USD/CAD trims weekly losses, rises to 1.3770

- USD/CAD still down for the week and pointing to the upside.

- US Dollar mixed on Friday between lower US yields and risk aversion.

- Key events for next week: Canada CPI (Tuesday) and FOMC meeting (Wednesday).

The USD/CAD printed a fresh daily high on Friday at 1.3772, amid a weaker Loonie and a mixed Greenback. After moving away from the bottom, the pair is about to post a small weekly loss.

The bad and the ugly

Data released on Friday showed the Canadian Industrial Product Price Index dropped 0.8%, a surprise considering market expectations of a 1.6% increase. The Raw Material Price Index fell 0.4%, below the estimate 0%. The economic figures did not help the Loonie, that is among the worst performers on Friday.

Next week, the key report from the Canadian economy will be February’s Consumer Price Index (CPI) on Tuesday. It is expected to show an increase of 0.4% MoM, and the annual rate slowing from 5.9% in January to 5.5%.

The US Dollar is mixed on Friday, attempting a recovery as stocks in Wall Street deepen losses. US yields are down by 4% on average, with the 10-year at 3.41%, slightly above March lows.

Markets remain anxious with the banking turmoil and next week is the FOMC meeting. The consensus is still for a 25bps rate hike but the end of the tightening cycle is seen sooner than previously thought. The change in expectations weighed on the Greenback.

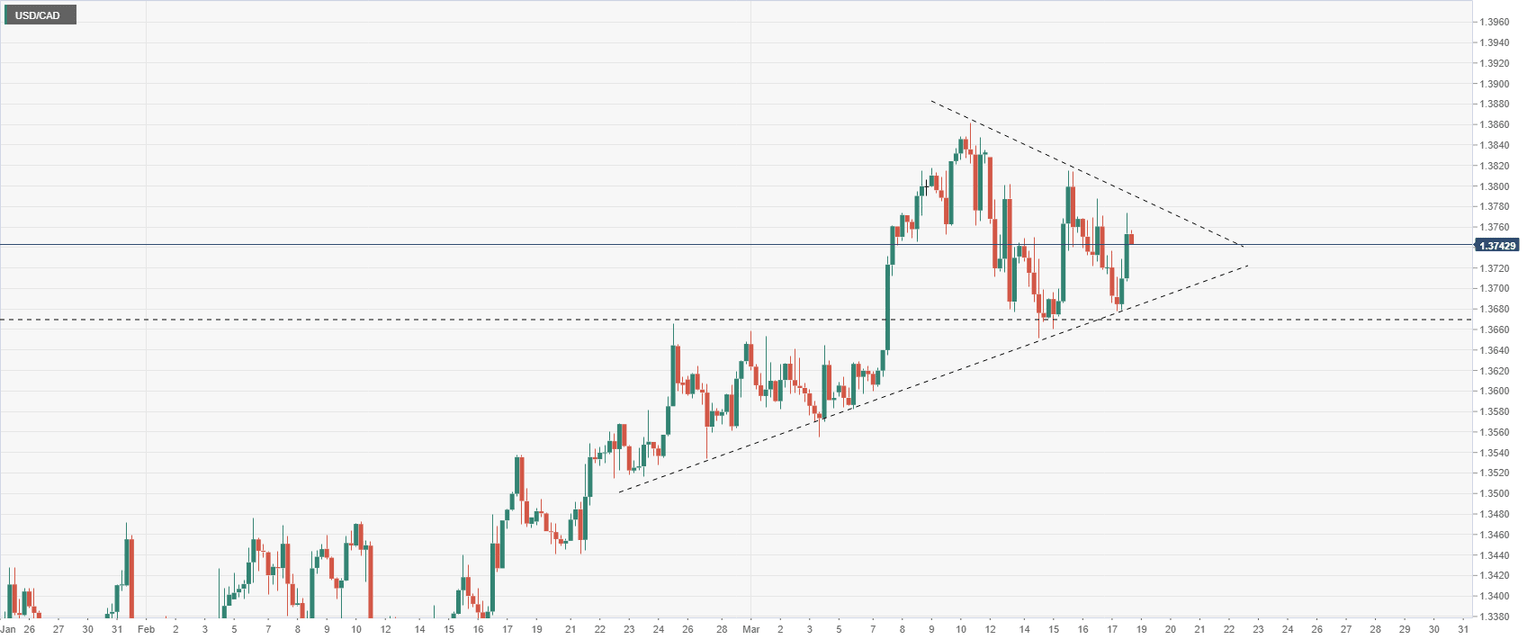

Higher lows, lower highs

The USD/CAD has been making higher lows and lower highs during the last sessions. On Friday, it reversed from a two-day low at 1.3676 and jumped to 1.3763. The short-term direction is not clear.

The pair remains above the 20-day Simple Moving Average (1.3655) and also above the 1.3660/70 key support area. While above that two supports, the outlook looks constructive for the USD/CAD.

USD/CAD 4-hour chart

Technical levels

Author

Matías Salord

FXStreet

Matías started in financial markets in 2008, after graduating in Economics. He was trained in chart analysis and then became an educator. He also studied Journalism. He started writing analyses for specialized websites before joining FXStreet.