USD/CAD Price Analysis: Bulls seeking a break of 1.2790/00

- USD/CAD bulls are lurking and the US dollar is firmer.

- Bulls need to commit to a break of 1.2780 and then 1.2790/00.

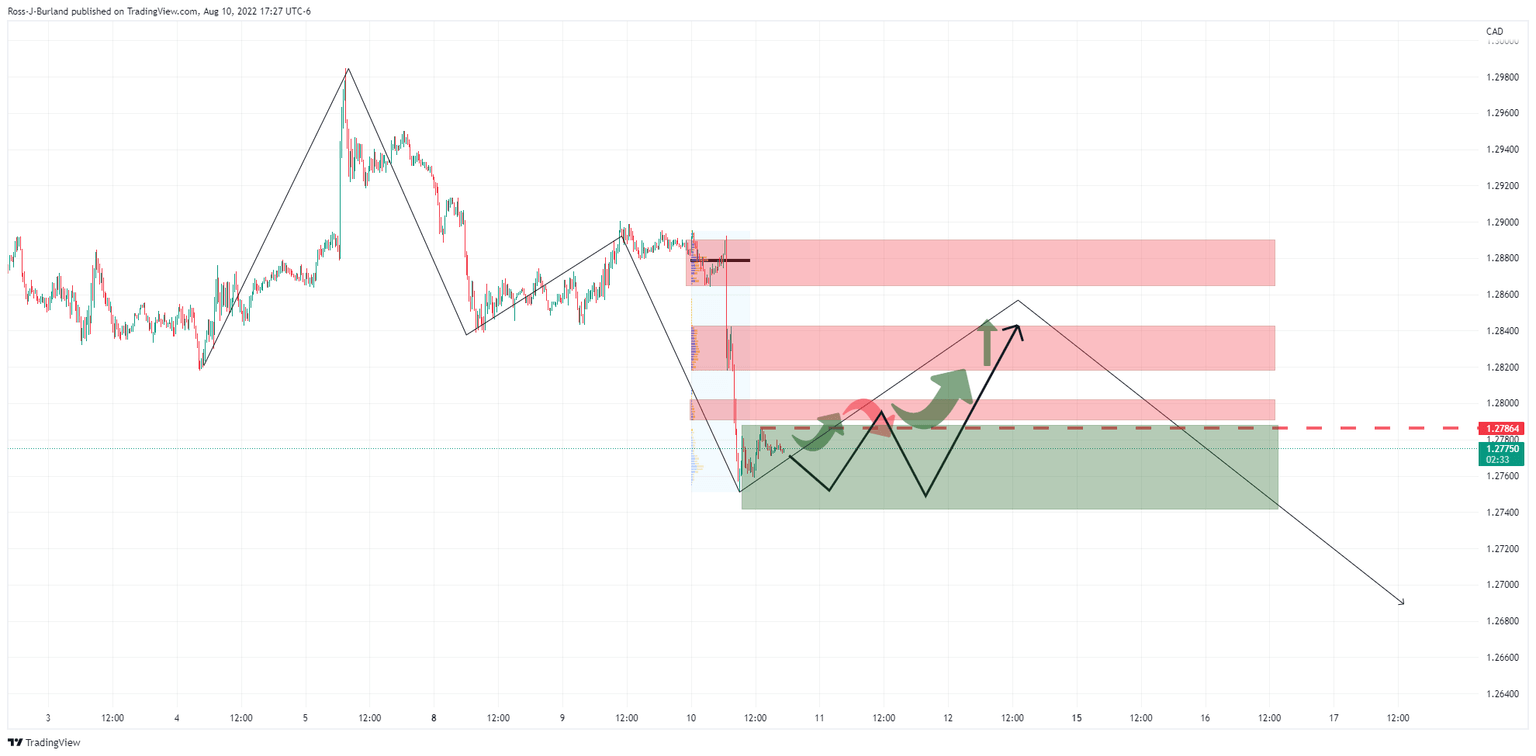

As per the prior analysis, USD/CAD Price Analysis: Bulls could be about to clean up, the price is in a phase of accumulation currently and a resurgence in the greenback would be expected to see USD/CAD rally in due course.

