US Treasury yields tumble as softer CPI fuels Fed rate cut speculation

- US CPI for May unchanged at 0% MoM, below estimates of 0.1%, with annual increase at 3.3%.

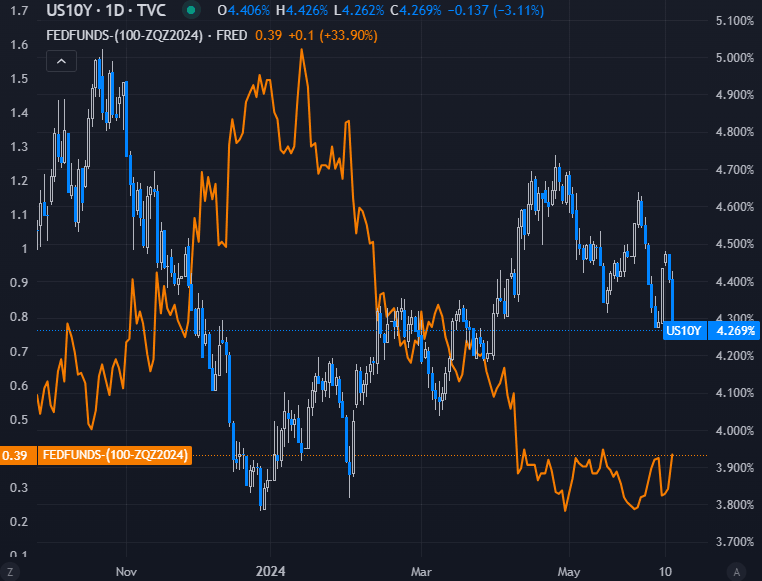

- 10-year Treasury bond yield drops 14 basis points to 4.266%, lowest since April.

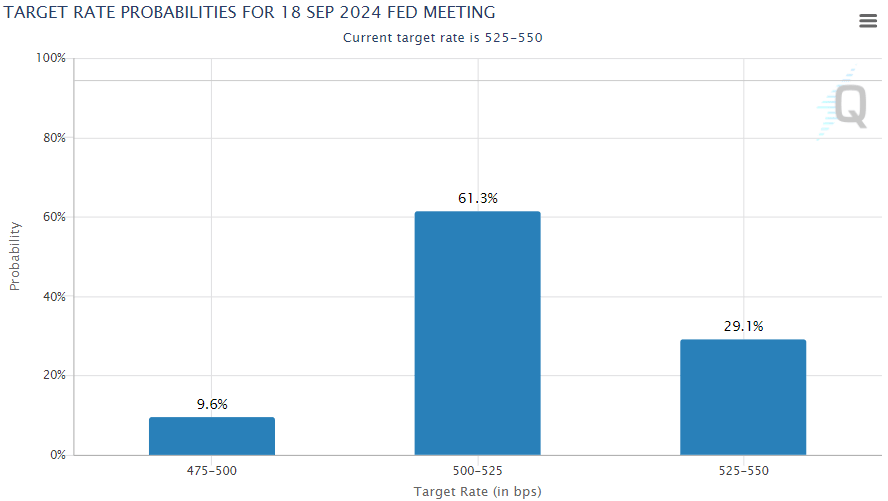

- Gold hits weekly high of $2,341; traders anticipate potential 25 bps rate cut by September with 61.3% odds.

US Treasury yields collapsed on Wednesday after a colder-than-expected May US Consumer Price Index (CPI) report increased speculation about the Federal Reserve's rate cuts in 2024. Despite that, caution is warranted, as the Federal Open Market Committee (FOMC) will reveal its monetary policy decision at around 18:00 GMT.

Colder-than-expected inflation report drives speculation of rate cuts ahead of FOMC policy decision

The US Bureau of Labor Statistics (BLS) revealed that the CPI was unchanged at 0% MoM, below estimates of 0.1% and April’s 0.3% increase. In the twelve months to May, it rose by 3.3%, below April’s and the 3.4% consensus.

Underlying inflation figures decreased from 0.3% to 0.2% MoM, while on an annual basis, hit 3.4%, lower than expectations of 3.5% and April’s 3.6%.

The US 10-year Treasury bond yield plummeted 14 basis points to 4.266%, its lowest level since April, after beginning the session at 4.426%. This pushed Gold prices toward a weekly high of $2,341 before stabilizing at around $2,324.

Data from the Chicago Board of Trade (CBOT) shows that traders expect 39 basis points (bps) of easing, according to December’s 2024 fed funds rate futures contract. In the meantime, the CME FedWatch Tool shows odds for a 25 bps rate cut in September jumped from 46.8% a day ago to 61.3%.

US inflation data came ahead of the Federal Reserve’s monetary policy decision. The Fed is expected to keep rates unchanged while updating its economic projections. Traders would be looking for hints about the future interest rate path.

Inflation FAQs

Inflation measures the rise in the price of a representative basket of goods and services. Headline inflation is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core inflation excludes more volatile elements such as food and fuel which can fluctuate because of geopolitical and seasonal factors. Core inflation is the figure economists focus on and is the level targeted by central banks, which are mandated to keep inflation at a manageable level, usually around 2%.

The Consumer Price Index (CPI) measures the change in prices of a basket of goods and services over a period of time. It is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core CPI is the figure targeted by central banks as it excludes volatile food and fuel inputs. When Core CPI rises above 2% it usually results in higher interest rates and vice versa when it falls below 2%. Since higher interest rates are positive for a currency, higher inflation usually results in a stronger currency. The opposite is true when inflation falls.

Although it may seem counter-intuitive, high inflation in a country pushes up the value of its currency and vice versa for lower inflation. This is because the central bank will normally raise interest rates to combat the higher inflation, which attract more global capital inflows from investors looking for a lucrative place to park their money.

Formerly, Gold was the asset investors turned to in times of high inflation because it preserved its value, and whilst investors will often still buy Gold for its safe-haven properties in times of extreme market turmoil, this is not the case most of the time. This is because when inflation is high, central banks will put up interest rates to combat it. Higher interest rates are negative for Gold because they increase the opportunity-cost of holding Gold vis-a-vis an interest-bearing asset or placing the money in a cash deposit account. On the flipside, lower inflation tends to be positive for Gold as it brings interest rates down, making the bright metal a more viable investment alternative.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.