USD/CHF jumps to late May highs, above 100-day SMA

- USD/CHF rose to 0.9030, reaching late May's highs.

- Fresh ISM PMI data showed contraction in the US manufacturing sector activity for June.

- The market odds for a September interest-rate cut by both the Fed and Swiss SNB have increased in the last session.

On Monday, the USD/CHF pair rose significantly, driven by market anticipation of the Federal Open Market Committee (FOMC) minutes release and other key labor market figures from the US due later in the week. The major mover in the session was the ISM Manufacturing PMI from the US, which despite showing a continued contraction in the country's manufacturing sector the Greenback held its ground. US Treasury yields remain high and provide a cushion to the USD.

The spotlight of Monday was the slightly disappointing ISM Manufacturing PMI from the US for June. The PMI edged lower to 48.5 from 48.7 in April. The Employment Index of the PMI fell to 49.3 from 51.1 in May, while the New Orders Index improved to 49.3 from 45.4. The Prices Paid Index, the inflation component, dropped to 52.1 from 57 in the preceding period. As a result, the markets are betting on a 70% probability of a September interest rate cut by the Federal Reserve (Fed) but the bank’s officials aren’t entirely embracing the rate cuts.

In addition to the FOMC minutes, the US labor market figures are a highlight for this week, particularly Friday's June jobs data. Bloomberg consensus anticipates 190k compared to 272k in May. The unemployment rate is not expected to change from 4.0% despite a possible increase in the participation rate. The average hourly earnings are forecast to rise by 0.3% MoM, potentially pushing the YoY rate down to 3.9%. Markets will also pay attention to the ADP and JOLTs figures to be released on Tuesday and Wednesday.

On the other hand, The Swiss June Consumer Price Index (CPI), due to be reported on Thursday, is projected to remain stable at 1.4% YoY for the third consecutive month.

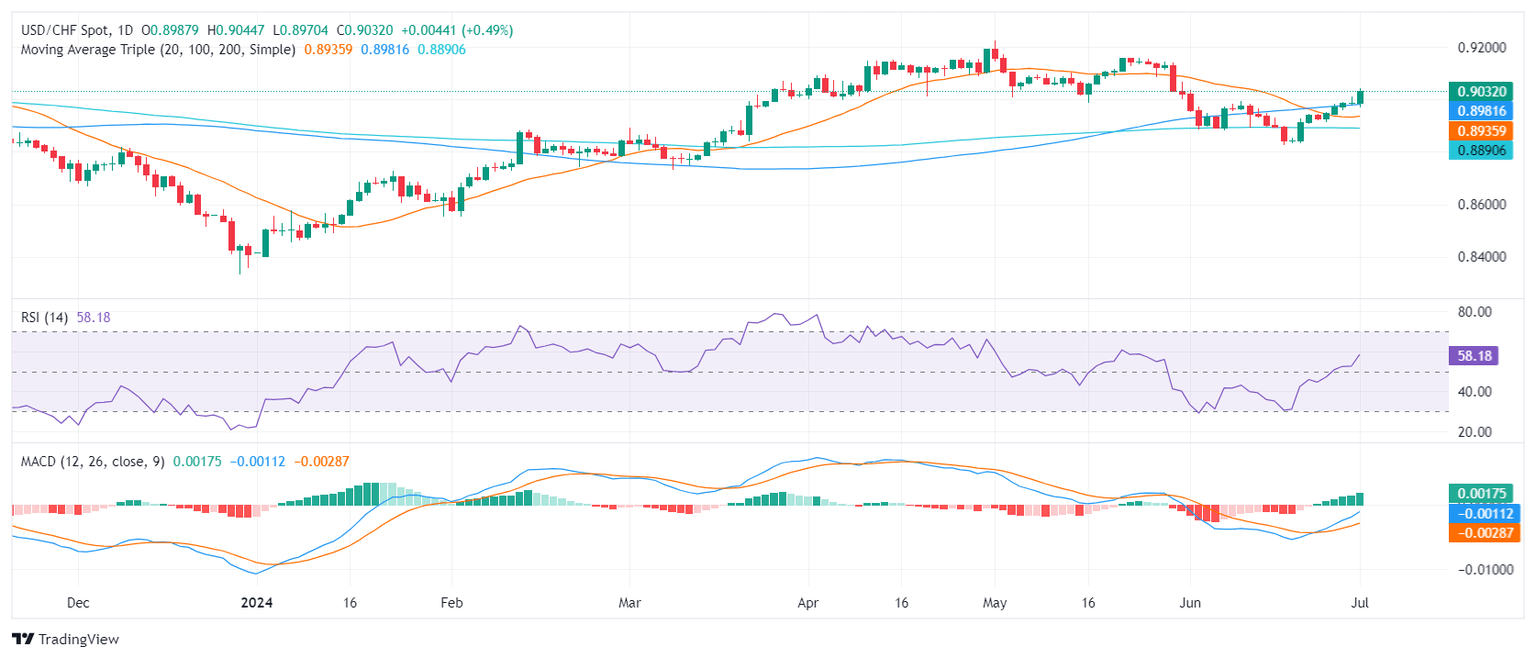

USD/CHF technical analysis

Regarding the technical analysis, the USD/CHF pair's outlook brightens. It has jumped to its highest level since late May, which along with a strong position above the 20, 100, and 200-day Simple Moving Average (SMA), lends a significantly positive outlook for the future. In addition, the pair tallied seven winning days out of the last eight which calls for a positive outlook.

USD/CHF daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.