The following is an update of the prior analysis.

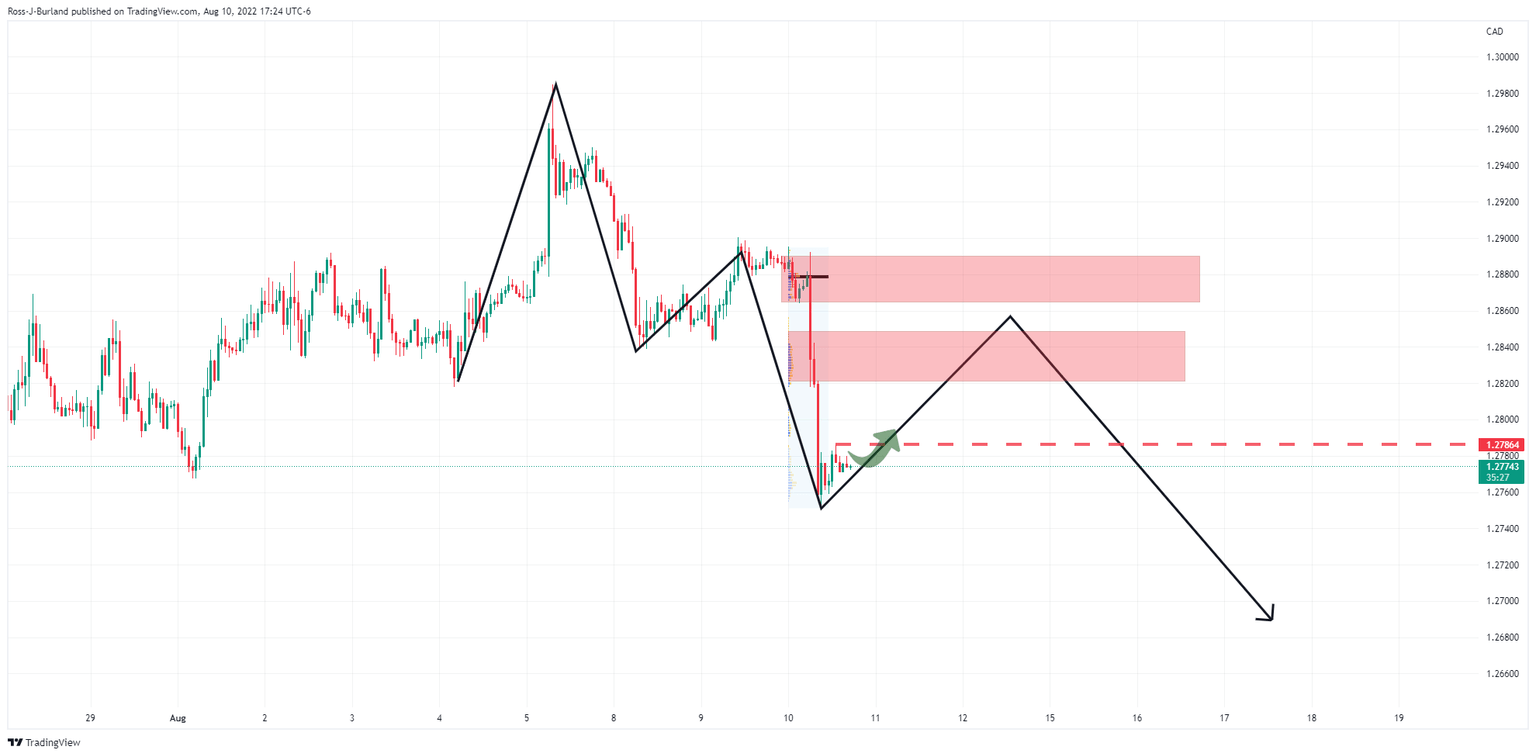

USD/CAD daily chart, prior analysis

The price extended a touch lower on Thursday, but the bullish thesis remains in play, as per the following hourly and 15-minute charts:

