets have priced in nearly a 64% chance that the Fed will cut rates three times this year — September, November and December, according to the CME FedWatch.

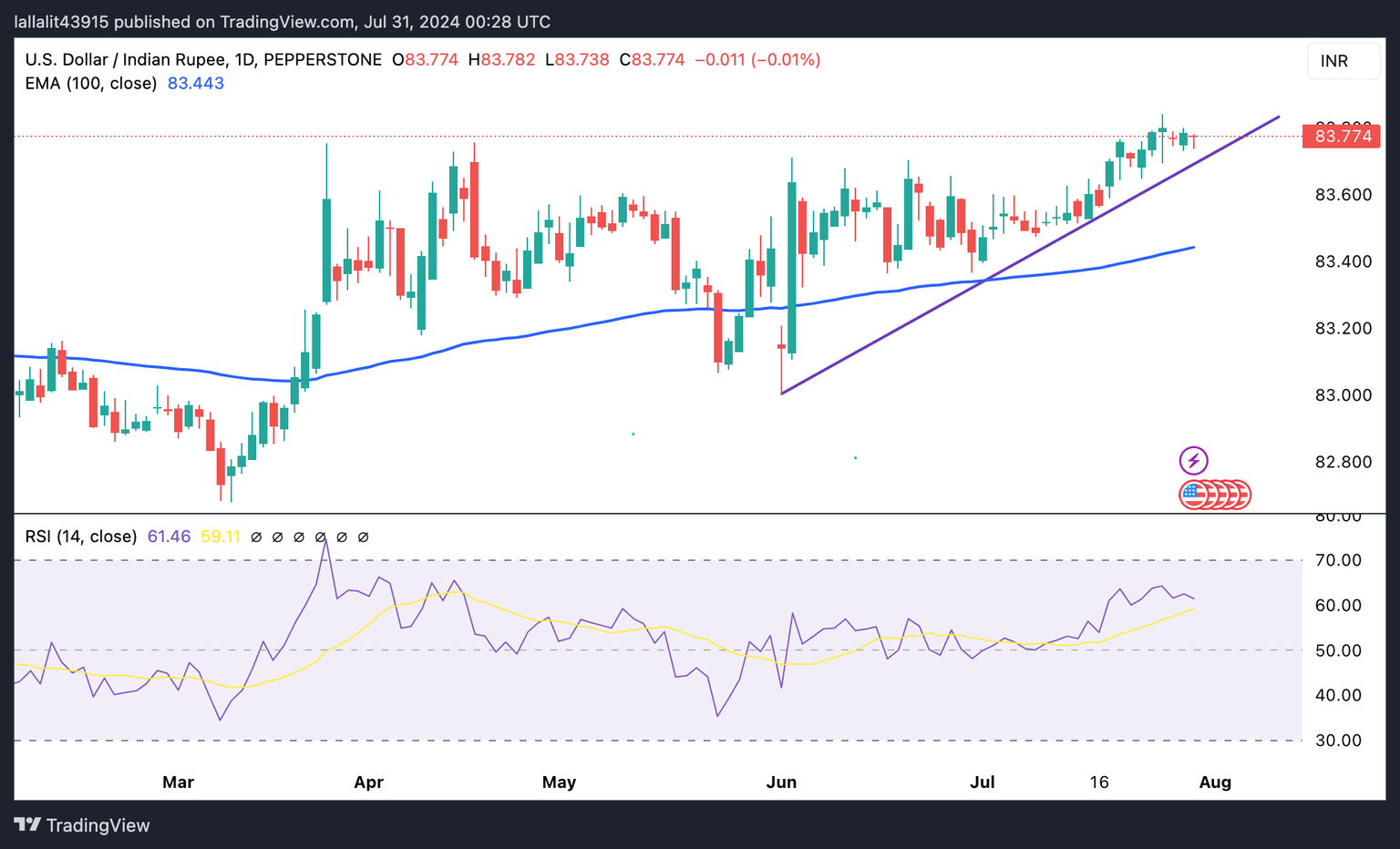

Technical analysis: USD/INR’s constructive outlook remains in play

The crucial resistance level will emerge at the all-time high of 83.85. A decisive break above this level could pave the way to the 84.00 psychological level.

Sustained trading below the uptrend line around 83.72 could see further downside towards 83.51, a low of July 12. Any follow-through selling will expose 83.44, the 100-day EMA.

US Dollar price this week

The table below shows the percentage change of US Dollar (USD) against listed major currencies this week. US Dollar was the strongest against the Australian Dollar.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | 0.23% | 0.14% | 0.07% | 0.71% | -0.85% | -0.38% | -0.31% | |

| EUR | -0.24% | -0.09% | -0.17% | 0.51% | -1.08% | -0.61% | -0.56% | |

| GBP | -0.15% | 0.09% | -0.07% | 0.59% | -0.99% | -0.52% | -0.45% | |

| CAD | -0.08% | 0.16% | 0.06% | 0.65% | -0.93% | -0.45% | -0.39% | |

| AUD | -0.75% | -0.50% | -0.59% | -0.66% | -1.57% | -1.11% | -1.06% | |

| JPY | 0.83% | 1.07% | 0.96% | 0.89% | 1.54% | 0.46% | 0.52% | |

| NZD | 0.41% | 0.61% | 0.52% | 0.45% | 1.11% | -0.44% | 0.09% | |

| CHF | 0.32% | 0.55% | 0.46% | 0.39% | 1.06% | -0.53% | -0.06% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

RBI FAQs

The role of the Reserve Bank of India (RBI), in its own words, is '..to maintain price stability while keeping in mind the objective of growth.” This involves maintaining the inflation rate at a stable 4% level primarily using the tool of interest rates. The RBI also maintains the exchange rate at a level that will not cause excess volatility and problems for exporters and importers, since India’s economy is heavily reliant on foreign trade, especially Oil.

The RBI formally meets at six bi-monthly meetings a year to discuss its monetary policy and, if necessary, adjust interest rates. When inflation is too high (above its 4% target), the RBI will normally raise interest rates to deter borrowing and spending, which can support the Rupee (INR). If inflation falls too far below target, the RBI might cut rates to encourage more lending, which can be negative for INR.

Due to the importance of trade to the economy, the Reserve Bank of India (RBI) actively intervenes in FX markets to maintain the exchange rate within a limited range. It does this to ensure Indian importers and exporters are not exposed to unnecessary currency risk during periods of FX volatility. The RBI buys and sells Rupees in the spot market at key levels, and uses derivatives to hedge its positions.

Author

Lallalit Srijandorn

FXStreet

Lallalit Srijandorn is a Parisian at heart. She has lived in France since 2019 and now becomes a digital entrepreneur based in Paris and Bangkok.