USD/CAD Price Forecast: Jumps to near 1.3550

- USD/CAD surges to near 1.3550 as the Canadian Dollar weakens ahead of the BoC policy meeting.

- The US Dollar surrenders its intraday gains with US NFP in focus.

- The US ISM Manufacturing PMI contracted again in August.

The USD/CAD pair climbs to near 1.3550 in Tuesday’s North American session. The Loonie asset gains sharply as the Canadian Dollar (CAD) weakens amid uncertainty ahead of the Bank of Canada’s (BoC) monetary policy meeting, which will be announced on Wednesday.

Investors see the BoC reducing interest rates again by 25 basis points (bps) 4.25%. This would be the third straight interest rate cut in a row due to easing price pressures, economic slowdown, and downside risks to the labor market.

The US Dollar (USD) gives up its intraday gains with investors focusing on the United States (US) Nonfarm Payrolls (NFP) data for August, releasing on Friday, which will influence market speculation for Federal Reserve (Fed) interest rate cuts.

Meanwhile, the US ISM has reported weaker-than-expected Manufacturing PMI data for August. The report showed that activities contracted at a slower pace, with PMI coming in at 47.2, lower than estimates of 47.5 but higher than the former release of 46.8.

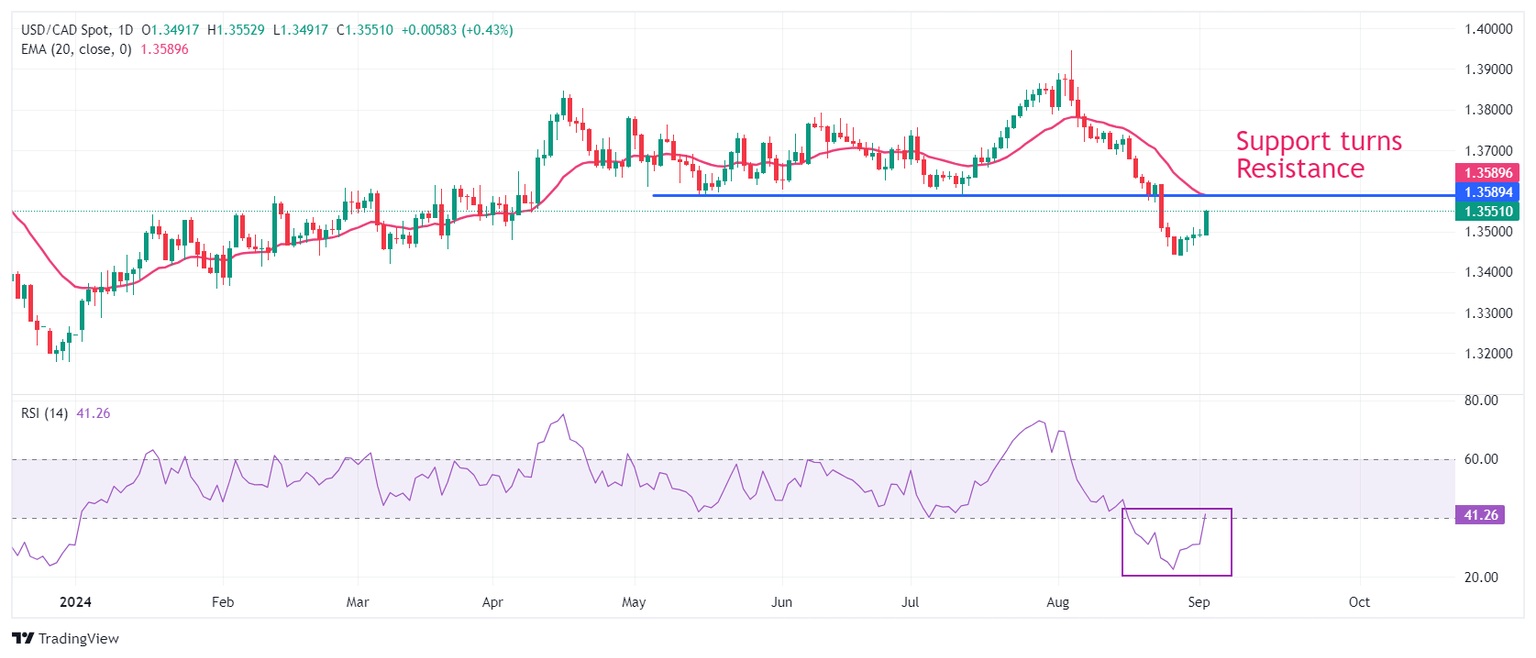

USD/CAD rebounds sharply after a V-shape recovery from a fresh five-month low of 1.3440 on a daily timeframe. The asset is expected to extend its recovery to near the horizontal resistance plotted from May 15 low of 1.3590, which used to be a key support for the US Dollar bulls.

The declining 20-day Exponential Moving Average (EMA) near 1.3590 suggests that the near-term trend is bearish. The 14-day Relative Strength Index (RSI) rebounds sharply after turning oversold near 22.50. The movement suggests that the bearish momentum has ended for now, however, the overall trend is still bearish.

Further pullback May 15 low of 1.3590 will likely be a selling opportunity for market participants, which would drag the asset towards April 5 low of 1.3540, followed by the psychological support of 1.3500.

On the flip side, an upside recovery above August 21 high of 1.3626 would drive the asset towards 19 August high of 1.3687 and August 15 high of 1.3738.

USD/CAD daily chart

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.