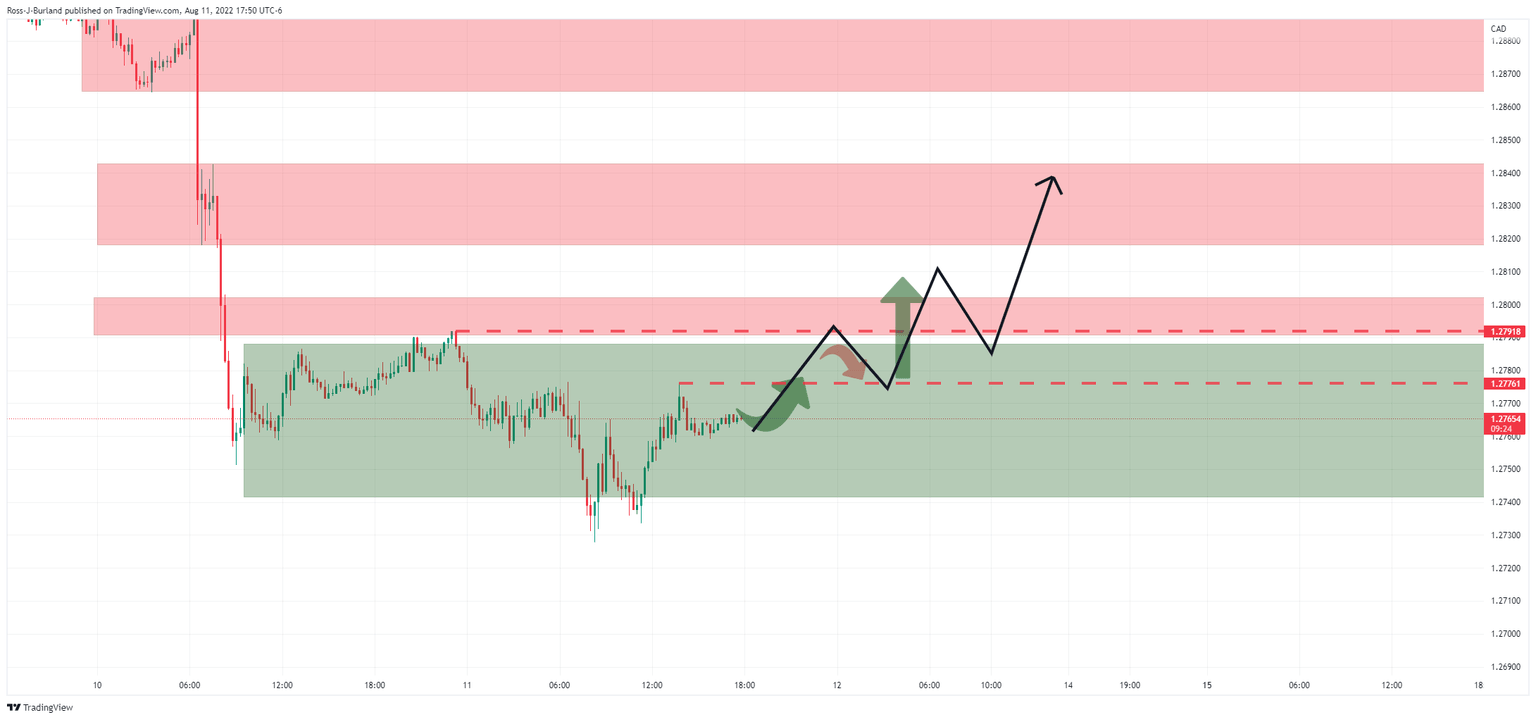

USD/CAD 15-min chart, live market

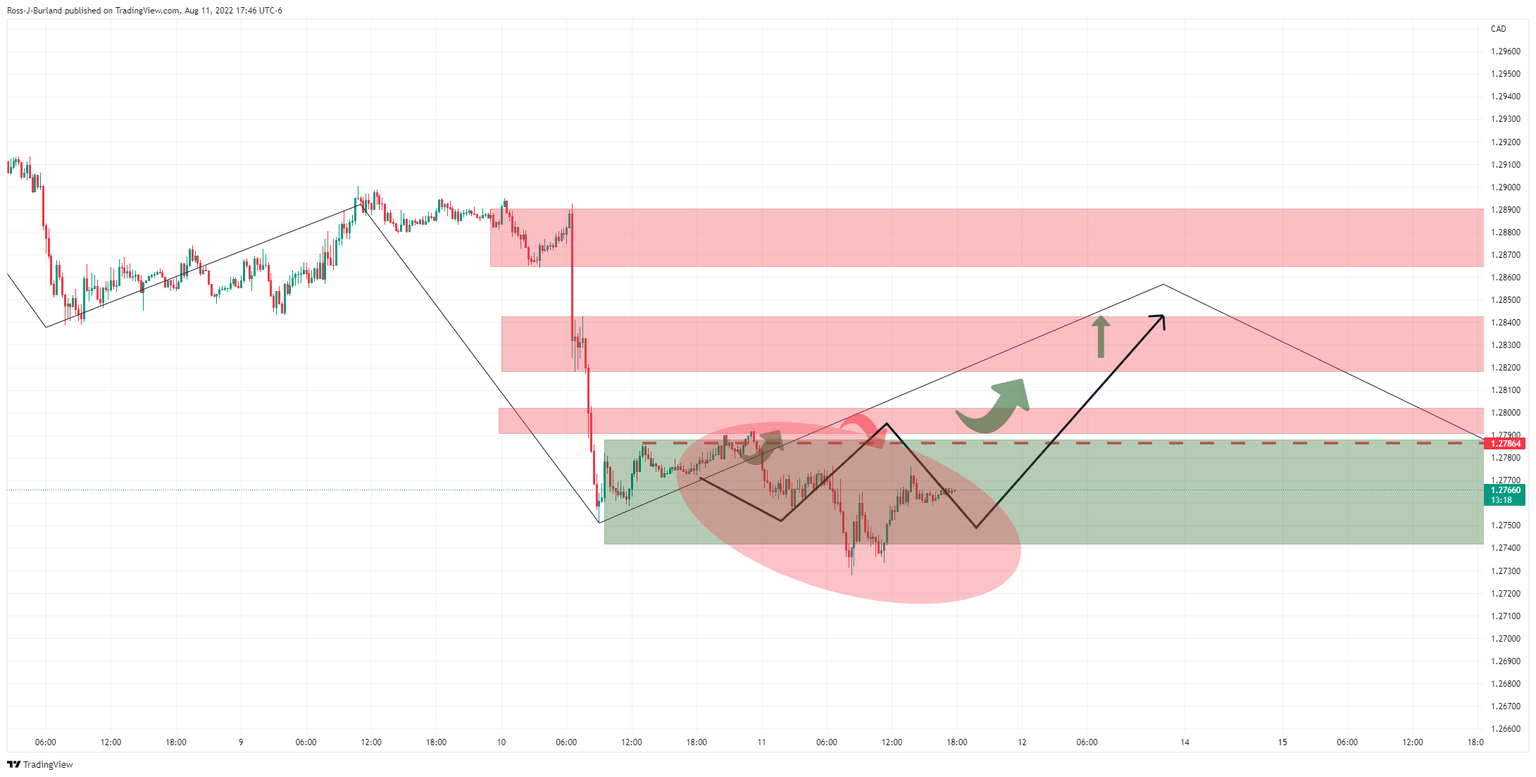

The price has been moving sideways within a consolidation price discovery phase of accumulation. This was flagged as a possibility in the prior analysis:

''From a 15-min perspective, the price action could develop over the coming sessions as follows. In a fast market, the price would be expected to correct steeply, but in a long drawn-out process in which there is a lack of commitment from the bulls, the ride could be a bumpy one along the support area as illustrated above. This would potentially result in an even lower low yet to come before the bulls fully commit to the correction in a phase of accumulation.''

The sentiment surrounding the greenback is turning more positive towards the end of the week so we could now start to see more commitment from the bulls over the coming sessions:

A break of 1.2780 and then 1.2790/00 will be key.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.