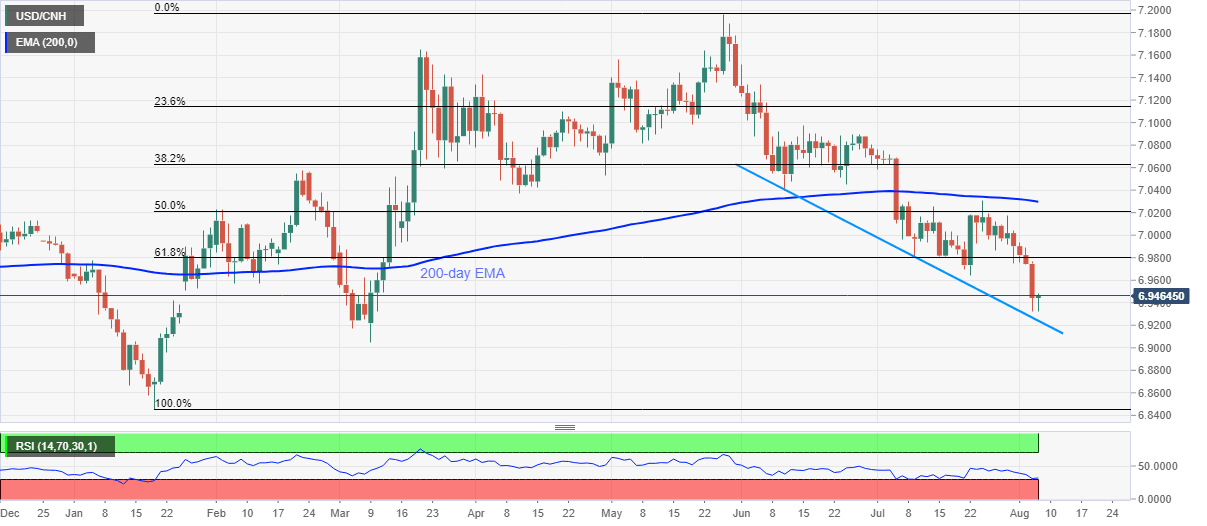

USD/CNH Price Analysis: Bears catch a breather around two-month-old support line

- USD/CNH aims to recover from five-month low while bouncing off 6.9321.

- Oversold RSI conditions suggest further pullback but 61.8% Fibonacci retracement guards immediate upside.

- March month’s low can please sellers below the near-term key trend line.

USD/CNH pulls back from multi-week low to 6.9458 amid the initial Chinese session on Thursday. The pair slumped to the lowest since March 09 the previous day. However, oversold RSI seems to have triggered the latest U-turn.

As a result, short-term buyers may target 61.8% Fibonacci retracement of January-May upside, at 6.9800 during the further upside. Though, July 22 low near 6.9640 could offer an intermediate halt during the rise.

In a case where the bulls dominate past-6.9800, 50% Fibonacci retracement level of 7.021 and 200-day SMA around 7.0300 could return to the charts.

Alternatively, a downward sloping trend line from June 10, at 6.9240 now, can stop the bears before pleasing them with the March low of 6.9048.

It should, however, be noted that the quote’s sustained downside past-6.9048 will make it vulnerable to revisit the yearly bottom close to 6.8455.

USD/CNH daily chart

Trend: Pullback expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.